- Canada

- /

- Food and Staples Retail

- /

- TSX:GCL

Colabor Group Inc. (TSE:GCL) Not Lagging Market On Growth Or Pricing

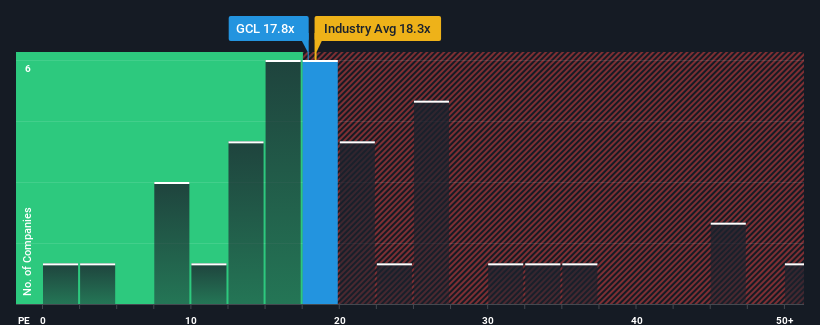

With a price-to-earnings (or "P/E") ratio of 17.8x Colabor Group Inc. (TSE:GCL) may be sending bearish signals at the moment, given that almost half of all companies in Canada have P/E ratios under 12x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

There hasn't been much to differentiate Colabor Group's and the market's retreating earnings lately. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Colabor Group

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Colabor Group's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.0%. Even so, admirably EPS has lifted 44% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 33% per year as estimated by the sole analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 7.0% per year, which is noticeably less attractive.

In light of this, it's understandable that Colabor Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Colabor Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Colabor Group, and understanding them should be part of your investment process.

If you're unsure about the strength of Colabor Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GCL

Colabor Group

Colabor Group Inc., together with its subsidiaries, markets, distributes, and wholesales food and food-related products in Canada.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026