- Canada

- /

- Consumer Finance

- /

- TSX:GSY

goeasy (TSX:GSY) Is Down 23.2% After Trading Halt and Q3 Earnings Miss - What's Changed

Reviewed by Sasha Jovanovic

- goeasy Ltd. recently reported its third quarter 2025 results, highlighting record revenue of C$440.22 million but a noticeable drop in net income to C$33.09 million, with trading in its shares halted by the Canadian Investment Regulatory Organization pending further news.

- A significant driver behind these figures is the company's rapid growth in new loan originations and an expanded consumer loan portfolio, even as earnings per share slipped versus the prior year.

- We’ll look at how the robust growth in loan originations and trading halt impact goeasy’s investment outlook and risk profile.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

goeasy Investment Narrative Recap

To own goeasy, you need confidence in continued demand for non-prime lending, margin resilience despite regulatory challenges, and the company’s ability to manage credit risk as it shifts further into secured lending. The recent Q3 results highlighted robust loan growth supporting revenue, but a sharp drop in net income and a trading halt signal that uncertainty remains; at present, these events may have a material impact on both near-term sentiment and the company’s risk profile, particularly regarding regulatory or operational updates.

The renewal of goeasy’s C$1.4 billion revolving securitization warehouse facility, on substantially similar terms, is especially relevant here given this growth in loan originations. Proven ability to access large-scale funding with stable conditions supports continued expansion, acting as a counterbalance to earnings volatility, though it does not eliminate the risk tied to credit performance in a tougher environment.

Yet, investors should note, heightened regulatory scrutiny and the risk of further rate cap changes mean ...

Read the full narrative on goeasy (it's free!)

goeasy's narrative projects CA$2.7 billion revenue and CA$476.3 million earnings by 2028. This requires 48.7% yearly revenue growth and a CA$191.6 million earnings increase from CA$284.7 million today.

Uncover how goeasy's forecasts yield a CA$223.30 fair value, a 72% upside to its current price.

Exploring Other Perspectives

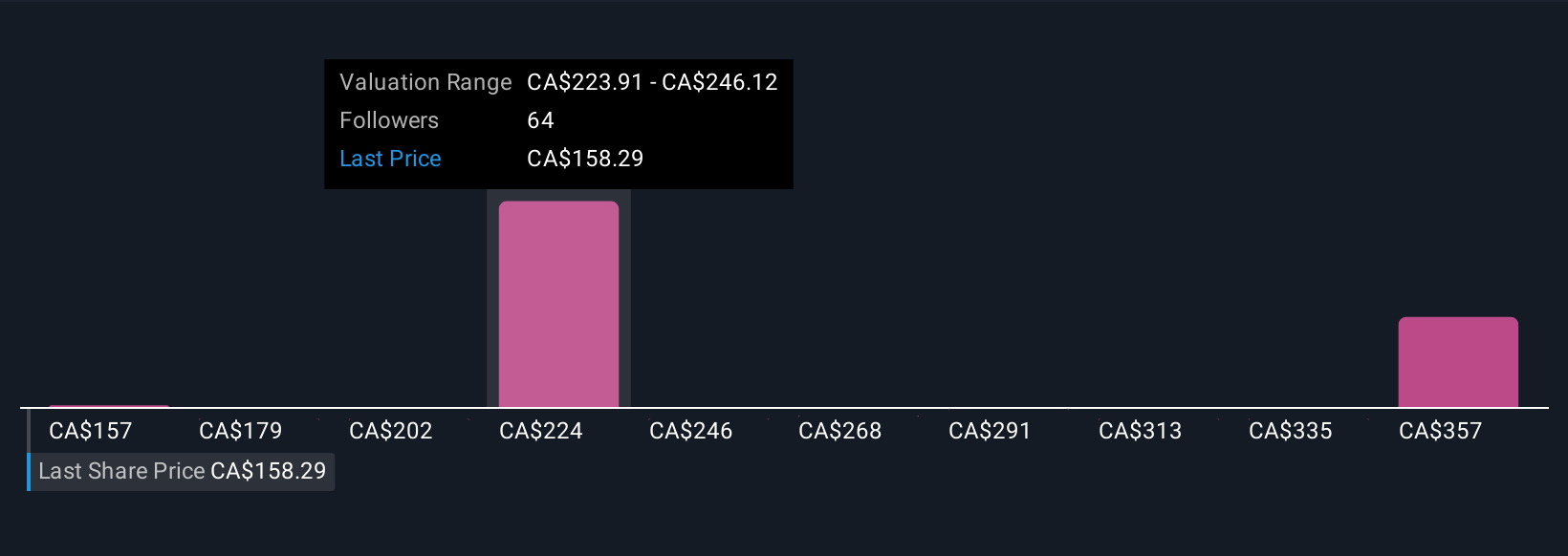

Simply Wall St Community members posted 11 fair value estimates for goeasy, with projections ranging widely from C$157.27 to C$385.44 per share. As you compare these opinions, remember that credit risk and margin pressure from regulatory actions could drive meaningful differences in future outcomes, so explore several viewpoints before deciding.

Explore 11 other fair value estimates on goeasy - why the stock might be worth just CA$157.27!

Build Your Own goeasy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your goeasy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free goeasy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate goeasy's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives