- Canada

- /

- Capital Markets

- /

- TSX:CF

Is It Smart To Buy Canaccord Genuity Group Inc. (TSE:CF) Before It Goes Ex-Dividend?

Canaccord Genuity Group Inc. (TSE:CF) stock is about to trade ex-dividend in two days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Canaccord Genuity Group's shares before the 24th of February in order to receive the dividend, which the company will pay on the 10th of March.

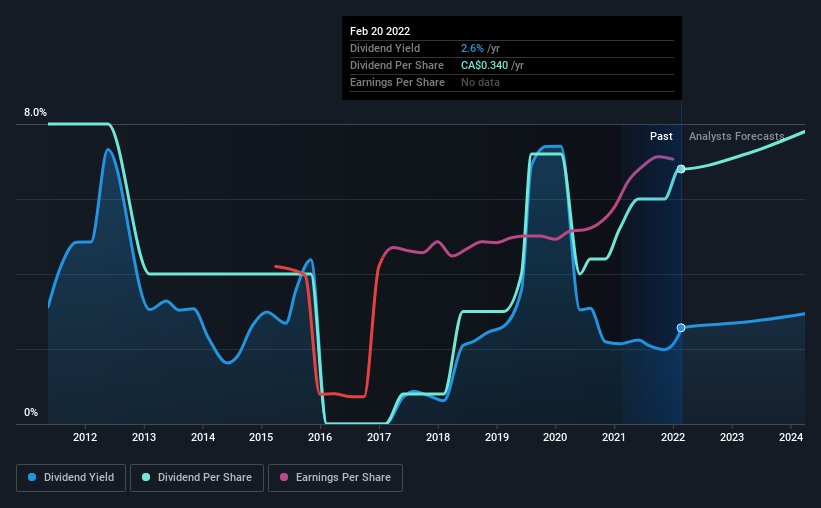

The company's upcoming dividend is CA$0.085 a share, following on from the last 12 months, when the company distributed a total of CA$0.34 per share to shareholders. Looking at the last 12 months of distributions, Canaccord Genuity Group has a trailing yield of approximately 2.6% on its current stock price of CA$13.25. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Canaccord Genuity Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Canaccord Genuity Group paid out just 11% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Canaccord Genuity Group's earnings have been skyrocketing, up 58% per annum for the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Canaccord Genuity Group's dividend payments per share have declined at 1.6% per year on average over the past 10 years, which is uninspiring.

Final Takeaway

Is Canaccord Genuity Group an attractive dividend stock, or better left on the shelf? Companies like Canaccord Genuity Group that are growing rapidly and paying out a low fraction of earnings, are usually reinvesting heavily in their business. This is one of the most attractive investment combinations under this analysis, as it can create substantial value for investors over the long run. In summary, Canaccord Genuity Group appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

In light of that, while Canaccord Genuity Group has an appealing dividend, it's worth knowing the risks involved with this stock. Every company has risks, and we've spotted 2 warning signs for Canaccord Genuity Group you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CF

Canaccord Genuity Group

Operates as a full-service investment dealer in Canada, the United States, the United Kingdom, Europe, Crown Dependencies, and Australia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives