Loblaw Companies (TSE:L) Is Paying Out Less In Dividends Than Last Year

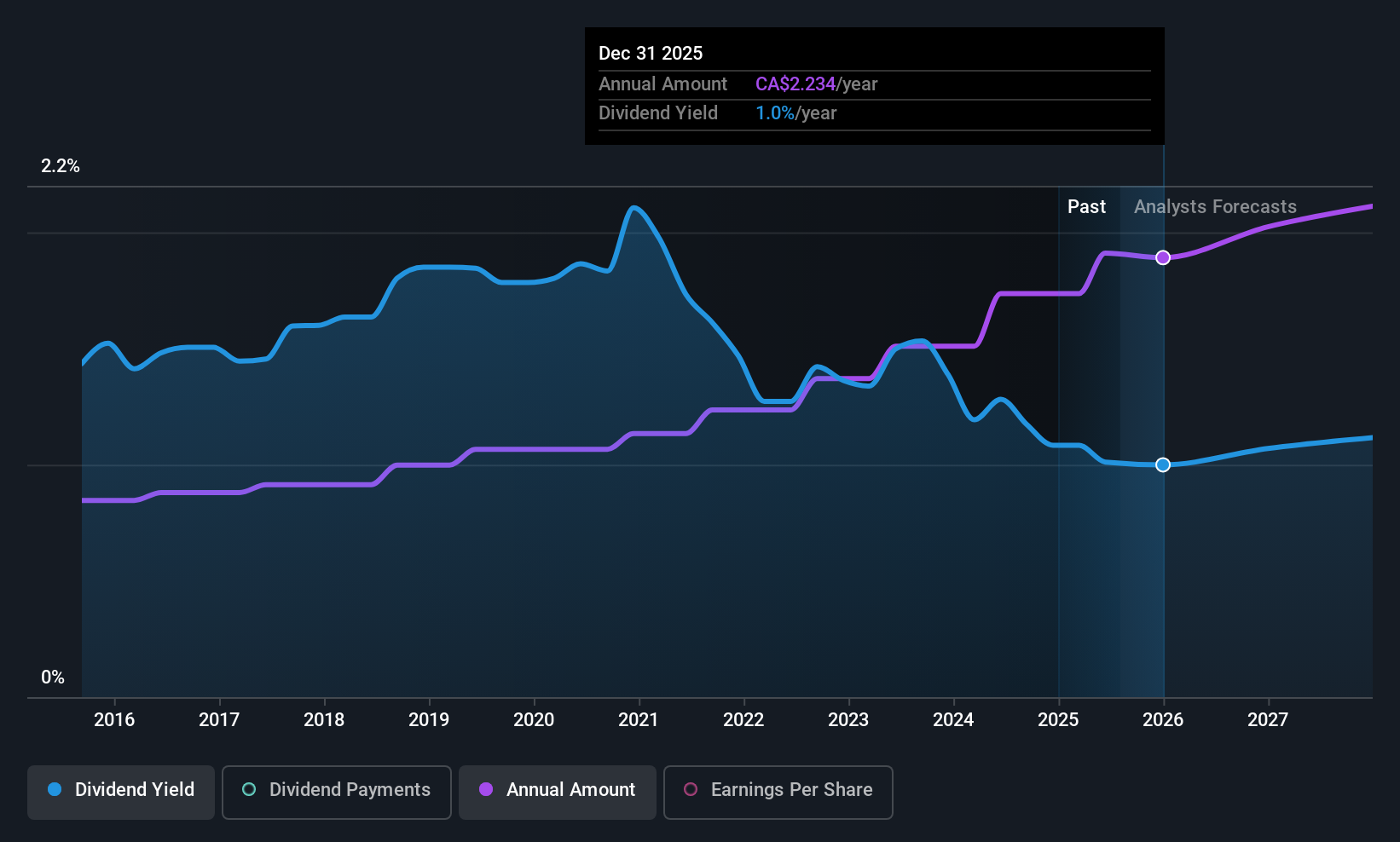

Loblaw Companies Limited (TSE:L) has announced that on 1st of October, it will be paying a dividend ofCA$0.1411, which a reduction from last year's comparable dividend. This means that the annual payment is 1.0% of the current stock price, which is lower than what the rest of the industry is paying.

Loblaw Companies' Future Dividend Projections Appear Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. However, prior to this announcement, Loblaw Companies' dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 13.6%. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

Check out our latest analysis for Loblaw Companies

Loblaw Companies Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2015, the annual payment back then was CA$0.98, compared to the most recent full-year payment of CA$2.26. This means that it has been growing its distributions at 8.7% per annum over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Loblaw Companies has impressed us by growing EPS at 19% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Loblaw Companies' prospects of growing its dividend payments in the future.

Loblaw Companies Looks Like A Great Dividend Stock

In general, we don't like to see the dividend being cut, especially when the company has such high potential like Loblaw Companies does. The cut will allow the company to continue paying out the dividend without putting the balance sheet under pressure, which means that it could remain sustainable for longer. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Loblaw Companies that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:L

Loblaw Companies

A food and pharmacy company, provides grocery, pharmacy and healthcare services, health and beauty products, apparel, general merchandise, financial services, and wireless mobile products and services in Canada and the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026