- Canada

- /

- Food and Staples Retail

- /

- TSX:FOOD

Some Shareholders Feeling Restless Over Goodfood Market Corp.'s (TSE:FOOD) P/S Ratio

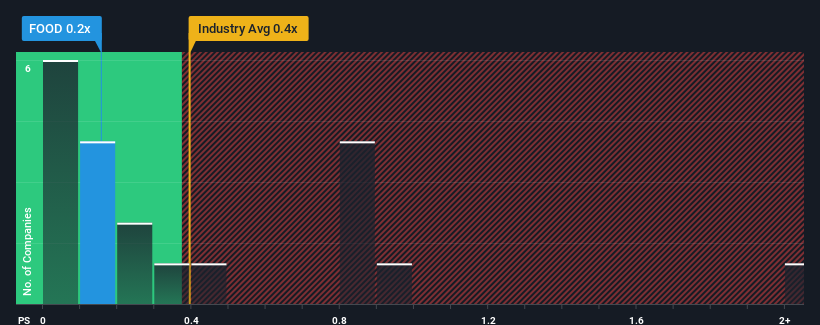

It's not a stretch to say that Goodfood Market Corp.'s (TSE:FOOD) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Consumer Retailing industry in Canada, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Goodfood Market

What Does Goodfood Market's Recent Performance Look Like?

Goodfood Market hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Goodfood Market.How Is Goodfood Market's Revenue Growth Trending?

In order to justify its P/S ratio, Goodfood Market would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. As a result, revenue from three years ago have also fallen 56% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.6% as estimated by the two analysts watching the company. Meanwhile, the broader industry is forecast to expand by 5.9%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Goodfood Market's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Goodfood Market's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Goodfood Market currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Goodfood Market (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Goodfood Market, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOOD

Goodfood Market

Goodfood Market Corp. delivers fresh meals and add-ons in Canada.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives