- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Assessing North West (TSX:NWC) Valuation After Modest Earnings Beat and Dividend Hike

Reviewed by Simply Wall St

North West (TSX:NWC) just released its latest earnings, showing a modest bump in both sales and net income for the quarter, paired with a small raise in its quarterly dividend. For investors weighing their next move, these results might look reassuring. Steady financials and a growing dividend suggest a company that’s keeping its promises and taking incremental steps forward. In a market where swings can be sudden, news like this tends to catch the eye of anyone scanning for consistent, long-term performers.

Zooming out, the price moves over the year tell a story of modest decline, with the stock down less than 1% in the past twelve months, diverging from its much stronger three- and five-year performance. Recent months have seen some weakness with a drift lower, even as management stayed active with a small buyback program and another dividend increase, signaling confidence in the business. Whether this signals momentum rebuilding or investors waiting for a fresh catalyst is up for debate. Right now, the market’s perception seems relatively steady but watchful.

So, as North West posts another stable quarter and extends its track record of shareholder returns, the question for investors becomes clear. Is there untapped value here, or is the market already pricing in everything this steady operator can deliver?

Price-to-Earnings of 16.7x: Is it justified?

North West is currently trading at a price-to-earnings (P/E) ratio of 16.7 times, which puts it noticeably below the North American Consumer Retailing industry average of 19.9 times. This suggests the market may not be valuing North West’s earnings as highly as its peers.

The price-to-earnings ratio is a widely used valuation metric in the retail sector, comparing a company’s share price to its per-share earnings. For North West, a lower P/E relative to industry peers often signals a degree of investor caution or skepticism. It may also highlight a value opportunity if the company's fundamentals are sound.

The implication for investors is that the market could be underpricing North West’s ability to generate consistent profits. With stable earnings quality and a defensive business model, a lower-than-average P/E may not be justified in the long run, especially if revenue growth continues to outpace the broader Canadian market.

Result: Fair Value of $48.57 (UNDERVALUED)

See our latest analysis for North West.However, persistent revenue growth may stall if consumer spending slows or if North West faces unexpected competitive pressures in key markets.

Find out about the key risks to this North West narrative.Another View: Our DCF Model Puts Things in Perspective

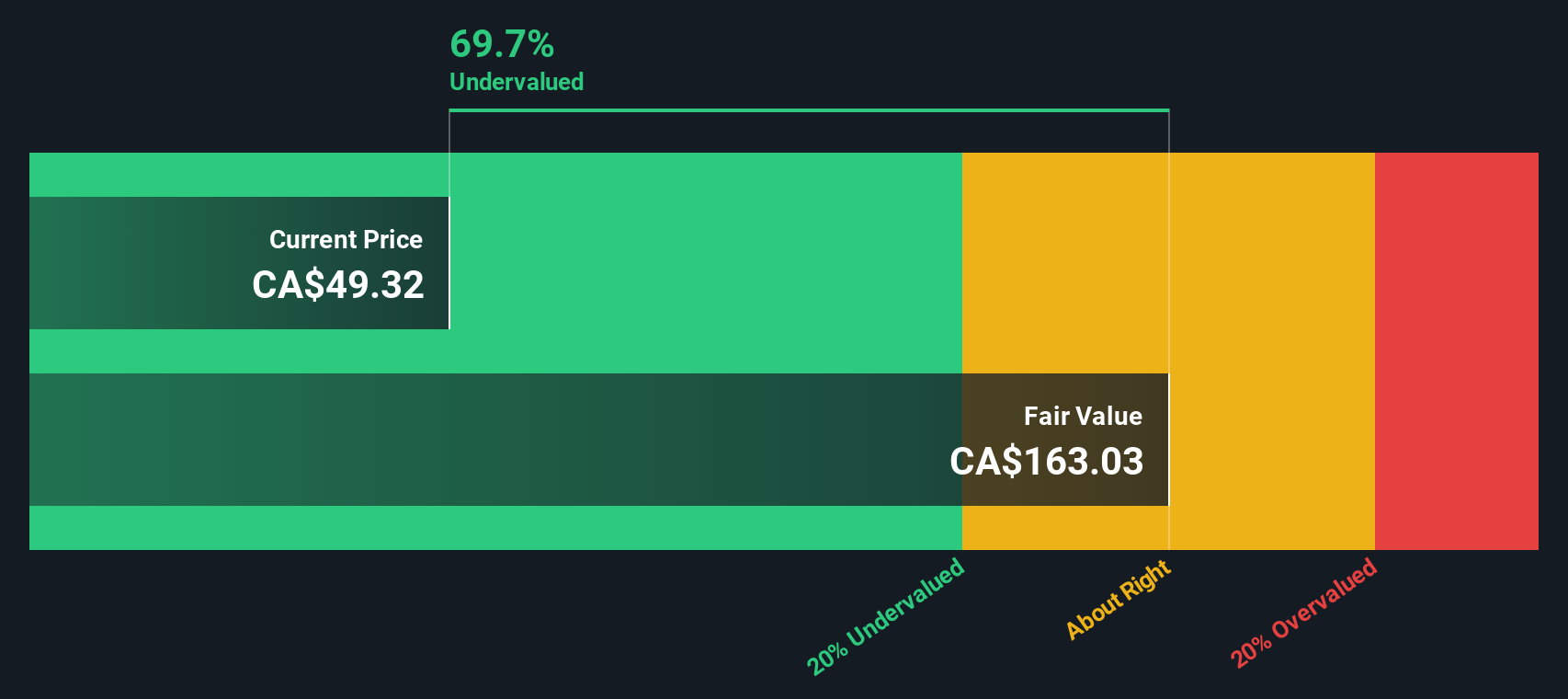

Looking at North West through the lens of our DCF model offers a different perspective. This method suggests the company is still significantly undervalued, which highlights a possible disconnect between market price and long-term fundamentals. Which valuation method gets closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own North West Narrative

If you see things differently or want to dive deeper into the numbers on your own terms, it only takes a few minutes to craft your perspective. Do it your way.

A great starting point for your North West research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know when to look past today's headlines and grab tomorrow's potential. It pays to spot opportunities before the crowd, and the Simply Wall Street Screener is designed to help you do just that. Don’t let the best stocks pass you by.

- Uncover undervalued opportunities by tapping into fresh, high-potential companies using undervalued stocks based on cash flows to see which stocks the market may have overlooked.

- Boost your yield with top picks in stable businesses. Check out dividend stocks with yields > 3% for stocks offering attractive dividend income that keeps working for you.

- Ride the AI innovation wave by searching through AI penny stocks. Find up-and-coming companies pioneering artificial intelligence solutions and reshaping industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives