This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll show how you can use IGM Financial Inc.'s (TSE:IGM) P/E ratio to inform your assessment of the investment opportunity. IGM Financial has a P/E ratio of 12.48, based on the last twelve months. That is equivalent to an earnings yield of about 8.0%.

View our latest analysis for IGM Financial

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for IGM Financial:

P/E of 12.48 = CA$38.26 ÷ CA$3.07 (Based on the trailing twelve months to September 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each CA$1 the company has earned over the last year. That isn't a good or a bad thing on its own, but a high P/E means that buyers have a higher opinion of the business's prospects, relative to stocks with a lower P/E.

Does IGM Financial Have A Relatively High Or Low P/E For Its Industry?

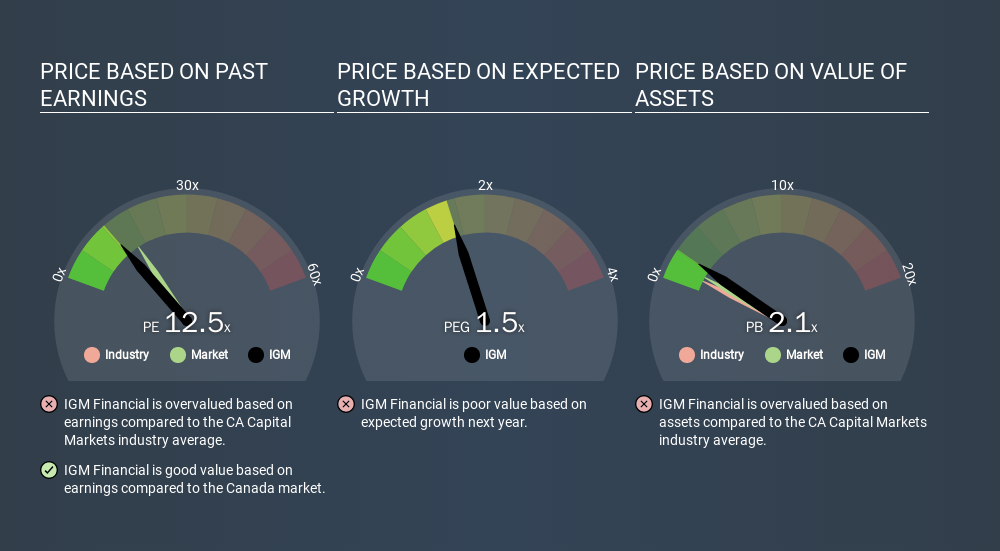

The P/E ratio indicates whether the market has higher or lower expectations of a company. As you can see below IGM Financial has a P/E ratio that is fairly close for the average for the capital markets industry, which is 12.3.

IGM Financial's P/E tells us that market participants think its prospects are roughly in line with its industry. The company could surprise by performing better than average, in the future. Further research into factors such as insider buying and selling, could help you form your own view on whether that is likely.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means even if the current P/E is high, it will reduce over time if the share price stays flat. Then, a lower P/E should attract more buyers, pushing the share price up.

IGM Financial increased earnings per share by an impressive 16% over the last twelve months. And earnings per share have improved by 1.5% annually, over the last three years. With that performance, you might expect an above average P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

How Does IGM Financial's Debt Impact Its P/E Ratio?

IGM Financial has net debt worth 15% of its market capitalization. It would probably deserve a higher P/E ratio if it was net cash, since it would have more options for growth.

The Verdict On IGM Financial's P/E Ratio

IGM Financial trades on a P/E ratio of 12.5, which is below the CA market average of 15.9. The company hasn't stretched its balance sheet, and earnings growth was good last year. If the company can continue to grow earnings, then the current P/E may be unjustifiably low.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

You might be able to find a better buy than IGM Financial. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:IGM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives