- Canada

- /

- Capital Markets

- /

- TSX:ONEX

ONCAP’s Backing of CSN Collision Could Be a Game Changer for Onex (TSX:ONEX)

Reviewed by Sasha Jovanovic

- CSN Collision announced a partnership with ONCAP, the private equity arm of Onex Corporation, to acquire a group of collision centers from CSN’s founders, who will remain as shareholders.

- This transaction marks a shift toward a more scalable and acquisition-driven model for CSN, with Onex’s ONCAP providing the capital and operational backing to pursue further growth opportunities in the collision repair sector.

- We will explore how ONCAP’s active role in building a larger collision repair platform underscores Onex’s ongoing efforts to expand its private equity pipeline.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Onex's Investment Narrative?

For investors looking at Onex, the essential big picture remains a belief in disciplined private equity execution and the firm’s ability to create long-term value through operational improvements and capital deployment. The recent announcement of a new CFO, Megan McClellan, with strong credentials in asset management and proven leadership in executing growth strategies, signals a commitment to maintaining financial discipline and pursuing transformational initiatives. While this executive change is significant internally, it is unlikely to change the course of Onex’s most pressing short‑term catalysts, which continue to center around unlocking value in its asset portfolio, supporting portfolio company growth (such as the ONCAP–CSN Collision partnership), and progressing ongoing M&A discussions. The greatest risks right now remain centered on board independence, a relatively low return on equity, and uncertainty regarding future growth rates, none of which appear directly impacted by the recent news. Onex’s stock price has not shown material reaction to these developments, reflecting investor trust in management transition and stable fundamentals.

Yet, while growth plans advance, board independence may remain a concern investors can’t ignore.

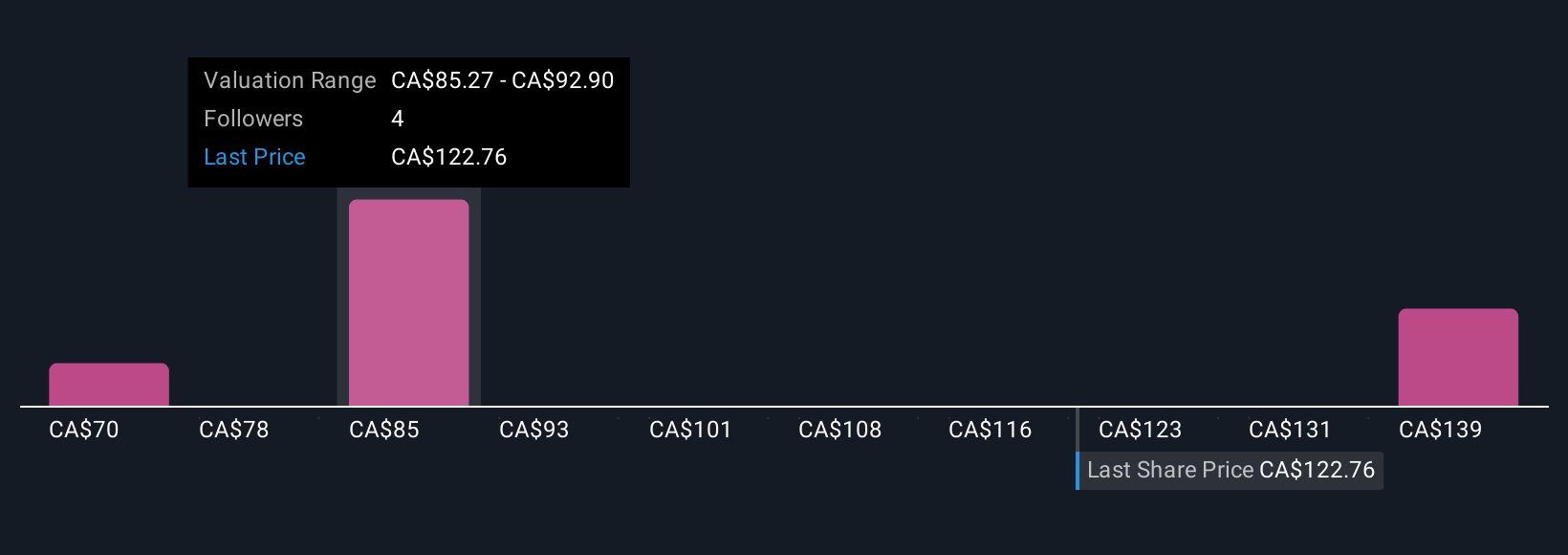

Onex's shares are on the way up, but they could be overextended by 29%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Onex - why the stock might be worth as much as 24% more than the current price!

Build Your Own Onex Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onex research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Onex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onex's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ONEX

Onex

A private equity firm specializing in acquisitions and platform acquisitions.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion