- Canada

- /

- Metals and Mining

- /

- TSXV:LITH

TSX Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of new tariffs and shifting economic policies, investors are closely watching how these factors might influence various sectors. Penny stocks, often representing smaller or emerging companies, continue to capture interest due to their affordability and potential for growth. While the term may seem outdated, these stocks can still offer compelling opportunities when aligned with strong financial fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.17 | CA$112M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.60 | CA$436.01M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.765 | CA$508.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.52 | CA$178.66M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$179.43M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.98 | CA$11.31M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

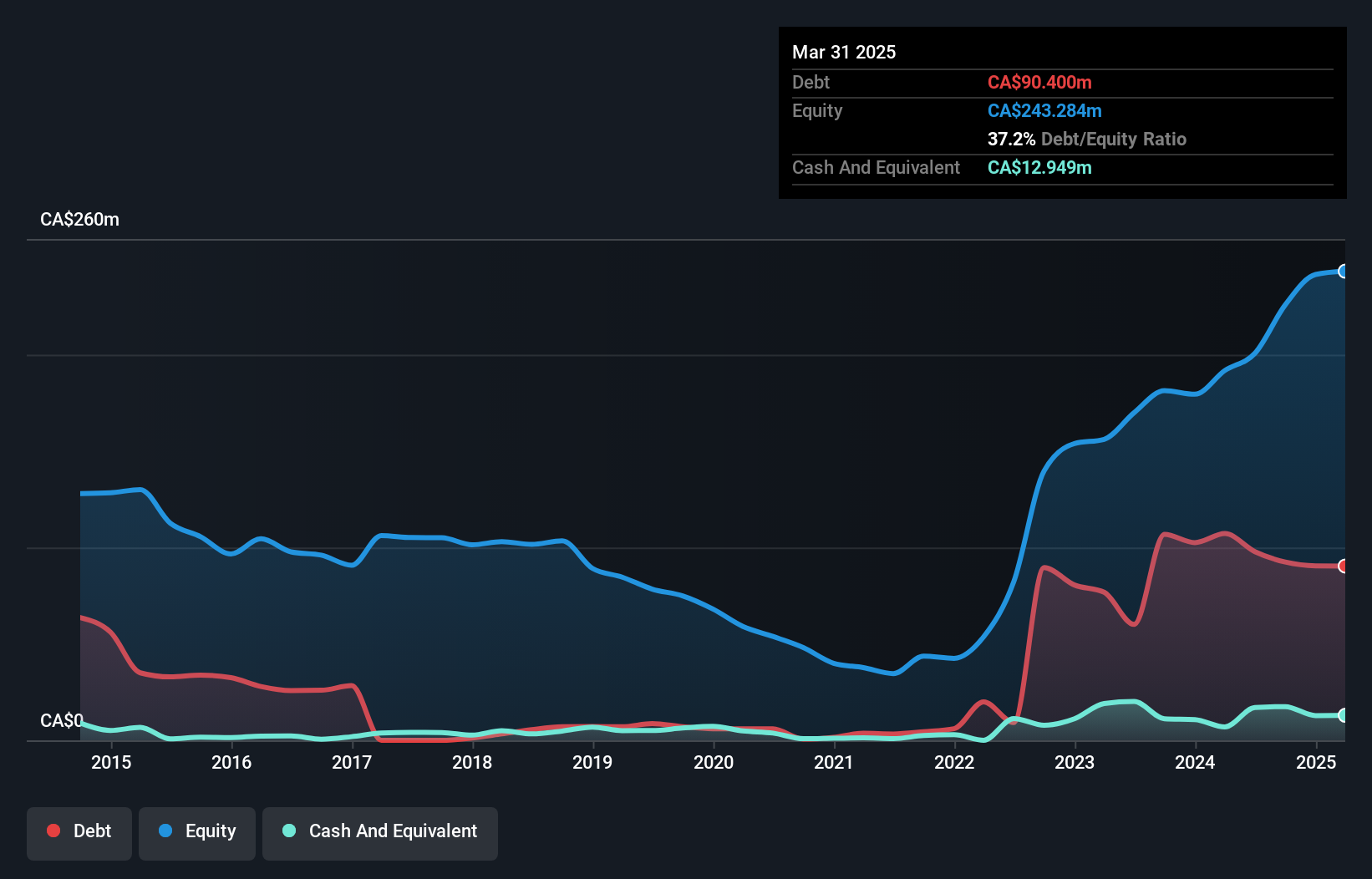

ACT Energy Technologies (TSX:ACX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ACT Energy Technologies Ltd. offers directional drilling services to oil and natural gas companies in Canada and the United States, with a market cap of CA$158.12 million.

Operations: The company generates CA$542.19 million in revenue from providing directional drilling services.

Market Cap: CA$158.12M

ACT Energy Technologies Ltd. presents a mixed picture for penny stock investors. The company has demonstrated robust earnings growth, with a 150.1% increase over the past year, surpassing both its historical average and industry performance. Its financial health is supported by short-term assets exceeding liabilities and satisfactory debt levels, with interest payments well covered by EBIT. However, recent earnings show a decline in sales and net income compared to the previous year, which may raise concerns about sustainability. Despite these challenges, ACT trades at good value relative to peers and maintains high-quality earnings without significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in ACT Energy Technologies' financial health report.

- Gain insights into ACT Energy Technologies' future direction by reviewing our growth report.

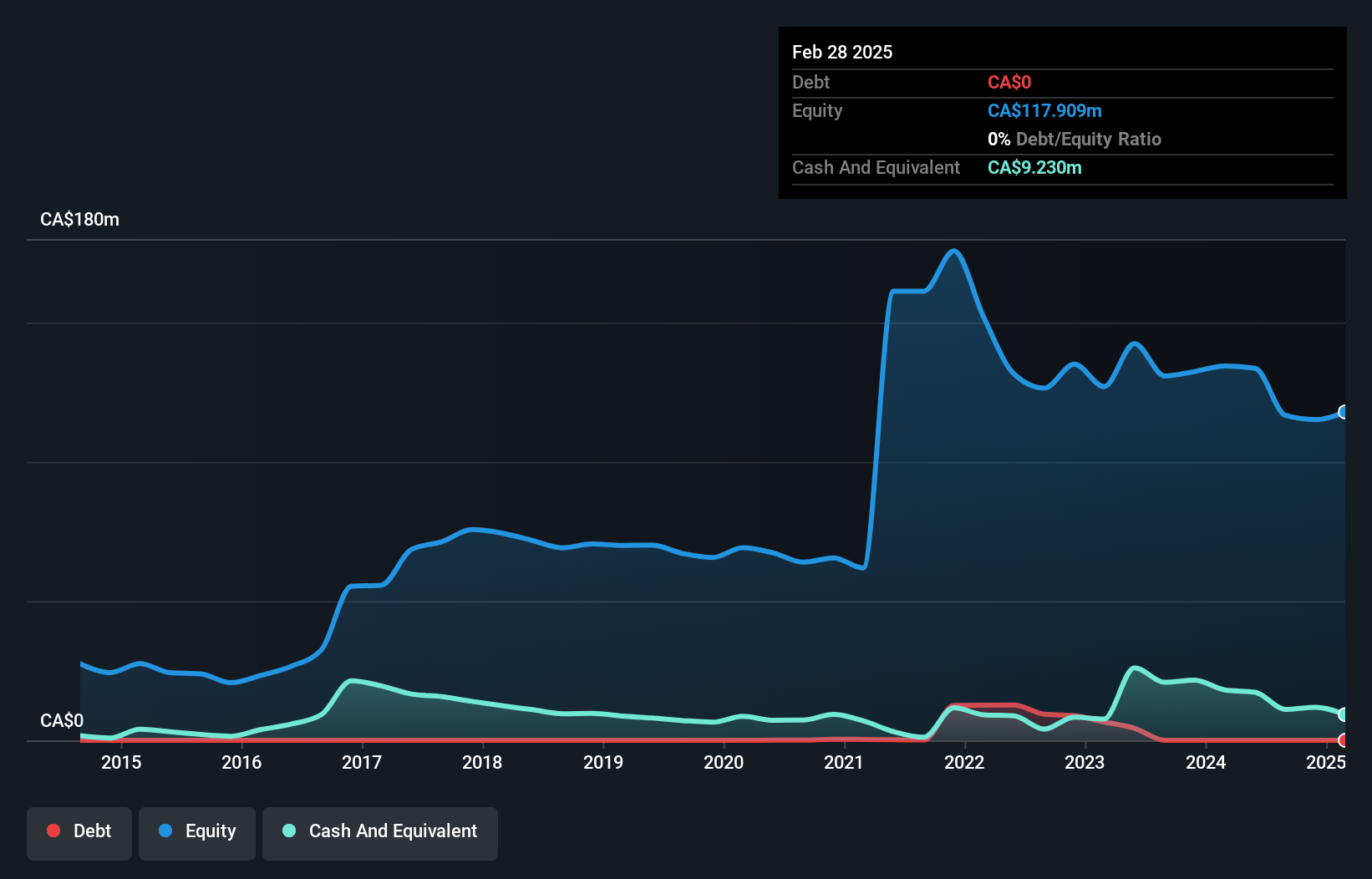

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$206.22 million.

Operations: GoldMining Inc. currently does not report any revenue segments.

Market Cap: CA$206.22M

GoldMining Inc. is a pre-revenue mineral exploration company focusing on gold and copper assets in the Americas, with a market cap of CA$206.22 million. Recent developments include promising drill results from its Crucero Project in Peru, highlighting significant antimony alongside gold mineralization, which could enhance multi-metal value creation amid high antimony prices. The company also initiated an extensive exploration program at its São Jorge Project in Brazil and secured regulatory approval for uranium exploration at its Rea Project in Canada. Despite being debt-free and having experienced management, GoldMining's cash runway remains limited to five months without additional capital infusion.

- Get an in-depth perspective on GoldMining's performance by reading our balance sheet health report here.

- Learn about GoldMining's future growth trajectory here.

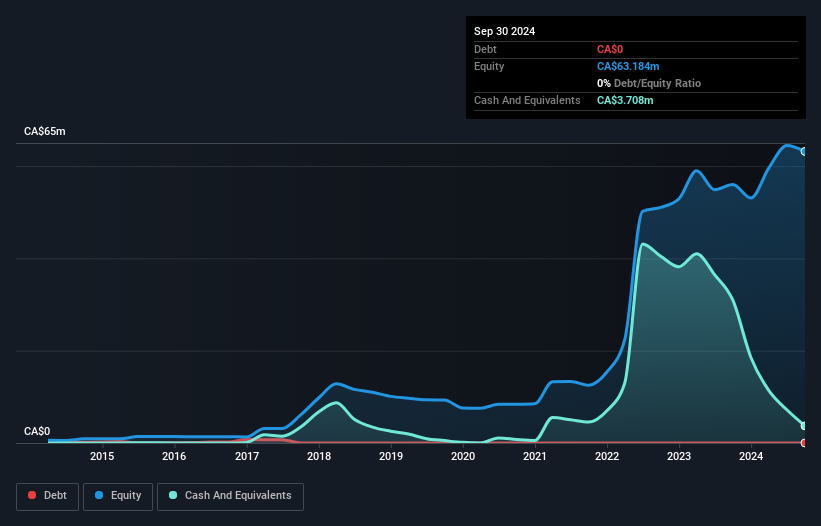

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$134.31 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$134.31M

Lithium Chile Inc., with a market cap of CA$134.31 million, is pre-revenue and focuses on lithium properties in Chile and Argentina. The company recently secured a Special Lithium Operation Contract (CEOL) for its Coipasa salar in northern Chile, marking an important step under Chile's new national lithium strategy. This initiative aims to expand the country's role in the global lithium supply chain through public-private partnerships. Despite being debt-free and having experienced management, its short-term assets do not cover liabilities, and auditors have expressed going concern doubts due to financial uncertainties despite recent profitability improvements.

- Click here and access our complete financial health analysis report to understand the dynamics of Lithium Chile.

- Assess Lithium Chile's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 445 names from our TSX Penny Stocks screener here.

- Want To Explore Some Alternatives? Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LITH

Lithium Chile

Engages in the acquisition and development of lithium properties in Chile and Argentina.

Adequate balance sheet with low risk.

Market Insights

Community Narratives