- Canada

- /

- Diversified Financial

- /

- TSXV:BNXA

The Market Lifts Banxa Holdings Inc. (CVE:BNXA) Shares 37% But It Can Do More

Banxa Holdings Inc. (CVE:BNXA) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

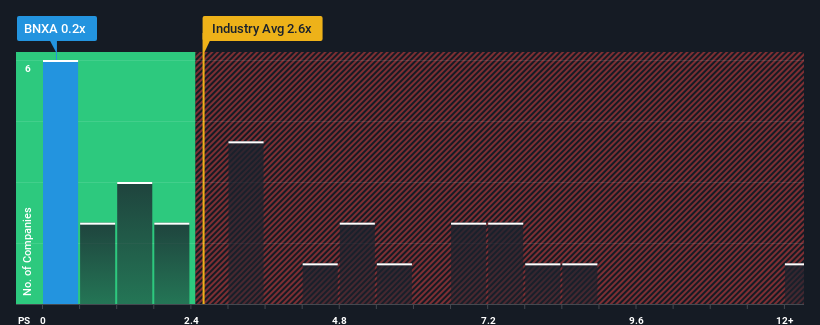

Although its price has surged higher, Banxa Holdings may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Diversified Financial industry in Canada have P/S ratios greater than 3.4x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Banxa Holdings

How Banxa Holdings Has Been Performing

With revenue growth that's superior to most other companies of late, Banxa Holdings has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Banxa Holdings will help you uncover what's on the horizon.How Is Banxa Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Banxa Holdings would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 60% over the next year. With the industry only predicted to deliver 34%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Banxa Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Banxa Holdings' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Banxa Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Banxa Holdings (3 are significant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Banxa Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BNXA

Banxa Holdings

Operates as a payments service provider for the cryptocurrency exchanges in Australia, North America, and Europe.

Slight and slightly overvalued.

Market Insights

Community Narratives