- Canada

- /

- Hospitality

- /

- TSX:TWC

We Take A Look At Whether TWC Enterprises Limited's (TSE:TWC) CEO May Be Underpaid

The solid performance at TWC Enterprises Limited (TSE:TWC) has been impressive and shareholders will probably be pleased to know that CEO Kuldip Sahi has delivered. This would be kept in mind at the upcoming AGM on 05 May 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

View our latest analysis for TWC Enterprises

How Does Total Compensation For Kuldip Sahi Compare With Other Companies In The Industry?

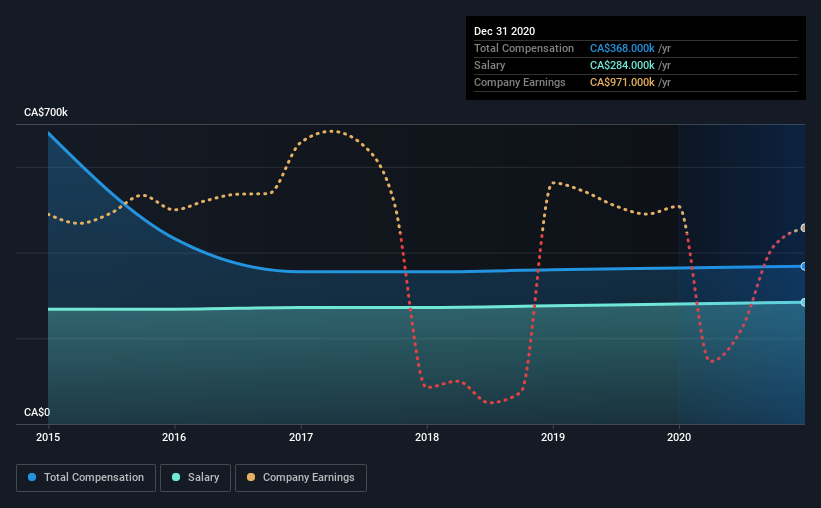

Our data indicates that TWC Enterprises Limited has a market capitalization of CA$552m, and total annual CEO compensation was reported as CA$368k for the year to December 2020. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CA$284.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between CA$248m and CA$991m, we discovered that the median CEO total compensation of that group was CA$2.5m. This suggests that Kuldip Sahi is paid below the industry median. Moreover, Kuldip Sahi also holds CA$427m worth of TWC Enterprises stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$284k | CA$280k | 77% |

| Other | CA$84k | CA$84k | 23% |

| Total Compensation | CA$368k | CA$364k | 100% |

Speaking on an industry level, nearly 63% of total compensation represents salary, while the remainder of 37% is other remuneration. According to our research, TWC Enterprises has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at TWC Enterprises Limited's Growth Numbers

TWC Enterprises Limited has seen its earnings per share (EPS) increase by 53% a year over the past three years. In the last year, its revenue is down 22%.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has TWC Enterprises Limited Been A Good Investment?

Boasting a total shareholder return of 104% over three years, TWC Enterprises Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for TWC Enterprises that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade TWC Enterprises, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TWC Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:TWC

TWC Enterprises

Owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion