Clairvest Group Inc. (TSE:CVG) will pay a dividend of CA$0.8016 on the 26th of July. The dividend yield is 1.2% based on this payment, which is a little bit low compared to the other companies in the industry.

Check out our latest analysis for Clairvest Group

Clairvest Group Might Find It Hard To Continue The Dividend

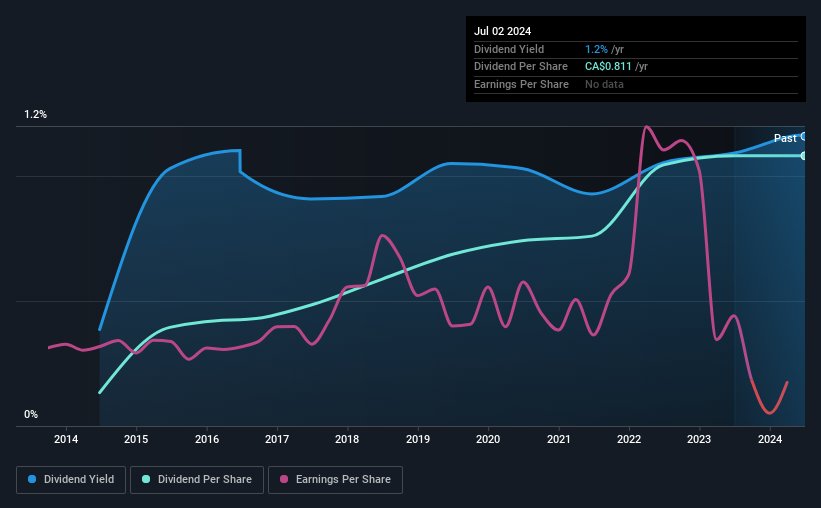

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Even in the absence of profits, Clairvest Group is paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Looking forward, earnings per share could 1.4% over the next year if the trend of the last few years can't be broken. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Clairvest Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was CA$0.10 in 2014, and the most recent fiscal year payment was CA$0.811. This means that it has been growing its distributions at 23% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Achieve

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Unfortunately, Clairvest Group's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Although they have been consistent in the past, we think the payments are a little high to be sustained. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Clairvest Group that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CVG

Clairvest Group

A private equity firm specializing in mid-market, growth equity investments, buyouts, industry consolidation and acquisitions.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives