- Canada

- /

- Capital Markets

- /

- TSX:GCG.A

Discovering Enghouse Systems And 2 Other Canadian Small Caps With Strong Potential

Reviewed by Simply Wall St

Amidst the backdrop of heightened market volatility and trade uncertainties, Canadian small-cap stocks present intriguing opportunities for investors willing to navigate the fluctuations. In this environment, identifying companies with strong fundamentals and growth potential becomes crucial, as these attributes can help them weather market turbulence and capitalize on future stability.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 4.89% | 13.46% | 20.23% | ★★★★★★ |

| Pinetree Capital | 0.24% | 59.68% | 61.83% | ★★★★★★ |

| Genesis Land Development | 46.48% | 30.46% | 55.37% | ★★★★★☆ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Itafos | 28.17% | 11.62% | 53.49% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Pizza Pizza Royalty | 15.76% | 4.94% | 5.38% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Enghouse Systems (TSX:ENGH)

Simply Wall St Value Rating: ★★★★★★

Overview: Enghouse Systems Limited, with a market cap of CA$1.32 billion, develops enterprise software solutions globally through its subsidiaries.

Operations: Enghouse generates revenue primarily from its Asset Management Group and Interactive Management Group, with contributions of CA$200.01 million and CA$306.00 million, respectively.

Enghouse Systems, a small cap player in the software space, is trading at 54% below its estimated fair value, presenting an intriguing opportunity. The company boasts high-quality earnings and operates debt-free, contrasting with its debt-to-equity ratio of 0.3 five years ago. Recent acquisitions like Aculab and Margento aim to bolster offerings in communications and transit solutions. With a free cash flow of CA$131 million for the latest period, Enghouse has repurchased shares worth CA$10.9 million recently while increasing dividends by 15%. Despite these strengths, challenges such as AI competition could impact future margins slightly down from 16.8% to 15.6%.

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guardian Capital Group Limited operates through its subsidiaries to provide investment services across Canada, the United States, the United Kingdom, and internationally, with a market capitalization of CA$896.27 million.

Operations: Guardian Capital Group generates revenue primarily from its Investment Management segment, which includes wealth management, accounting for CA$281.18 million, while Corporate Activities and Investments contribute CA$44.66 million.

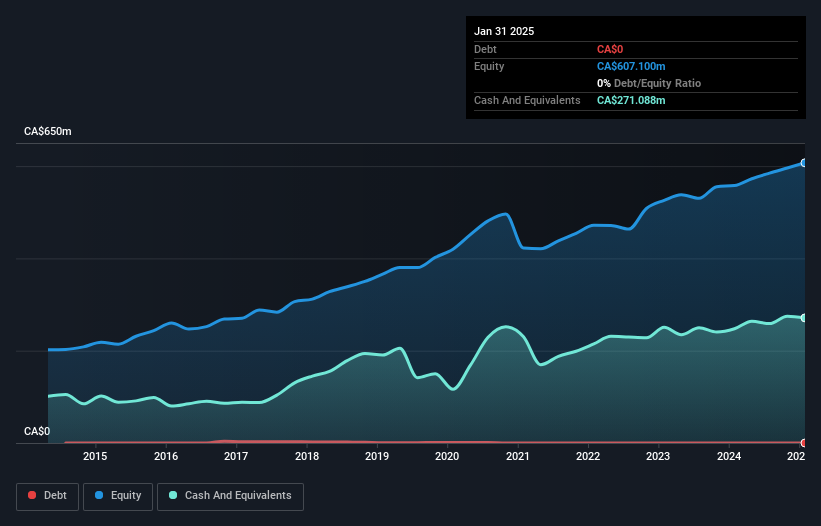

Guardian Capital's recent performance showcases a mixed bag of impressive growth and challenges. Over the past year, earnings skyrocketed by 1151.9%, significantly outpacing the capital markets industry average of 25%. However, this surge was influenced by a substantial one-off gain of CA$82 million. Despite a reduction in debt-to-equity from 16.4% to 10.9% over five years, significant insider selling in recent months raises questions about internal confidence. The company has been actively repurchasing shares, completing buybacks worth CA$24.9 million for nearly 2.5% of its shares since December 2023, suggesting efforts to enhance shareholder value amidst fluctuating net income figures.

Magellan Aerospace (TSX:MAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Magellan Aerospace Corporation, with a market cap of CA$673.66 million, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe.

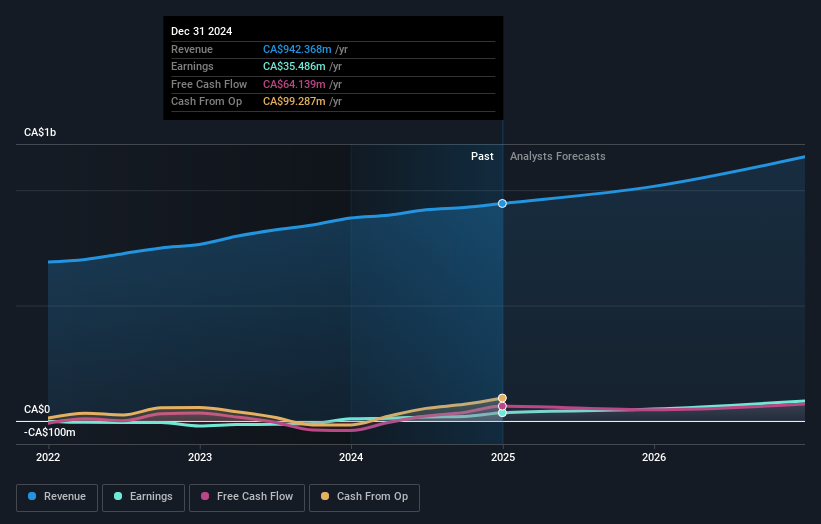

Operations: Magellan Aerospace generates revenue primarily from its aerospace segment, amounting to CA$942.37 million. The company's financial performance can be evaluated by examining its net profit margin, which provides insights into profitability after accounting for all expenses.

With a robust presence in the aerospace industry, Magellan Aerospace is making waves with its recent financial performance and strategic ventures. Over the past year, earnings soared by 283.8%, significantly outpacing the industry's 24% growth rate. The company also managed to reduce its debt-to-equity ratio from 8.9% to 6% over five years, indicating improved financial health. Its interest payments are well covered by EBIT at a ratio of 12.2x, showcasing strong operational efficiency. Recently, Magellan reported an impressive net income of CAD 35.49 million for the full year ended December 31, 2024, compared to CAD 9.25 million previously, reflecting its growing profitability and market position.

- Click to explore a detailed breakdown of our findings in Magellan Aerospace's health report.

Evaluate Magellan Aerospace's historical performance by accessing our past performance report.

Taking Advantage

- Delve into our full catalog of 36 TSX Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GCG.A

Guardian Capital Group

Through its subsidiaries, primarily engages in the provision of investment services in Canada, the United States, the United Kingdom, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives