- Canada

- /

- Food and Staples Retail

- /

- TSX:MRU

Metro's (TSE:MRU) Upcoming Dividend Will Be Larger Than Last Year's

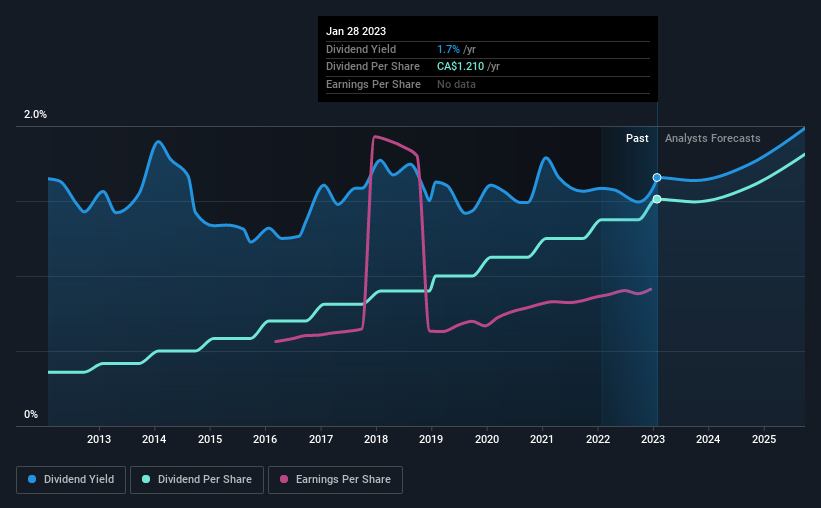

Metro Inc. (TSE:MRU) will increase its dividend from last year's comparable payment on the 6th of March to CA$0.3025. This takes the dividend yield to 1.7%, which shareholders will be pleased with.

View our latest analysis for Metro

Metro's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. However, prior to this announcement, Metro's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 22.8%. If the dividend continues on this path, the payout ratio could be 28% by next year, which we think can be pretty sustainable going forward.

Metro Has A Solid Track Record

The company has an extended history of paying stable dividends. The annual payment during the last 10 years was CA$0.287 in 2013, and the most recent fiscal year payment was CA$1.21. This implies that the company grew its distributions at a yearly rate of about 15% over that duration. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Earnings per share has been sinking by 14% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Our Thoughts On Metro's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 9 analysts we track are forecasting for the future. Is Metro not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MRU

Metro

Through its subsidiaries, operates as a retailer, franchisor, distributor, and manufacturer in the food and pharmaceutical sectors in Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives