- Canada

- /

- Capital Markets

- /

- TSXV:PLRB.H

Investors Give Pluribus Technologies Corp. (CVE:PLRB) Shares A 40% Hiding

To the annoyance of some shareholders, Pluribus Technologies Corp. (CVE:PLRB) shares are down a considerable 40% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 87% share price decline.

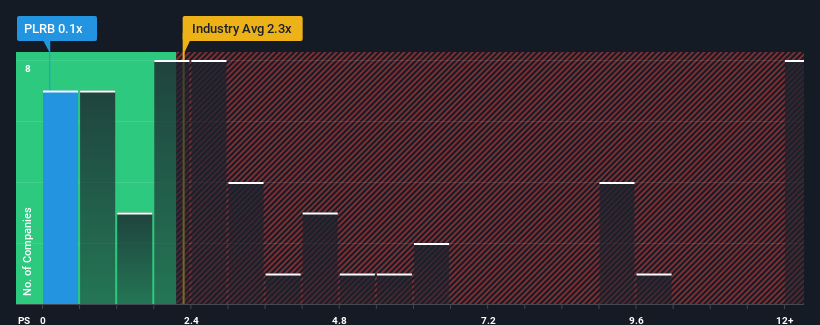

After such a large drop in price, Pluribus Technologies' price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Capital Markets industry in Canada, where around half of the companies have P/S ratios above 2.3x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Pluribus Technologies

What Does Pluribus Technologies' Recent Performance Look Like?

Recent times haven't been great for Pluribus Technologies as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Pluribus Technologies will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Pluribus Technologies?

Pluribus Technologies' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 7.8% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 9.0%. That would be an excellent outcome when the industry is expected to decline by 3.1%.

In light of this, it's quite peculiar that Pluribus Technologies' P/S sits below the majority of other companies. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Pluribus Technologies' P/S Mean For Investors?

Having almost fallen off a cliff, Pluribus Technologies' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Pluribus Technologies' analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 3 warning signs for Pluribus Technologies (2 make us uncomfortable!) that we have uncovered.

If you're unsure about the strength of Pluribus Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:PLRB.H

Low and slightly overvalued.

Market Insights

Community Narratives