- Canada

- /

- Capital Markets

- /

- TSX:BAM

Is Brookfield a Bargain After Recent Stock Pullback?

Reviewed by Bailey Pemberton

Thinking about what to do with Brookfield Asset Management stock right now? You are not alone. Investors are weighing their options as the share price has pulled back lately, slipping 7.7% over the past week and sitting roughly 5.5% lower than it was just a month ago. Year to date, Brookfield’s stock is down 2.9%. Looking at the last year, however, the stock has still gained a healthy 11.2%.

What is behind this mix of upward potential and recent dip? Some of it comes down to market sentiment shifting as investors reassess risk in the broader financial sector. There have also been ongoing discussions around asset management fee structures and market developments that spark both optimism and caution among analysts. But as any savvy investor knows, price swings are only half the story. The other half is whether the stock’s current price actually represents fair value.

To answer that, let’s look closer at the numbers. Brookfield Asset Management scores a 2 out of 6 on our valuation scale, meaning it is considered undervalued by two key metrics. Is that enough to jump in, or is it a sign to dig deeper? Next, we will break down those valuation approaches and, most importantly, hint at an even better way to look for value before you make your final call.

Brookfield Asset Management scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Brookfield Asset Management Excess Returns Analysis

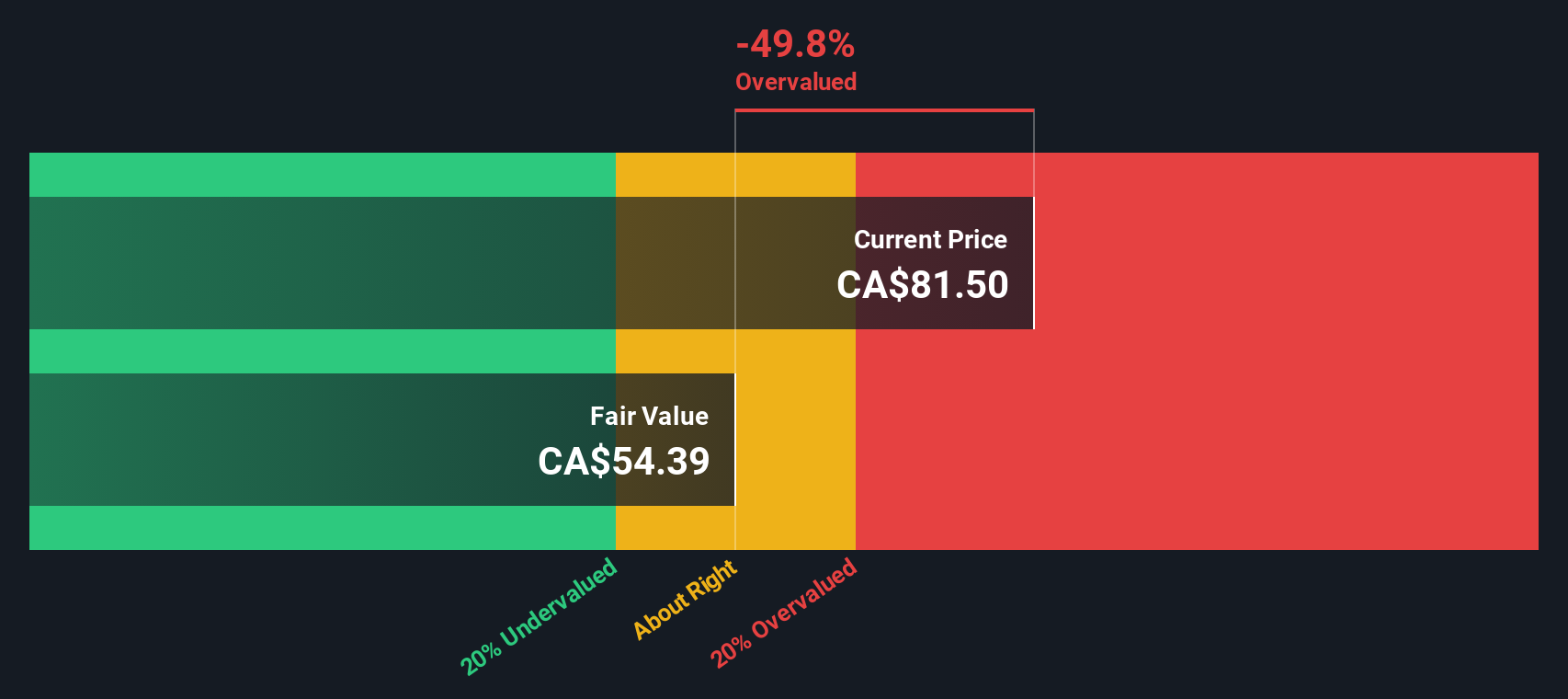

The Excess Returns valuation model focuses on a company's ability to generate returns on invested capital above its cost of equity. Essentially, it asks whether Brookfield Asset Management's profits on equity are consistently strong enough to justify a premium price. Key metrics for this approach include:

- Book Value: CA$5.25 per share

- Stable EPS: CA$1.96 per share (Source: Weighted future Return on Equity estimates from 4 analysts.)

- Cost of Equity: CA$0.44 per share

- Excess Return: CA$1.52 per share

- Average Return on Equity: 33.82%

- Stable Book Value: CA$5.78 per share (Source: Weighted future Book Value estimates from 4 analysts.)

The Excess Returns model estimates the intrinsic value of Brookfield Asset Management by projecting how much the company can earn above its cost of capital using the above figures. According to this analysis, the stock is estimated to be 49.8% overvalued compared to its intrinsic value. This suggests that current prices are significantly above what this detailed returns analysis would justify.

Result: OVERVALUED

Our Excess Returns analysis suggests Brookfield Asset Management may be overvalued by 49.8%. Find undervalued stocks or create your own screener to find better value opportunities.

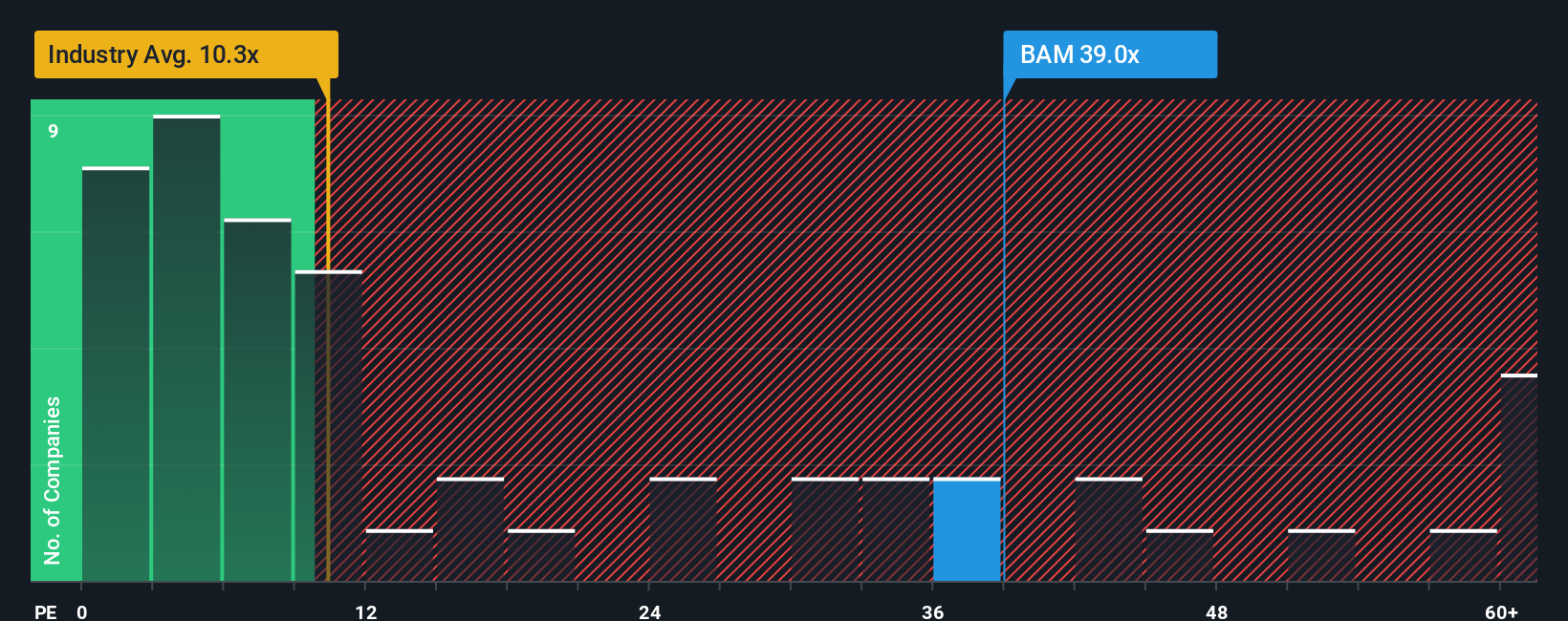

Approach 2: Brookfield Asset Management Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies because it allows investors to quickly see how much they are paying for each dollar of earnings. For businesses with steady profitability and easily understood earnings, the PE ratio is particularly useful as a yardstick for fair value.

A “normal” or “fair” PE ratio depends on expectations for future growth and the perceived risks the company faces. Higher growth prospects and lower risks often justify higher PE multiples. On the other hand, slower growth or elevated uncertainty may warrant a lower multiple.

Currently, Brookfield Asset Management trades at a PE ratio of 35.9x, which is notably higher than both the Capital Markets industry average of 10.3x and the peer group average of 52.2x. This premium suggests the market has high expectations for Brookfield’s future performance. However, looking only at peer or industry averages can miss crucial details about the company’s specific attributes and outlook.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, set at 37.9x for Brookfield, accounts for its expected earnings growth, profit margins, risk profile, industry, and market capitalization. By synthesizing all these factors, it provides a more tailored benchmark than a simple comparison to peers or industry norms.

Comparing Brookfield’s actual PE of 35.9x to its Fair Ratio of 37.9x, the difference is minor. This suggests the stock is priced about right given its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brookfield Asset Management Narrative

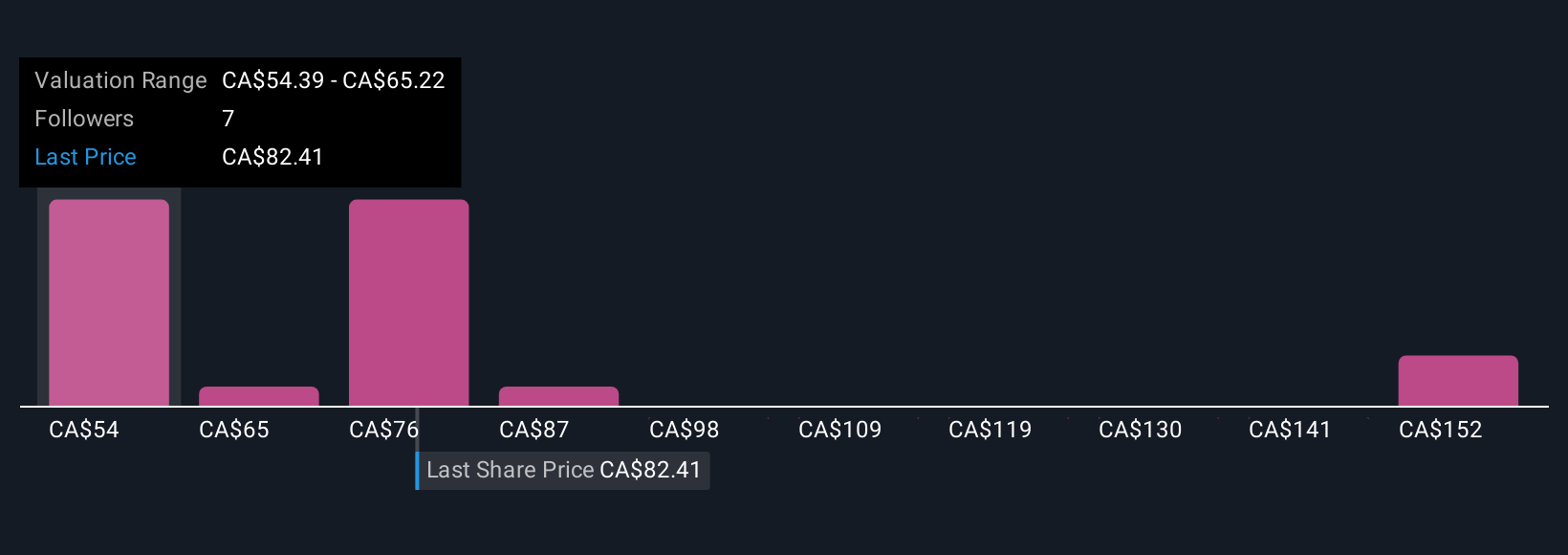

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a powerful tool that lets you tell the story behind the numbers, linking your perspective on a company, such as Brookfield Asset Management, to financial forecasts and fair value estimates. Instead of relying solely on static ratios or peer comparisons, Narratives help you connect the company’s outlook, growth assumptions, and key risks directly to what you think is a fair price.

Narratives are available to everyone on Simply Wall St’s platform within the Community page, making it easy for millions of investors to create, share, and review stories that capture their view of the company’s future. These Narratives update automatically as new data or news emerges, ensuring your investment view is always current. Simply compare your personal Fair Value to the latest price to decide if it’s time to buy, sell, or hold. For example, one Brookfield Narrative might see strong fee growth and assign a higher Fair Value, while another expects margin pressure and sees a lower Fair Value. This shows how your own outlook can drive better investment decisions than just the numbers alone.

Do you think there's more to the story for Brookfield Asset Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with high growth potential.

Market Insights

Community Narratives