- Canada

- /

- Capital Markets

- /

- TSX:BAM

Brookfield Asset Management (TSX:BAM): Is the Current Valuation Justified After Recent Share Price Pullback?

Reviewed by Kshitija Bhandaru

Brookfield Asset Management (TSX:BAM) shares have traded in a relatively tight range over the past month, showing little reaction even as broader market sentiment shifts. Investors watching for catalysts may be assessing the latest numbers.

See our latest analysis for Brookfield Asset Management.

Brookfield Asset Management’s share price has wobbled over the past month, reflecting a 7.28% dip, even as it holds steady year to date. However, long-term total shareholder return remains positive at 11.81% for the past twelve months, suggesting that momentum is cooling in the short term but has been constructive for patient investors.

If recent market shifts have you looking for new opportunities, consider broadening the search and see what else is possible with fast growing stocks with high insider ownership

With shares taking a breather after strong returns, investors now face a critical question: does Brookfield Asset Management offer value at current levels, or is the market already factoring in its future growth potential?

Price-to-Earnings of 36.2x: Is it justified?

Brookfield Asset Management currently trades on a price-to-earnings (P/E) ratio of 36.2x, which is high relative to both its industry and historical norms. This elevated valuation stands out given the recent share price of CA$76.65.

The P/E ratio measures how much investors are willing to pay for each dollar of company earnings, reflecting expectations about future growth, profitability, and risk. In the capital markets sector, a higher P/E can signal strong anticipated earnings growth, but it also implies increased expectations and potentially higher risks if future results falter.

BAM's P/E of 36.2x is notably above the Canadian Capital Markets industry average of 10.2x. This highlights the market’s confidence in Brookfield Asset Management’s growth story. Interestingly, compared to its estimated Fair P/E Ratio of 37.8x, the valuation looks more reasonable and could represent where the market might be heading. This suggests that although the stock is expensive versus peers, it is not far from its fair value according to regression-based analysis.

Explore the SWS fair ratio for Brookfield Asset Management

Result: Price-to-Earnings of 36.2x (ABOUT RIGHT)

However, softer recent share performance and a high valuation could leave Brookfield Asset Management vulnerable if anticipated earnings growth slows or if market sentiment weakens.

Find out about the key risks to this Brookfield Asset Management narrative.

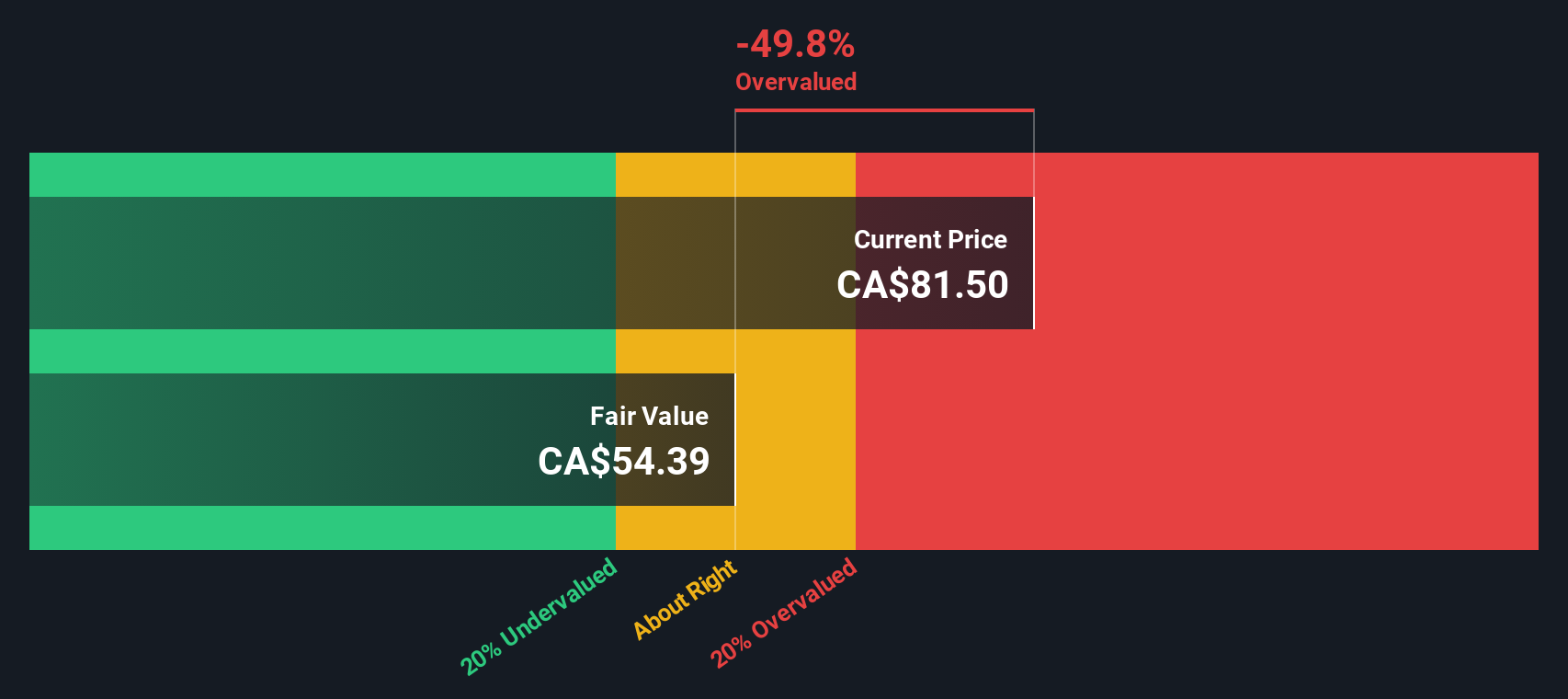

Another View: Discounted Cash Flow

Switching to our DCF model, we see a very different story. While the market is pricing Brookfield Asset Management close to its fair ratio, our DCF analysis estimates a fair value of CA$50.94 per share. At CA$76.65, the stock appears overvalued by this approach. Could the market be too optimistic, or is growth being underestimated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Asset Management Narrative

If you see these results differently, or would rather dig into the numbers in your own way, you can easily craft your own perspective in under three minutes with Do it your way.

A great starting point for your Brookfield Asset Management research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stick with the familiar and risk missing out on the next set of big movers. These handpicked screens reveal stocks that could reshape your portfolio.

- Turn your eye to high-yield opportunities and benefit from steady cash returns by reviewing these 17 dividend stocks with yields > 3%.

- Harness the momentum of artificial intelligence by tapping into these 24 AI penny stocks and see which companies are leading this game-changing field.

- Seize value before the market catches on with these 873 undervalued stocks based on cash flows that highlight hidden gems trading below their potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with high growth potential.

Market Insights

Community Narratives