David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Canlan Ice Sports Corp. (TSE:ICE) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Canlan Ice Sports

What Is Canlan Ice Sports's Net Debt?

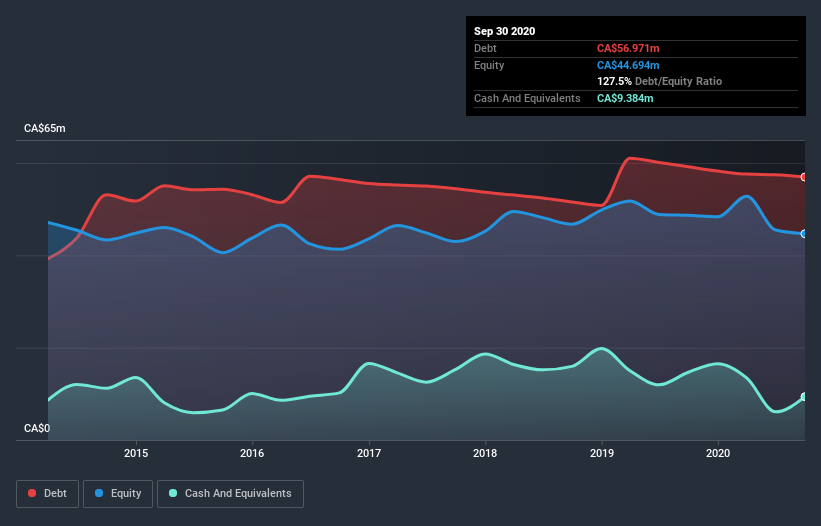

As you can see below, Canlan Ice Sports had CA$57.0m of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, it also had CA$9.38m in cash, and so its net debt is CA$47.6m.

A Look At Canlan Ice Sports' Liabilities

We can see from the most recent balance sheet that Canlan Ice Sports had liabilities of CA$20.8m falling due within a year, and liabilities of CA$61.3m due beyond that. Offsetting these obligations, it had cash of CA$9.38m as well as receivables valued at CA$2.22m due within 12 months. So its liabilities total CA$70.5m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of CA$53.1m, we think shareholders really should watch Canlan Ice Sports's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Canlan Ice Sports's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Canlan Ice Sports had a loss before interest and tax, and actually shrunk its revenue by 38%, to CA$55m. To be frank that doesn't bode well.

Caveat Emptor

Not only did Canlan Ice Sports's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping CA$7.0m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of CA$5.6m over the last twelve months. So suffice it to say we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Canlan Ice Sports (1 shouldn't be ignored!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Canlan Ice Sports, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ICE

Canlan Ice Sports

Engages in the acquisition, development, lease, and operation of recreation facilities in Canada and the United States.

Average dividend payer and fair value.

Market Insights

Community Narratives