- Canada

- /

- Capital Markets

- /

- TSX:FIH.U

How Investors May Respond To Fairfax India Holdings' (TSX:FIH.U) Expanded Credit Facility and Extended Maturity

Reviewed by Sasha Jovanovic

- Fairfax India Holdings Corporation recently amended its credit agreement, increasing its revolving credit facility from US$175 million to US$200 million with an option for a further US$20 million, and extending its maturity date to November 13, 2028.

- This adjustment provides the company with greater financial flexibility, supporting its ability to pursue new investments and manage liquidity needs in the Indian market.

- We'll explore how the expanded credit facility and extended maturity date may influence Fairfax India Holdings' overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Fairfax India Holdings' Investment Narrative?

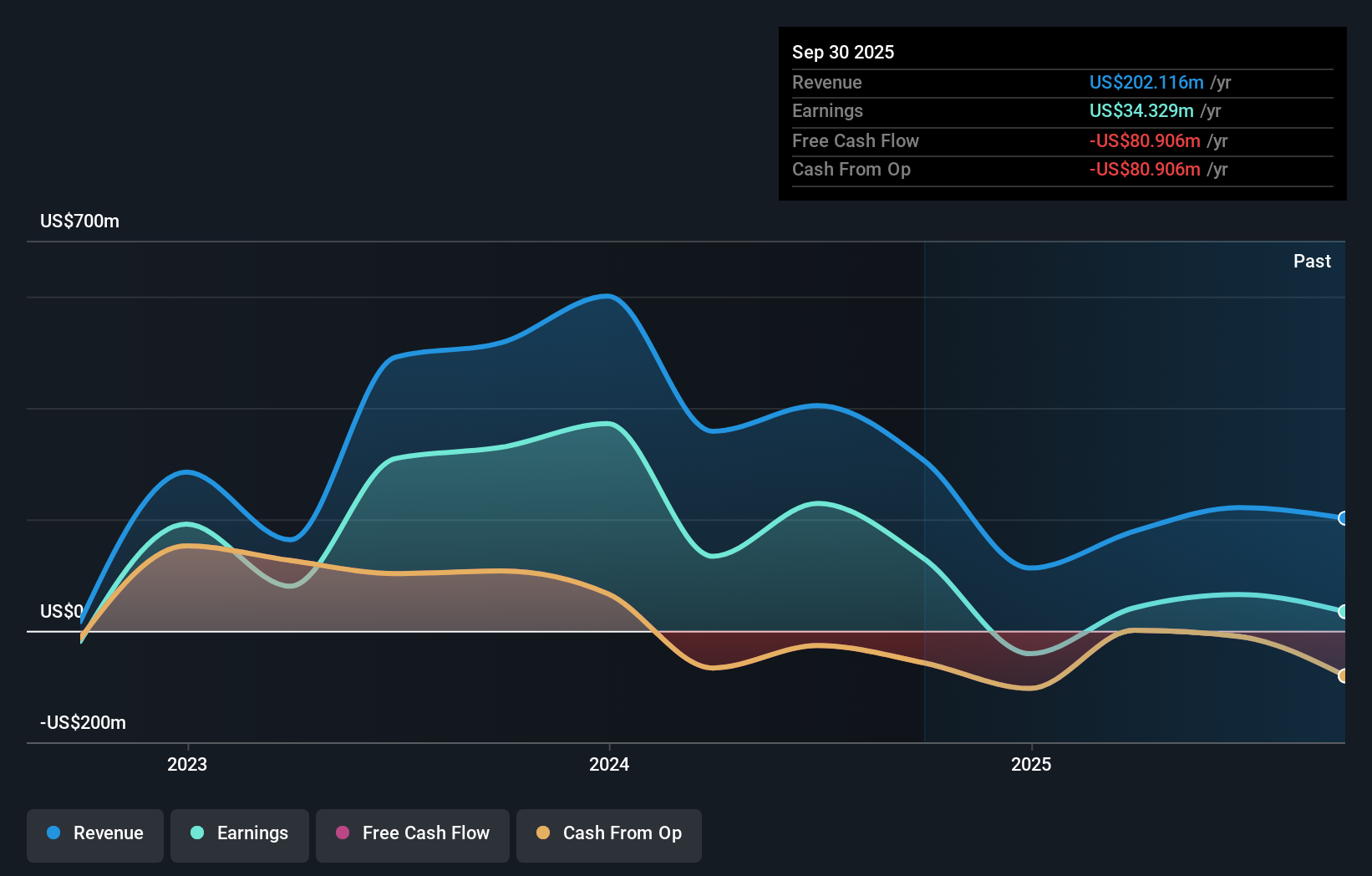

Owning a piece of Fairfax India Holdings means believing not only in the long-term investment potential of India but also in the company's ability to find and nurture quality assets within that market. The recent expansion and extension of its revolving credit facility give Fairfax India more room to maneuver, which, if capitalized on, could support near-term investment opportunities or buttress liquidity to weather uncertain markets. Catalysts like asset sales or a potential airport IPO remain central to the investment story, while risks persist: earnings volatility, leadership transition, expensive valuations relative to peers, and lagging returns against market benchmarks all call for careful watch. The amended credit facility modestly reduces short-term liquidity risk, but for most of the business’s biggest drivers, its real impact will depend on how effectively management uses this extra flexibility. Yet, despite this boost in flexibility, earnings volatility still looms as a key concern for shareholders.

Fairfax India Holdings' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Fairfax India Holdings - why the stock might be worth less than half the current price!

Build Your Own Fairfax India Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fairfax India Holdings research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Fairfax India Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fairfax India Holdings' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FIH.U

Fairfax India Holdings

Operates as an investment holding company in India.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives