- Canada

- /

- Metals and Mining

- /

- TSXV:OCO

3 Promising TSX Penny Stocks With Under CA$70M Market Cap

Reviewed by Simply Wall St

The Canadian market is navigating potential challenges from increased tariffs, which could impact economic growth and inflation, yet the overall economic backdrop remains supportive with above-trend growth and low unemployment. In such uncertain times, diversification becomes crucial for investors seeking to balance risk and opportunity. Penny stocks, often overlooked due to their vintage label, can offer valuable opportunities when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.79M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$129.13M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$434.8M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$656.3M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$25.79M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$411.5M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$181.56M | ★★★★★☆ |

Click here to see the full list of 941 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Stock Trend Capital (CNSX:PUMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stock Trend Capital Inc. is an investment company concentrating on the Canadian cannabis and artificial intelligence industries, with a market cap of CA$9.90 million.

Operations: The company's revenue segment in Corporate and Development reported CA$-0.56 million.

Market Cap: CA$9.9M

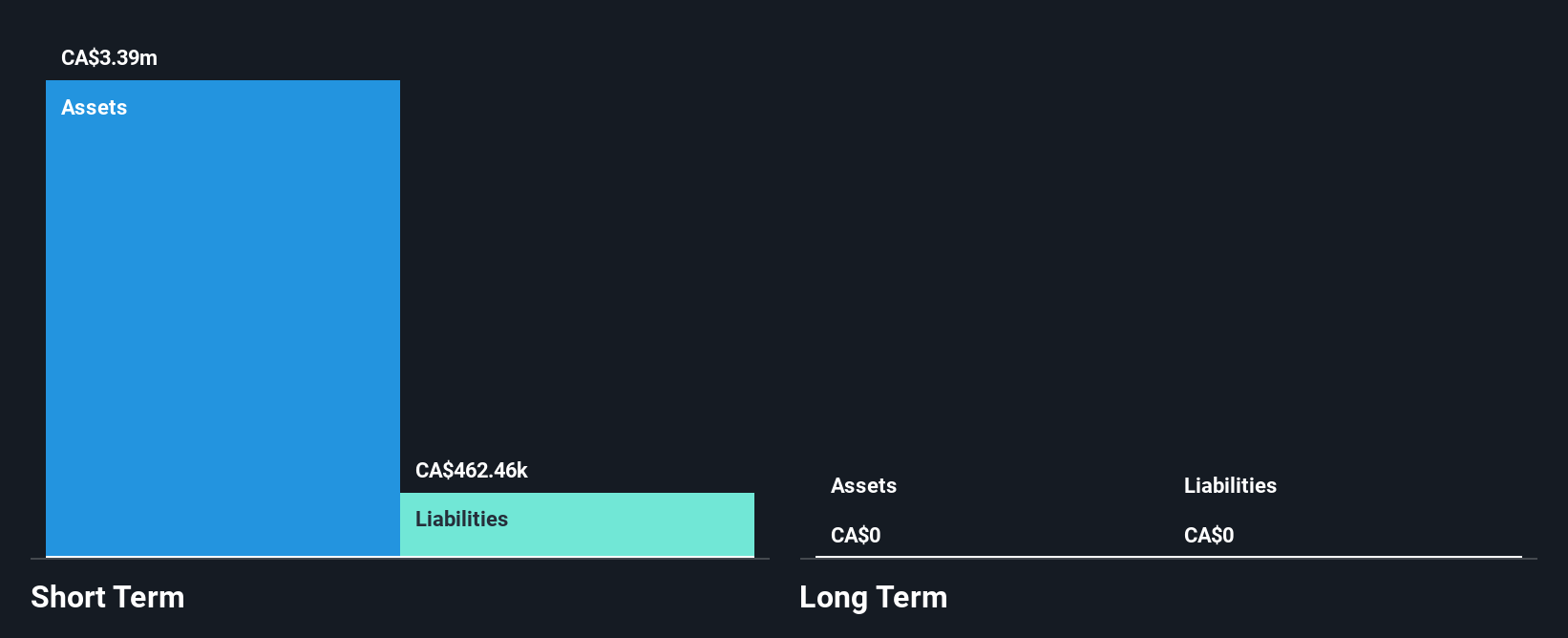

Stock Trend Capital Inc. focuses on the cannabis and artificial intelligence sectors, with a market cap of CA$9.90 million and is currently pre-revenue, reporting negative revenues of CA$-0.56 million. Despite being unprofitable, the company has reduced its losses significantly over five years at 69.7% annually and maintains a sufficient cash runway for over two years if free cash flow grows consistently. The experienced board and management team are noteworthy, though the stock's high volatility may concern some investors. Short-term assets comfortably cover liabilities, while no debt or long-term liabilities provide financial flexibility.

- Unlock comprehensive insights into our analysis of Stock Trend Capital stock in this financial health report.

- Gain insights into Stock Trend Capital's past trends and performance with our report on the company's historical track record.

Oroco Resource (TSXV:OCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oroco Resource Corp. is an exploration stage company focused on acquiring and exploring mineral properties in Mexico, with a market capitalization of CA$63.25 million.

Operations: Oroco Resource Corp. does not report any revenue segments as it is currently in the exploration stage.

Market Cap: CA$63.25M

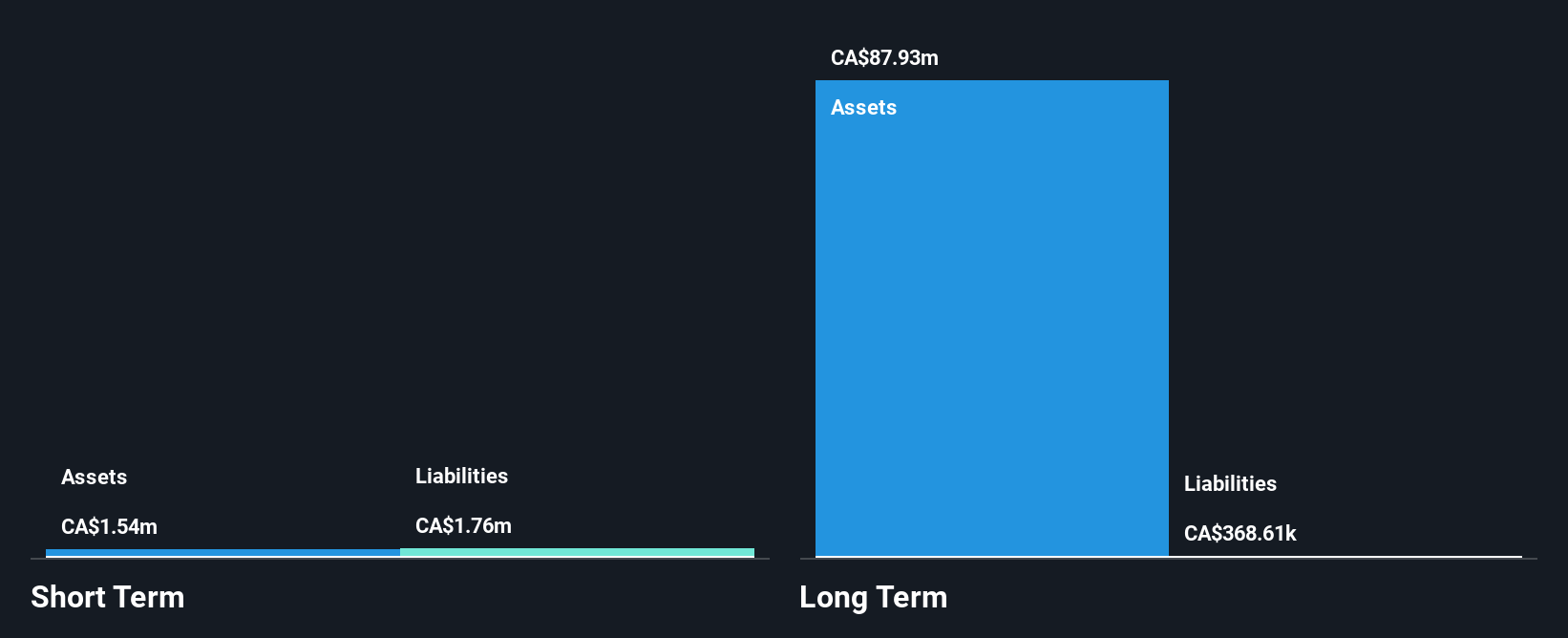

Oroco Resource Corp., with a market cap of CA$63.25 million, operates in the exploration stage without significant revenue, making it pre-revenue. The company has experienced management and board teams but faces challenges with short-term liabilities exceeding assets by CA$0.3 million. Despite being debt-free, Oroco's financial position is strained as evidenced by recent net losses totaling CA$2.03 million for six months ending November 2024. A recent private placement aims to raise up to CA$1.5 million, potentially improving liquidity after being dropped from the S&P/TSX Venture Composite Index in January 2025 due to performance issues.

- Click here to discover the nuances of Oroco Resource with our detailed analytical financial health report.

- Examine Oroco Resource's past performance report to understand how it has performed in prior years.

Black Swan Graphene (TSXV:SWAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Swan Graphene Inc. focuses on producing and commercializing patented graphene products for industrial sectors in Canada, with a market cap of CA$26.78 million.

Operations: Currently, there are no reported revenue segments for Black Swan Graphene Inc.

Market Cap: CA$26.78M

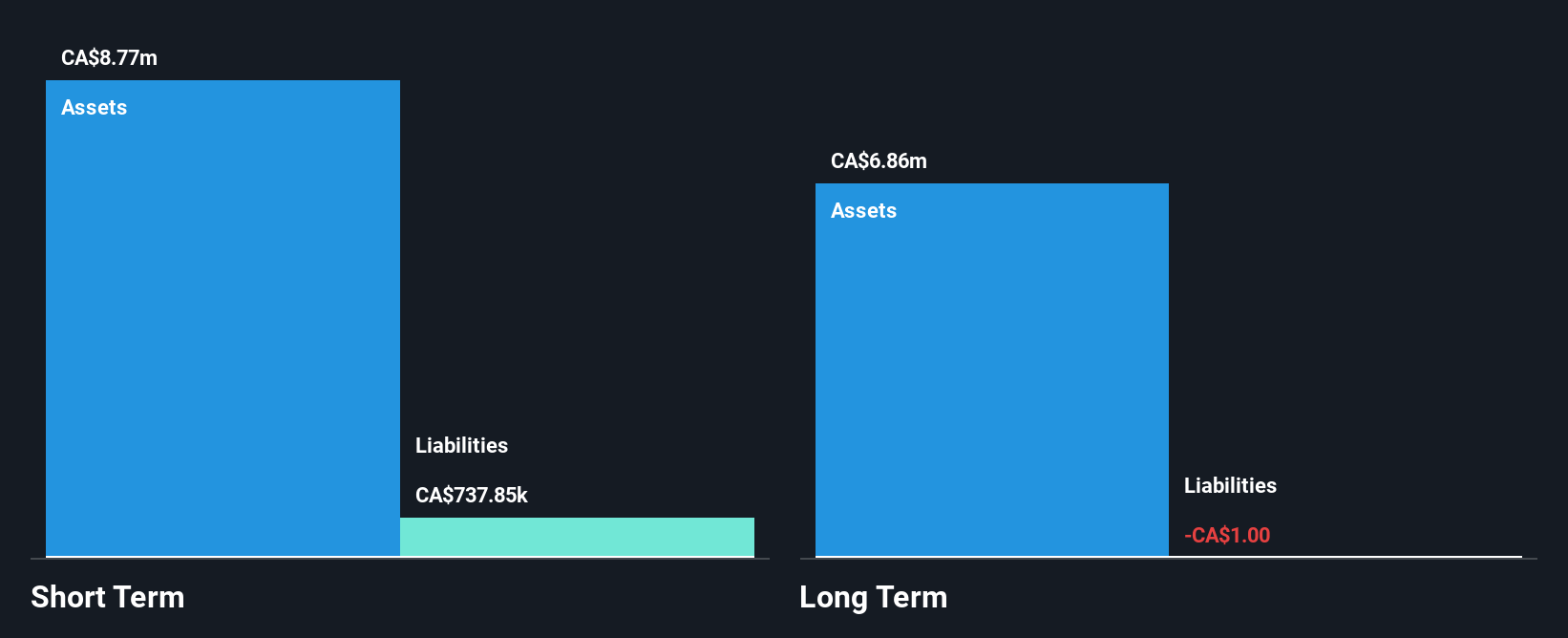

Black Swan Graphene Inc., with a market cap of CA$26.78 million, remains pre-revenue and unprofitable, which is typical for early-stage companies in the graphene sector. Recent financial moves include a non-brokered private placement aiming to raise CA$6 million and a 1:8 stock split, reflecting strategic efforts to enhance capital structure. The company benefits from being debt-free with sufficient cash runway for over a year, though it experiences high share price volatility and negative return on equity (-44.23%). Management's average tenure of 2.5 years indicates relative experience amidst ongoing challenges in achieving profitability.

- Get an in-depth perspective on Black Swan Graphene's performance by reading our balance sheet health report here.

- Learn about Black Swan Graphene's future growth trajectory here.

Key Takeaways

- Investigate our full lineup of 941 TSX Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OCO

Oroco Resource

An exploration stage company, engages in the acquisition and exploration of mineral properties in Mexico.

Excellent balance sheet slight.

Market Insights

Community Narratives