- Canada

- /

- Healthcare Services

- /

- TSX:WELL

TSX Penny Stocks With Market Caps Over CA$100M To Watch

Reviewed by Simply Wall St

The Canadian market has shown robust performance, increasing by 1.4% over the last week and rising 28% in the past year, with earnings forecasted to grow by 16% annually. Penny stocks, often representing smaller or newer companies, continue to offer intriguing opportunities for growth at lower price points despite being considered an outdated term. By focusing on those with strong balance sheets and solid fundamentals, investors can uncover hidden gems that present compelling opportunities for potential returns without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.16 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.83 | CA$303.72M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sol Strategies (CNSX:HODL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sol Strategies Inc. invests in cryptocurrencies and blockchain technologies, with a market cap of CA$103.78 million.

Operations: The company's revenue segment is focused on investment in cryptocurrencies and blockchain technology, generating CA$-0.73 million.

Market Cap: CA$103.78M

Sol Strategies Inc., formerly Cypherpunk Holdings, is a pre-revenue company with a focus on cryptocurrency and blockchain investments. Despite having no debt and sufficient short-term assets to cover liabilities, the company remains unprofitable with negative revenue of CA$1.13 million for Q3 2024. Its share price has been highly volatile recently, adding risk for investors. The appointment of Ungad Chadda as an independent director may bring valuable expertise from his extensive experience in capital markets. However, the management team lacks seasoned leadership with an average tenure of only 0.8 years, which could impact strategic execution.

- Click here to discover the nuances of Sol Strategies with our detailed analytical financial health report.

- Learn about Sol Strategies' historical performance here.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally, with a market cap of CA$300.12 million.

Operations: The company's revenue is primarily derived from Canada (CA$470.33 million), with additional contributions from the United States (CA$38.74 million) and international markets (CA$2.04 million).

Market Cap: CA$300.12M

High Tide Inc. is a prominent player in the cannabis retail sector with a market cap of CA$300.12 million, primarily generating revenue in Canada (CA$470.33 million). Despite being unprofitable, it has more cash than its total debt and maintains a positive free cash flow, providing a cash runway exceeding three years. The company is expanding aggressively, recently opening its 185th Canna Cabana store and planning further mergers and acquisitions to bolster market presence. High Tide's management team has an average tenure of 3.8 years, reflecting seasoned leadership amid ongoing shareholder dilution concerns due to increased shares outstanding by 7.2% last year.

- Dive into the specifics of High Tide here with our thorough balance sheet health report.

- Gain insights into High Tide's outlook and expected performance with our report on the company's earnings estimates.

WELL Health Technologies (TSX:WELL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WELL Health Technologies Corp. is a practitioner-focused digital healthcare company operating in Canada, the United States, and internationally, with a market cap of CA$1.18 billion.

Operations: The company generates revenue from SaaS and Technology Services (CA$72.15 million), Canadian Primary Patient Services (CA$160.50 million), U.S. Primary Patient Services through WISP (CA$85.50 million) and Circle Medical (CA$113.30 million), Canadian Specialized Patient Services via Myhealth (CA$117.58 million), and U.S. Specialized Patient Services through CRH Medical (CA$254.54 million).

Market Cap: CA$1.18B

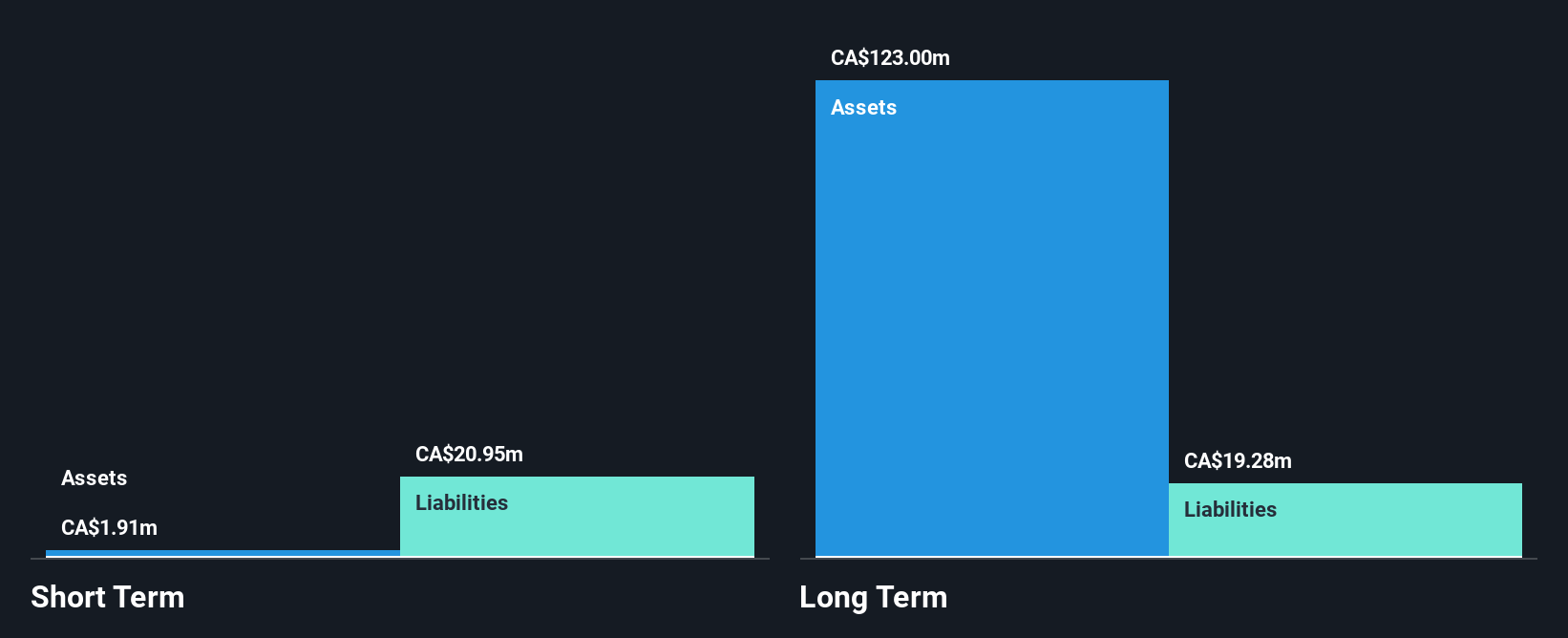

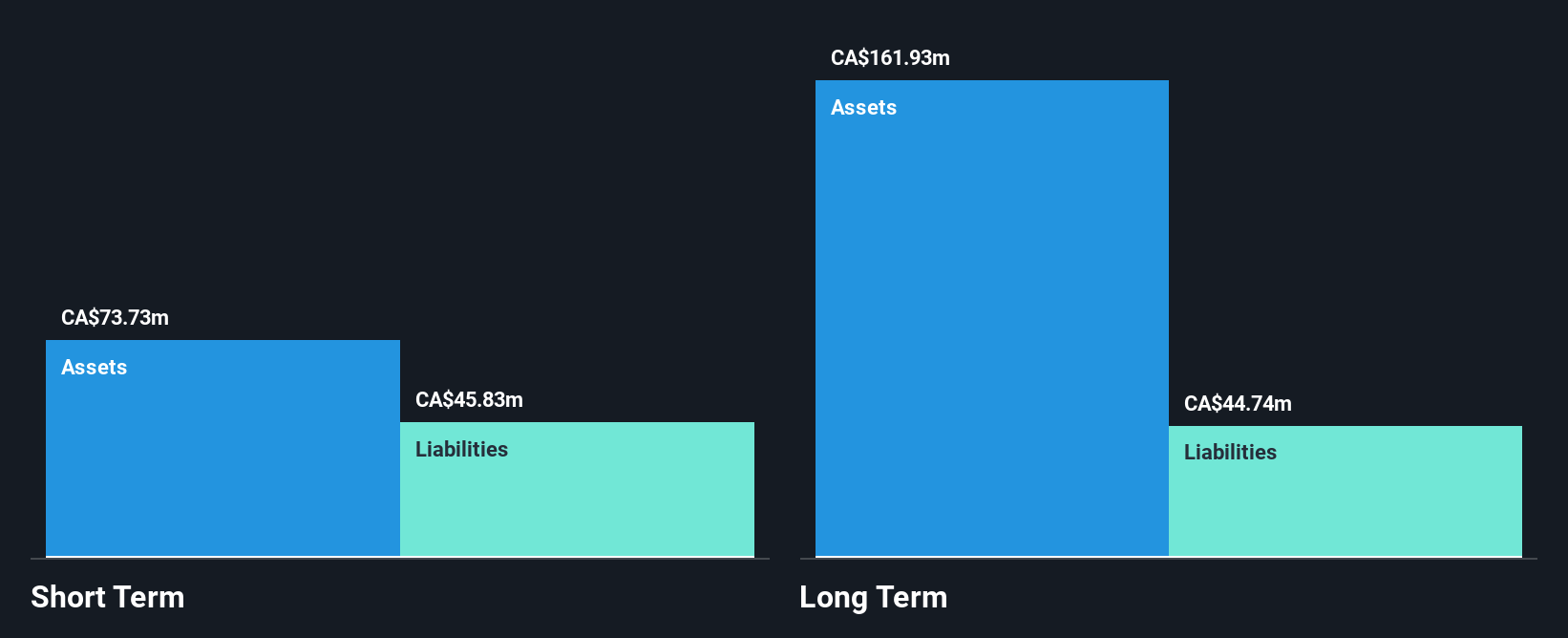

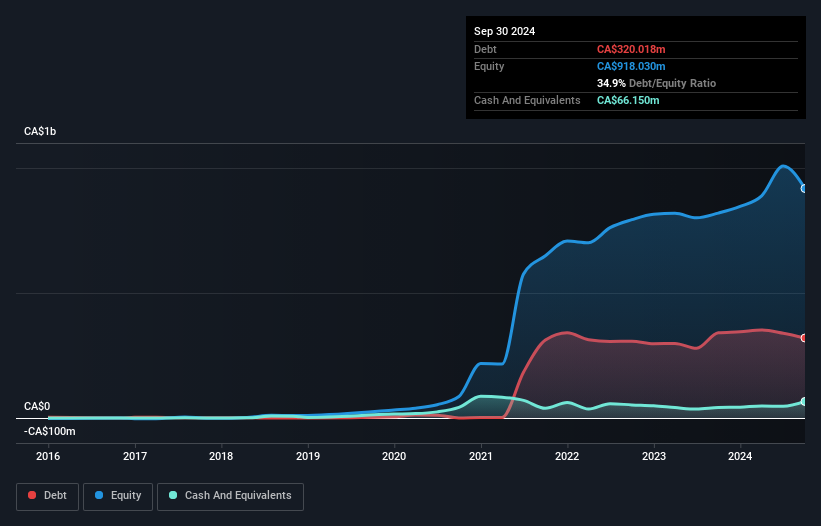

WELL Health Technologies, with a market cap of CA$1.18 billion, has shown financial resilience by becoming profitable recently and reporting significant revenue growth. The company has diversified income streams across SaaS and Technology Services, Canadian and U.S. Primary Patient Services, and Specialized Patient Services. Despite recent shareholder dilution of 4.6%, WELL's debt management is commendable with a reduced debt-to-equity ratio over five years. However, interest coverage remains weak at 1.3 times EBIT. Recent strategic partnerships and acquisitions indicate an aggressive expansion strategy aimed at enhancing healthcare service integration and improving patient care efficiency across its network.

- Unlock comprehensive insights into our analysis of WELL Health Technologies stock in this financial health report.

- Explore WELL Health Technologies' analyst forecasts in our growth report.

Summing It All Up

- Access the full spectrum of 947 TSX Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives