- Canada

- /

- Capital Markets

- /

- TSX:FIH.U

The three-year decline in earnings might be taking its toll on Fairfax India Holdings (TSE:FIH.U) shareholders as stock falls 3.8% over the past week

It might be of some concern to shareholders to see the Fairfax India Holdings Corporation (TSE:FIH.U) share price down 10% in the last month. But at least the stock is up over the last three years. In that time, it is up 73%, which isn't bad, but not amazing either.

In light of the stock dropping 3.8% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Fairfax India Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years of share price growth, Fairfax India Holdings actually saw its earnings per share (EPS) drop 26% per year.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, we think it's worth considering other metrics as well.

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 26% per year). The only thing that's clear is there is low correlation between Fairfax India Holdings' share price and its historic fundamental data. Further research may be required!

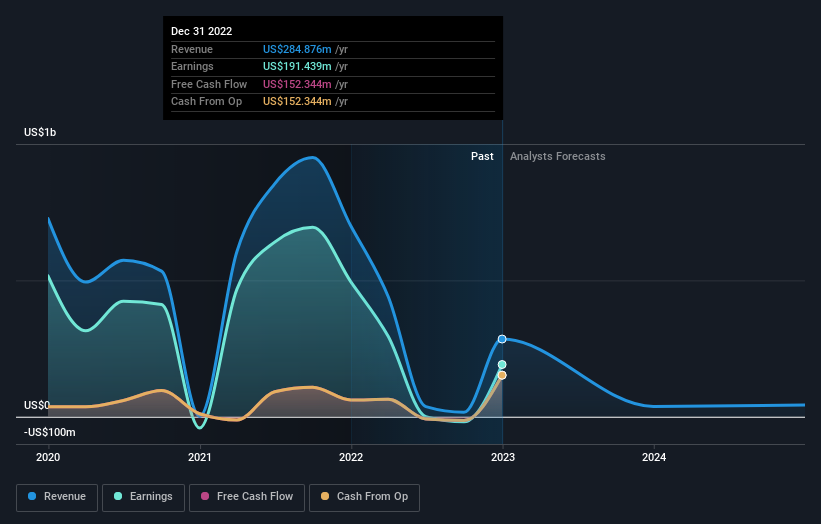

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Fairfax India Holdings will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Fairfax India Holdings shareholders have received a total shareholder return of 5.1% over one year. Notably the five-year annualised TSR loss of 5% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Fairfax India Holdings by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FIH.U

Fairfax India Holdings

Operates as an investment holding company in India.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success