- Canada

- /

- Capital Markets

- /

- TSX:X

TMX Group (TSX:X) Earnings Grow 13.1%—Premium Valuation Fuels Narrative Debate

Reviewed by Simply Wall St

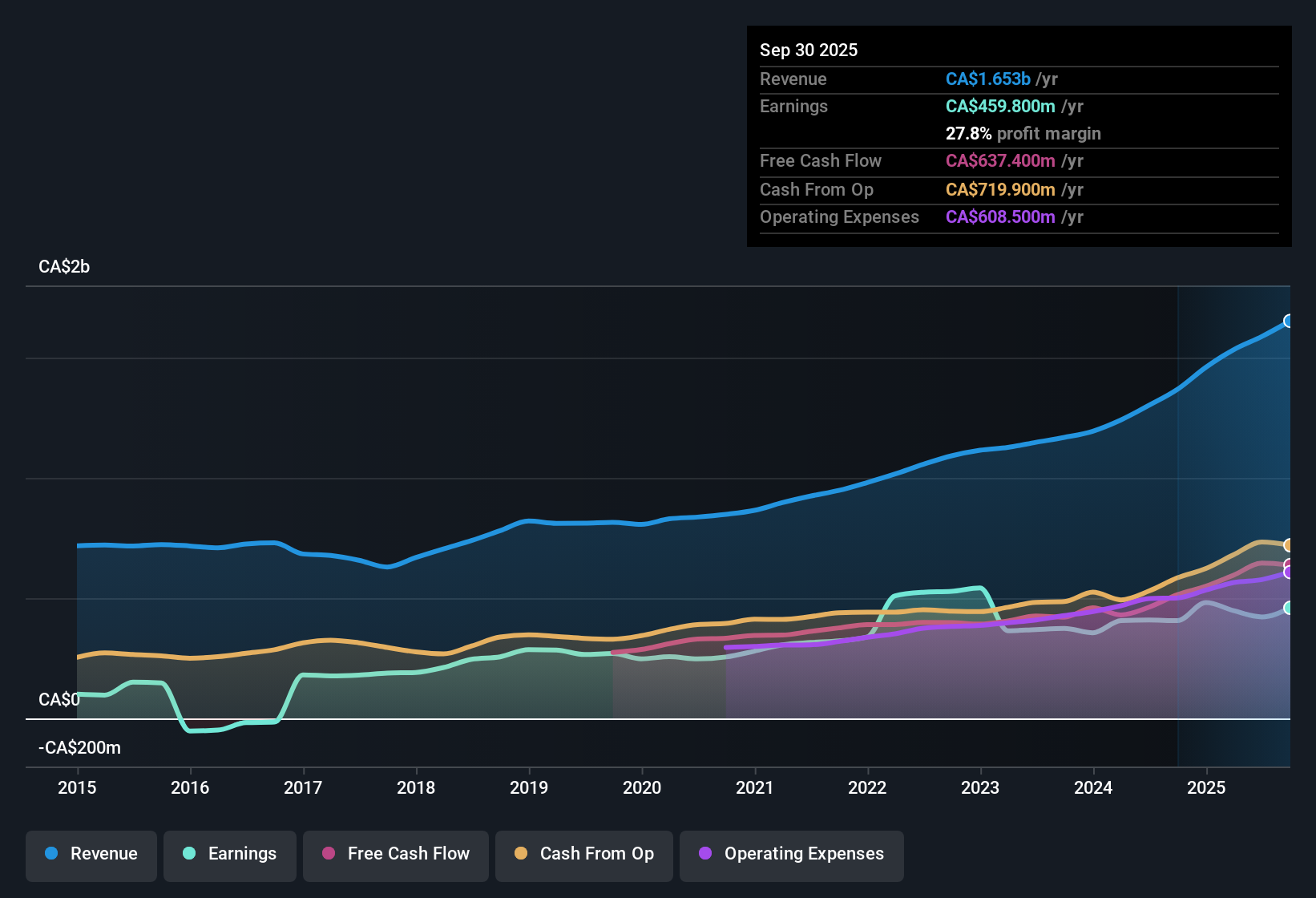

TMX Group (TSX:X) reported another solid set of numbers, with earnings growing 13.1% over the past year and maintaining an impressive 6.6% average annual growth rate over the last five years. The company’s revenue is forecast to accelerate by 6.7% per year, outpacing the broader Canadian market’s 5% projection. Earnings are projected to climb 13.1% annually, ahead of the market’s 11.9% pace. Although net profit margins have eased to 27.8% from last year’s 29.7%, ongoing growth and an appealing dividend profile give investors reasons to remain optimistic even as valuations look stretched.

See our full analysis for TMX Group.The next section puts these headline results side by side with the prevailing narratives, to see where expectations hold up and where the story might shift.

See what the community is saying about TMX Group

Margins Narrow But Remain Robust

- Net profit margins came in at 27.8%, slightly below last year's 29.7% but still well above many competitors. This reflects solid cost control even as investments in digital and global operations ramp up.

- Analysts' consensus view suggests strong momentum in higher-margin recurring revenue segments. Double-digit growth in derivatives trading and the Data Analytics division, including Trayport and VettaFi, is increasing predictable income streams, helping offset pressures from cost increases and sustaining overall margin strength.

- Recent initiatives in digital platforms and expanded international listings are credited with driving higher-quality profits and enhancing margin durability as the market landscape evolves.

- Even with margin compression relative to last year, the company still outpaces most regional peers. This supports analyst optimism about future earnings resilience and improvement.

- Consensus narrative notes that faster growth in high-margin digital and analytics segments could further widen profits if operating expenses are kept in check, especially as revenues diversify away from core Canadian equity listings.

See how the balance of margin stability and expansion fits the broader analyst narrative and projections in the full consensus roundup. 📊 Read the full TMX Group Consensus Narrative.

Premium Valuation Faces Tough Peer Comparison

- TMX Group trades at a price-to-earnings ratio of 31.3x, a significant premium versus the Canadian capital markets industry average of 9.5x and the peer average of 25.6x. This sets a high bar for delivering sustained outperformance.

- Analysts' consensus view raises the question of whether continued revenue growth and successful digital investments fully justify such a premium, especially since the current trading price of CA$51.78 remains well above the DCF fair value of CA$27.44.

- This valuation gap is notable even as analysts see room for higher future profits and assign a target price of CA$62.06, about 20% higher than the current share price, if TMX maintains its projected growth rates and margin improvements.

- Yet, aligning actual results to these ambitions means the company must continue to defend its high-quality multiple by extending global reach and recurring revenue streams, with little room for execution missteps.

Globalization and Diversification Power Recurring Revenues

- Analysts project annual revenue growth of 7.3% over the next three years, driven by international acquisitions, the expansion of digital data platforms, and record ETF listings that are broadening the business mix beyond Canadian equities.

- According to the consensus narrative, the ongoing globalization of TMX’s operations and expansion of data and analytics solutions are credited with reducing earnings volatility and strengthening resilience against competitive and technological threats.

- Diversification through investments like AlphaX US and cross-selling data services in North America and Europe is expected to deliver more stable top-line growth, anticipating rising demand for risk management and digital trading infrastructure.

- These efforts help to offset risks highlighted around private markets and blockchain, which could otherwise erode traditional revenue streams over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TMX Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these results from a different angle? Share your perspective and add your unique insight in just a few minutes by Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TMX Group.

See What Else Is Out There

Despite its global reach and robust growth, TMX Group’s lofty valuation means investors face a sizable premium and less upside compared to sector peers.

If you want to avoid overpaying and identify opportunities with greater value potential, use our these 864 undervalued stocks based on cash flows to spot companies trading well below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:X

TMX Group

Operates exchanges, markets, and clearinghouses primarily for capital markets in Canada, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives