- Canada

- /

- Oil and Gas

- /

- CNSX:TCF

Trillion Energy International (CSE:TCF) spikes 28% this week, taking one-year gains to 118%

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Trillion Energy International Inc. (CSE:TCF) share price has soared 118% in the last 1 year. Most would be very happy with that, especially in just one year! In more good news, the share price has risen 60% in thirty days. We note that Trillion Energy International reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report. We'll need to follow Trillion Energy International for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

The past week has proven to be lucrative for Trillion Energy International investors, so let's see if fundamentals drove the company's one-year performance.

Before we look at the performance, you might like to know that our analysis indicates that TCF is potentially overvalued!

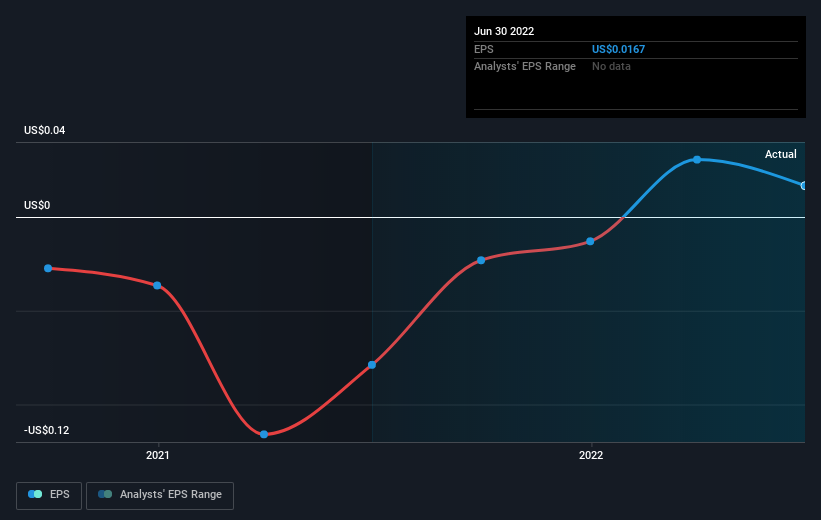

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Trillion Energy International went from making a loss to reporting a profit, in the last year.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Inflection points like this can be a great time to take a closer look at a company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Trillion Energy International shareholders should be happy with the total gain of 118% over the last twelve months. The more recent returns haven't been as impressive as the longer term returns, coming in at just 7.8%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Trillion Energy International (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Trillion Energy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:TCF

Trillion Energy International

Operates an oil and gas exploration and production company primarily in Turkiye.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026