- Canada

- /

- Capital Markets

- /

- TSX:AAB

TSX Penny Stocks To Monitor In December 2024

Reviewed by Simply Wall St

The Canadian market has shown resilience, with inflation easing and economic growth being supported by strong household spending and robust corporate profits. This backdrop creates a fertile ground for investors seeking opportunities in various sectors, including the often-overlooked realm of penny stocks. While the term "penny stocks" might seem outdated, these low-priced shares can still offer significant growth potential when backed by sound financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.56 | CA$165.86M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.66 | CA$278.54M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.22 | CA$119.58M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$395.45M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$237.5M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.51 | CA$955.1M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$4.87M | ★★★★★★ |

Click here to see the full list of 914 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Spearmint Resources (CNSX:SPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spearmint Resources Inc. is an exploration stage company focused on the identification, acquisition, and exploration of mineral properties, with a market cap of CA$6.81 million.

Operations: Spearmint Resources Inc. does not have any reported revenue segments as it is currently in the exploration stage.

Market Cap: CA$6.81M

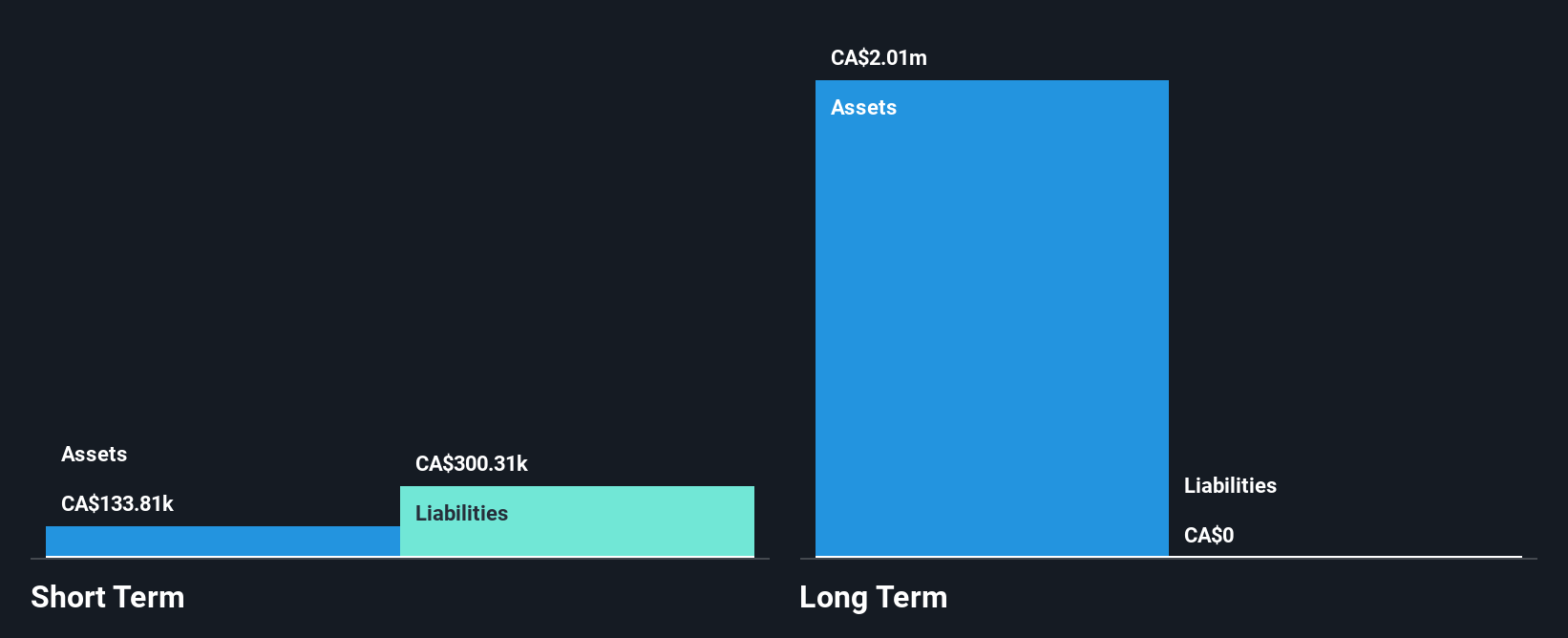

Spearmint Resources Inc., a pre-revenue exploration stage company, recently acquired the George Lake South Antimony Project, expanding its portfolio in a region with historical significance for antimony production. Despite being debt-free, the company faces financial challenges with short-term liabilities exceeding assets and only a brief cash runway before recent capital raises. The stock has experienced high volatility over the past three months. While management and the board are seasoned, Spearmint remains unprofitable with increasing losses over five years and negative return on equity at -37.16%.

- Click here to discover the nuances of Spearmint Resources with our detailed analytical financial health report.

- Examine Spearmint Resources' past performance report to understand how it has performed in prior years.

Aberdeen International (TSX:AAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aberdeen International Inc. is a resource investment and merchant banking company that targets small-cap firms in the metals, mining, and renewable energy sectors, with a market cap of CA$6.55 million.

Operations: Aberdeen International's revenue segments include unclassified services, which reported a revenue of -CA$8.90 million.

Market Cap: CA$6.55M

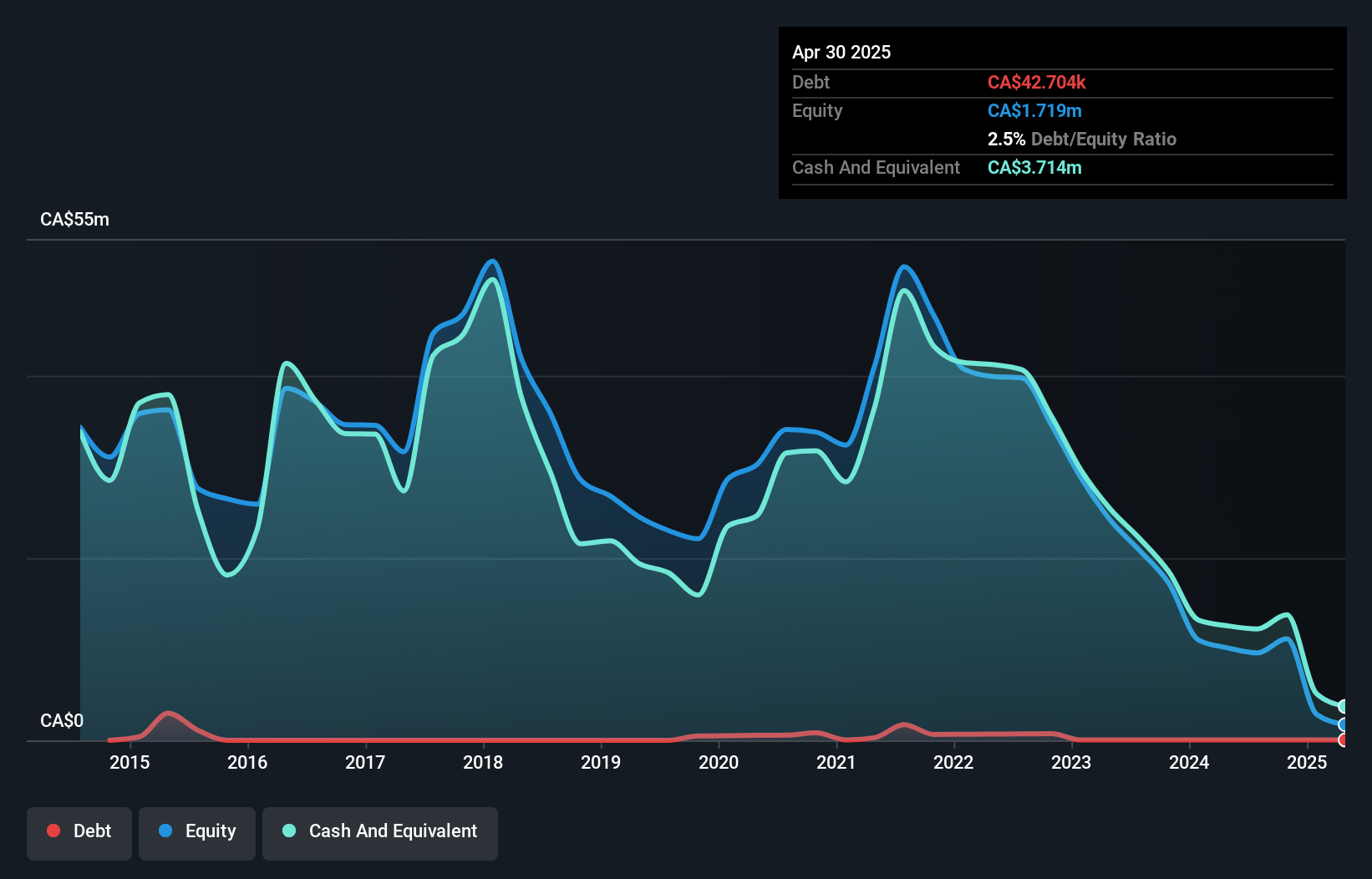

Aberdeen International Inc., with a market cap of CA$6.55 million, is a pre-revenue entity focused on small-cap investments in metals and mining. Despite being unprofitable, the company has seen reduced losses over the past year and maintains more cash than its total debt, indicating financial stability. The recent appointment of Dev Shetty as CEO signals a strategic pivot towards energy transition and precious metals, leveraging his extensive experience in revitalizing mining assets. Aberdeen's stock remains volatile but offers potential upside if Mr. Shetty successfully implements his turnaround strategy amidst high industry volatility.

- Unlock comprehensive insights into our analysis of Aberdeen International stock in this financial health report.

- Understand Aberdeen International's track record by examining our performance history report.

Payfare (TSX:PAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Payfare Inc. is a financial technology company offering instant payout and digital banking solutions to gig economy workers in Canada, the United States, and Mexico, with a market cap of CA$98.98 million.

Operations: The company's revenue primarily comes from its Data Processing segment, which generated CA$216.87 million.

Market Cap: CA$98.98M

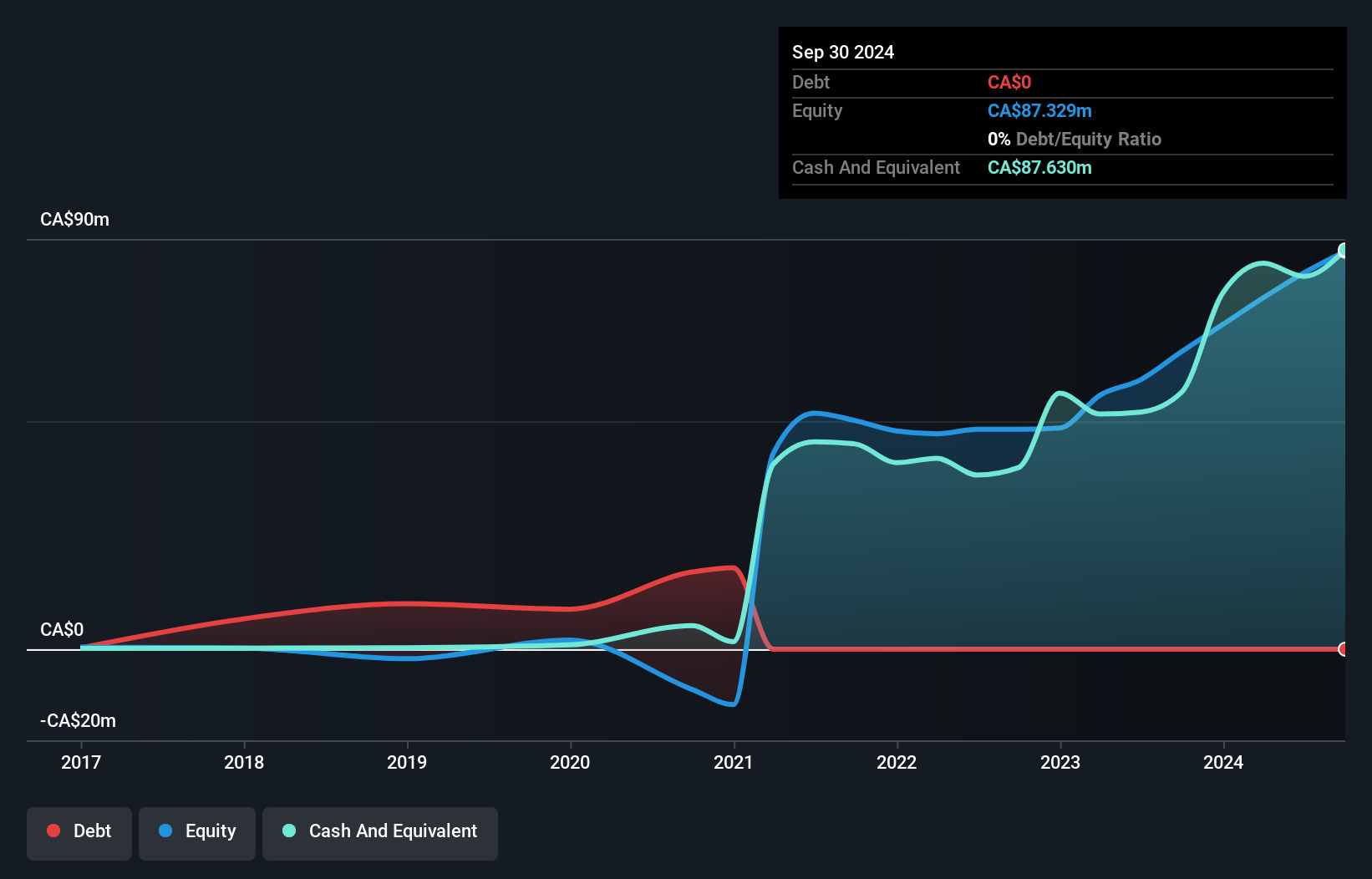

Payfare Inc., with a market cap of CA$98.98 million, has shown significant financial growth, reporting third-quarter sales of CA$58.97 million and net income of CA$4.46 million. The recent launch of Pronto by PayfareTM, an earned wage access product, aims to enhance financial flexibility for Canadian gig workers and could improve employer retention rates in competitive labor markets. Despite high share price volatility and increased weekly volatility over the past year, Payfare's strong earnings growth outpaces the industry average significantly. The company remains debt-free with robust short-term assets covering liabilities effectively.

- Take a closer look at Payfare's potential here in our financial health report.

- Assess Payfare's future earnings estimates with our detailed growth reports.

Summing It All Up

- Access the full spectrum of 914 TSX Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAB

Aberdeen International

A resource investment and merchant banking company, engages in small capitalization companies in the metals and mining sector and renewal energy sectors.

Excellent balance sheet slight.

Market Insights

Community Narratives