- Canada

- /

- Capital Markets

- /

- TSX:SII

A Look at Sprott (TSX:SII) Valuation After Launching Its Active Metals & Miners ETF

Reviewed by Simply Wall St

Price-to-Earnings of 35.7x: Is it justified?

Sprott's current Price-To-Earnings (P/E) ratio of 35.7 times earnings positions the stock as expensive compared to both the Canadian Capital Markets industry average of 10.3x and the average among its peers at 16.6x. This suggests that the market is placing a significant premium on Sprott’s future earnings potential or growth prospects, relative to similar companies.

The P/E ratio is a widely used valuation metric that indicates how much investors are willing to pay today for a dollar of the company’s earnings. In capital markets, a higher P/E can reflect strong confidence in a company’s ability to grow earnings, but it can also signal overvaluation if growth expectations do not materialize.

Sprott’s high P/E, especially compared to the broader industry, suggests that investors expect robust profit growth or see the company as less risky than its peers. However, if the firm cannot deliver on these expectations, the stock’s valuation may be difficult to justify over the long term.

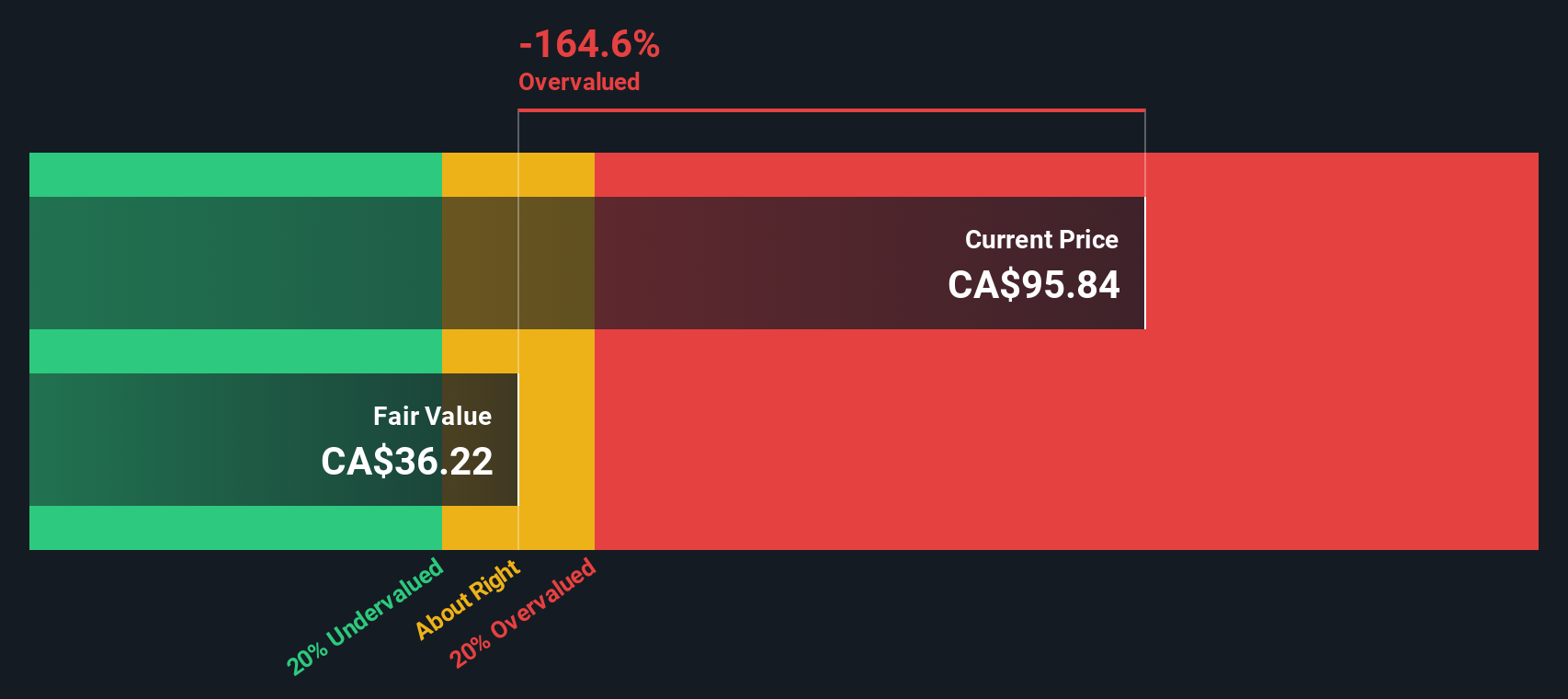

Result: Fair Value of $38.08 (OVERVALUED)

See our latest analysis for Sprott.However, if Sprott's revenue growth slows or metals markets cool, investor optimism could fade. This could put downward pressure on the stock’s current valuation.

Find out about the key risks to this Sprott narrative.Another View: Our DCF Model Says Overvalued Too

Looking at Sprott through our DCF model, we reach a similar conclusion as with the multiple approach. The current share price sits above its calculated fair value. Could both methods be missing something about future growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sprott Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sprott.

Looking for more investment ideas?

Don’t limit your potential to just one opportunity. Give yourself an edge by finding companies with strong growth, yield, or innovation using these powerful tools:

- Uncover high-potential disruptors in AI by checking out AI penny stocks. These companies are transforming industries with smart technologies and breakthrough automation.

- Tap into the next wave of healthy returns by seeking out healthcare AI stocks and explore which pioneers are revolutionizing medicine with artificial intelligence.

- Boost your income with reliable dividend stocks with yields > 3%. These options deliver yields higher than 3 percent while maintaining financial stability and long-term growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives