- Canada

- /

- Hospitality

- /

- TSX:PZA

It Might Not Be A Great Idea To Buy Pizza Pizza Royalty Corp. (TSE:PZA) For Its Next Dividend

Pizza Pizza Royalty Corp. (TSE:PZA) stock is about to trade ex-dividend in 4 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Pizza Pizza Royalty's shares before the 29th of July in order to receive the dividend, which the company will pay on the 13th of August.

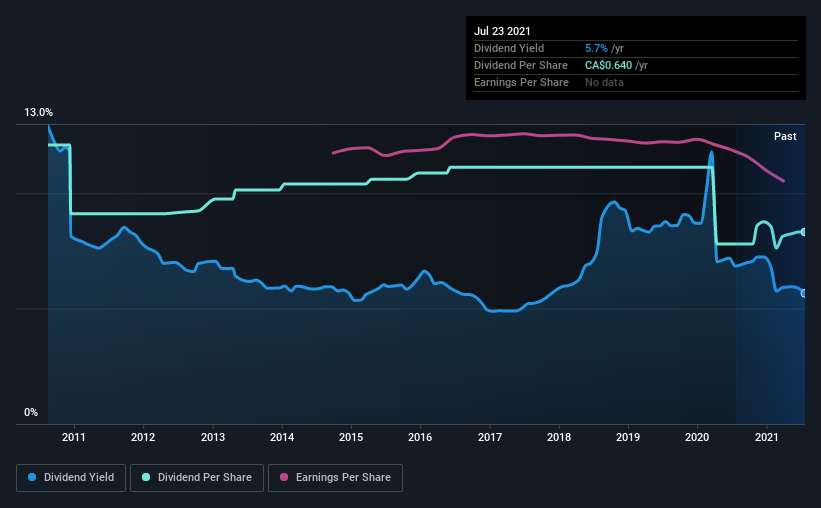

The company's next dividend payment will be CA$0.055 per share. Last year, in total, the company distributed CA$0.63 to shareholders. Based on the last year's worth of payments, Pizza Pizza Royalty has a trailing yield of 5.7% on the current stock price of CA$11.3. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Pizza Pizza Royalty

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Its dividend payout ratio is 86% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. The company paid out 92% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Pizza Pizza Royalty paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Pizza Pizza Royalty to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit Pizza Pizza Royalty paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. So we're not too excited that Pizza Pizza Royalty's earnings are down 2.3% a year over the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Pizza Pizza Royalty has seen its dividend decline 3.7% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

To Sum It Up

From a dividend perspective, should investors buy or avoid Pizza Pizza Royalty? Pizza Pizza Royalty had an average payout ratio, but its free cash flow was lower and earnings per share have been declining. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

So if you're still interested in Pizza Pizza Royalty despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. For example, we've found 1 warning sign for Pizza Pizza Royalty that we recommend you consider before investing in the business.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PZA

Pizza Pizza Royalty

Through its subsidiary, Pizza Pizza Royalty Limited Partnership, franchises and operates quick-service restaurants under the Pizza Pizza and Pizza 73 brands in Canada.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026