- Canada

- /

- Oil and Gas

- /

- CNSX:API

Even though Appia Rare Earths & Uranium Corp.'s (CSE:API) stock is down 15% this week, insiders who bought lately made a CA$79k profit

Insiders who bought Appia Rare Earths & Uranium Corp. (CSE:API) in the last 12 months may probably not pay attention to the stock's recent 15% drop. Reason being, despite the recent loss, insiders original purchase value of CA$74k is now worth CA$153k.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for Appia Rare Earths & Uranium

The Last 12 Months Of Insider Transactions At Appia Rare Earths & Uranium

While there weren't any large insider transactions in the last twelve months, it's still worth looking at the trading.

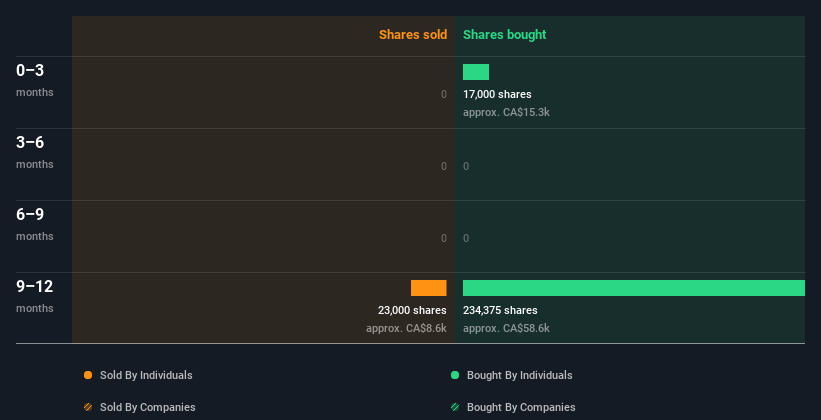

Over the last year, we can see that insiders have bought 251.38k shares worth CA$74k. But insiders sold 23.00k shares worth CA$8.8k. In total, Appia Rare Earths & Uranium insiders bought more than they sold over the last year. The average buy price was around CA$0.29. To my mind it is good that insiders have invested their own money in the company. But we must note that the investments were made at well below today's share price of CA$0.61. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insiders at Appia Rare Earths & Uranium Have Bought Stock Recently

We saw some Appia Rare Earths & Uranium insider buying shares in the last three months. President Frederick Kozak purchased CA$15k worth of shares in that period. It's great to see that insiders are only buying, not selling. But the amount invested in the last three months isn't enough for us too put much weight on it, as a single factor.

Insider Ownership of Appia Rare Earths & Uranium

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. From looking at our data, insiders own CA$1.8m worth of Appia Rare Earths & Uranium stock, about 2.5% of the company. However, it's possible that insiders might have an indirect interest through a more complex structure. We prefer to see high levels of insider ownership.

So What Do The Appia Rare Earths & Uranium Insider Transactions Indicate?

We note a that there has been a bit of insider buying recently (but no selling). That said, the purchases were not large. But insiders have shown more of an appetite for the stock, over the last year. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Appia Rare Earths & Uranium stock. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Appia Rare Earths & Uranium. When we did our research, we found 5 warning signs for Appia Rare Earths & Uranium (2 are concerning!) that we believe deserve your full attention.

But note: Appia Rare Earths & Uranium may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:API

Appia Rare Earths & Uranium

Engages in the acquisition, exploration, and development of mineral properties in Canada and Brazil.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026