- Canada

- /

- Capital Markets

- /

- TSX:SII

Can Sprott’s (TSX:SII) New Metals ETF Reveal a Shift in Its Value Investing Playbook?

Reviewed by Simply Wall St

- Sprott Inc. recently introduced the Sprott Active Metals & Miners ETF (Nasdaq: METL), an actively managed fund designed to pursue long-term capital appreciation by investing across the global metals and mining value chain, with a value-oriented, contrarian approach.

- This ETF is managed by a team with extensive sector expertise and leverages both top-down and bottom-up research, including hundreds of annual management meetings and mining site visits.

- Let's explore how the launch of an actively managed ETF focused on overlooked mining assets adds a new layer to Sprott's investment story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sprott's Investment Narrative?

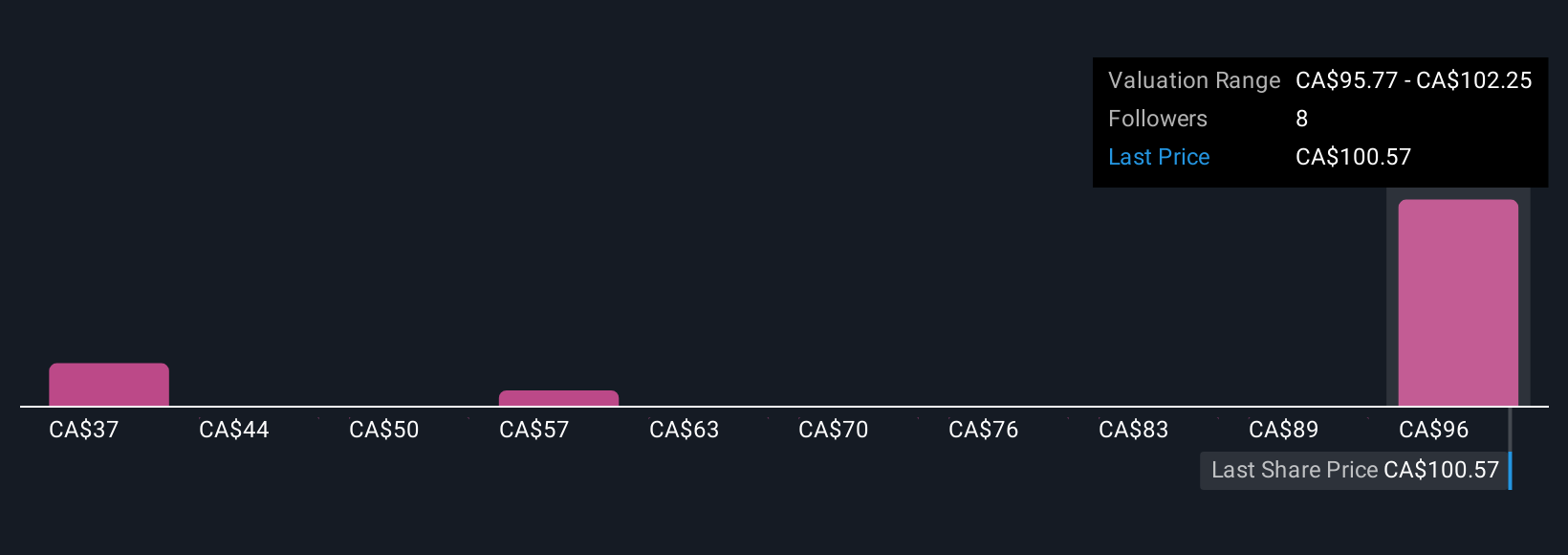

To be a Sprott shareholder, you have to believe in two key things: that global demand for metals and mining assets will remain robust, and that experienced active management can uncover value overlooked by the broader market. The launch of the Sprott Active Metals & Miners ETF (METL) sharpens Sprott's focus on differentiated, actively managed strategies within an industry vulnerable to cycles and sentiment shifts. While METL plugs a gap in Sprott’s product suite, its impact on near-term financials may be modest, given Sprott’s already-strong revenue growth and the inherent time it takes for new ETF AUM to reach scale. The main catalysts remain broader sector inflows and sentiment around commodities and critical materials. With Sprott's shares appearing expensive relative to industry averages, execution risk and investor willingness to pay a premium for growth remain top of mind, particularly if METL fails to attract meaningful flows.

But despite the appeal of new products, execution risks with ETF launches are something investors should watch. Sprott's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Sprott - why the stock might be worth less than half the current price!

Build Your Own Sprott Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprott research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sprott research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprott's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives