- Canada

- /

- Capital Markets

- /

- TSX:SII

Sprott (TSX:SII) Eyes Growth with New ETFs Amid High P/E Ratio and Precious Metals Demand Surge

Reviewed by Simply Wall St

Sprott (TSX:SII) has demonstrated impressive financial health with a 20.4% annual earnings growth over the past five years, outpacing the industry average. The recent $2.3 billion increase in assets under management, driven by rising precious metal prices, highlights the company's strategic asset management capabilities. However, challenges such as a high P/E ratio and forecasted revenue decline necessitate strategic adjustments. In the following report, we cover key areas such as Sprott's financial performance, growth opportunities with new ETFs, and the impact of market volatility on its operations.

See the full analysis report here for a deeper understanding of Sprott.

Key Assets Propelling Sprott Forward

Sprott's impressive earnings growth of 20.4% annually over the past five years underscores its financial health. This growth rate not only surpasses the Capital Markets industry average of 7.2% but also reflects the company's strategic positioning in the market. The recent increase in assets under management (AUM) by $2.3 billion to $33.4 billion, as highlighted by CEO Whitney George, further cements Sprott's strong market presence. This AUM growth, driven by rising precious metal prices, indicates effective asset management strategies. Additionally, the company maintains a strong financial position with earnings before interest and taxes (EBIT) covering interest payments 27.3 times, showcasing its ability to manage debt effectively. The consistent increase in dividend payments over the past decade is another testament to its financial stability and commitment to shareholder value.

Internal Limitations Hindering Sprott's Growth

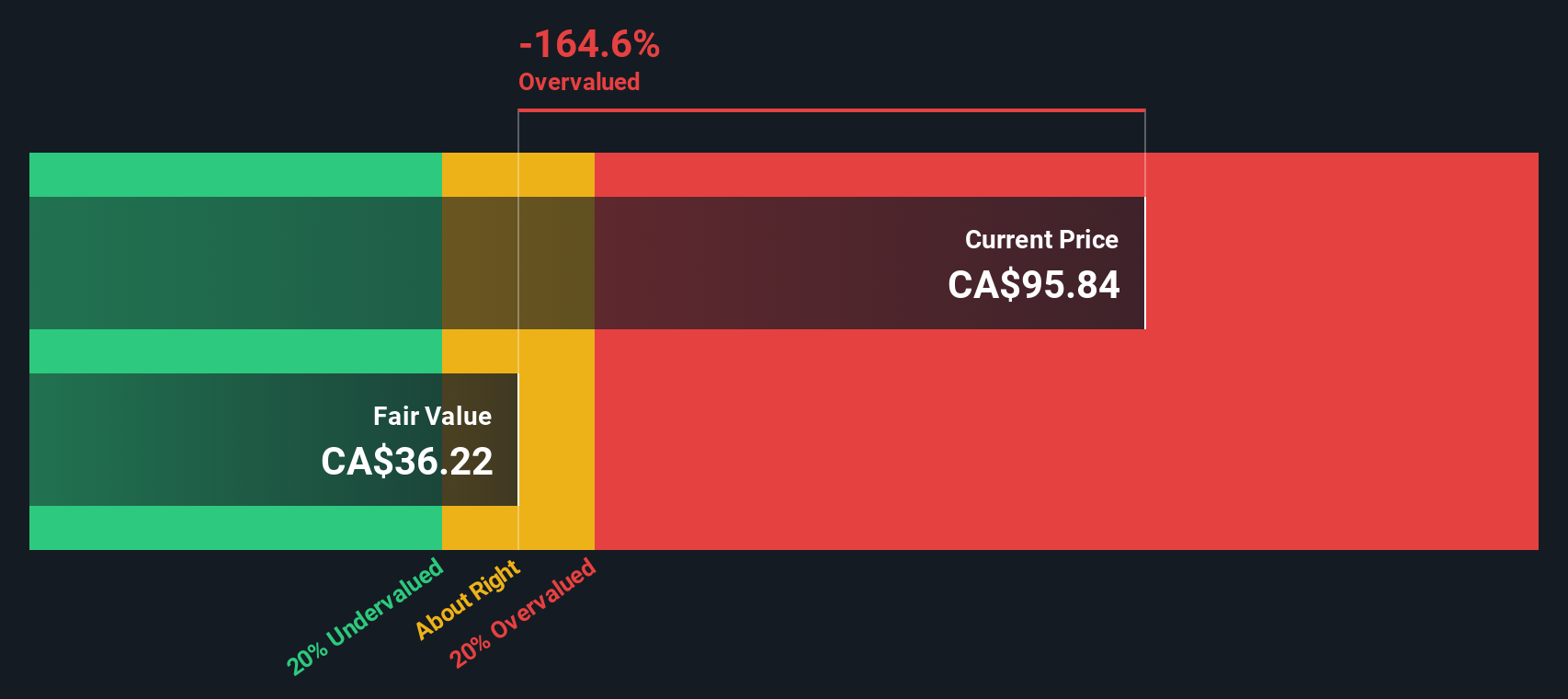

While Sprott's financial performance is commendable, the high Price-To-Earnings (P/E) ratio of 23.1x, significantly above the industry average of 12.5x, suggests that the stock may be overvalued. This valuation could potentially deter new investors. Furthermore, the managed equity segment faces challenges, with $54.6 million in net reductions during the quarter, as noted by George. This indicates potential difficulties in retaining investors. Additionally, the company's return on equity stands at 13.5%, which is below the desired 20% threshold, reflecting a need for improved operational efficiency. The forecasted 3.8% annual revenue decline over the next three years poses another challenge, necessitating strategic adjustments to sustain growth.

Emerging Markets or Trends for Sprott

The development of two new precious metals ETFs, expected to launch in early 2025, presents a significant growth opportunity for Sprott. This expansion, as mentioned by George, could enhance market share in the precious metals sector. Furthermore, the increasing demand for precious metals, with net flows of $617 million in the last quarter, represents the strongest momentum in two years. This resurgence in investor interest offers Sprott a chance to capitalize on this trend, potentially boosting revenue and market positioning. The target price being over 20% higher than the current share price also suggests potential for growth, provided market conditions remain favorable.

Market Volatility Affecting Sprott's Position

Sprott faces external pressures from market volatility and economic uncertainties, particularly following significant political events. CEO Whitney George highlighted the impact of such events on financial markets, which could disrupt Sprott's operations and investment strategies. Additionally, deteriorating trade relations, especially between major economies like the U.S. and China, could influence global demand for precious metals, as noted by John Ciampaglia. This poses a risk to Sprott's business, potentially affecting its revenue and market share. The recent insider selling activity further raises concerns about internal confidence, which could impact investor sentiment.

To gain deeper insights into Sprott's historical performance, explore our detailed analysis of past performance.Conclusion

Sprott's impressive earnings growth and strategic market positioning, evidenced by its significant increase in assets under management and strong financial health, underscore its potential for continued success in the precious metals sector. However, the high Price-To-Earnings ratio of 23.1x, well above industry and peer averages, indicates a perception of being overpriced, which could deter potential investors and necessitate a careful reevaluation of its market strategy. The company faces internal challenges, such as a lower-than-desired return on equity and a forecasted revenue decline, which require strategic adjustments to maintain growth momentum. The upcoming launch of new precious metals ETFs and the resurgence in investor interest present promising opportunities for Sprott to enhance its market share, provided it navigates external economic uncertainties and internal operational efficiencies effectively.

Where To Now?

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives