- Canada

- /

- Capital Markets

- /

- TSX:BN

Improved Revenues Required Before Brookfield Corporation (TSE:BN) Stock's 26% Jump Looks Justified

Those holding Brookfield Corporation (TSE:BN) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 33%.

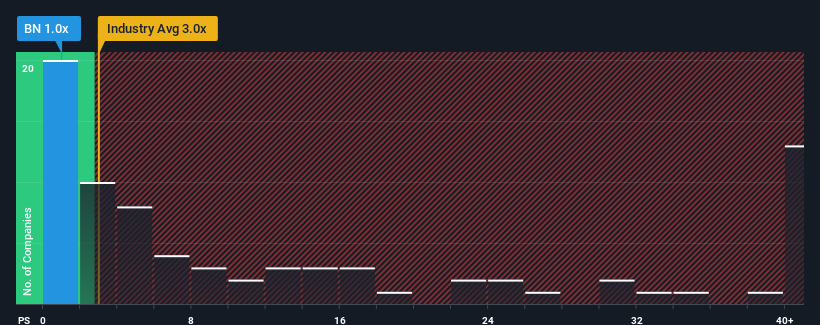

Although its price has surged higher, Brookfield may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Capital Markets industry in Canada have P/S ratios greater than 3.9x and even P/S higher than 19x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Brookfield

What Does Brookfield's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Brookfield's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Brookfield's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Brookfield?

In order to justify its P/S ratio, Brookfield would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.4%. Regardless, revenue has managed to lift by a handy 13% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to plummet, contracting by 54% each year during the coming three years according to the two analysts following the company. With the rest of the industry predicted to shrink by 39% per annum, it's a sub-optimal result.

In light of this, it's understandable that Brookfield's P/S sits below the majority of other companies. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Brookfield's P/S

Shares in Brookfield have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Brookfield's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. With such a gloomy outlook, investors feel the potential for an improvement in revenue isn't great enough to justify paying a premium resulting in a higher P/S ratio. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Brookfield (2 make us uncomfortable!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BN

Brookfield

A multi-asset manager focused on real estate, credit, renewable power & transition, infrastructure and venture capital and private equity including growth capital and emerging growth investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives