- Canada

- /

- Food and Staples Retail

- /

- TSX:CRP

While shareholders of Ceres Global Ag (TSE:CRP) are in the red over the last three years, underlying earnings have actually grown

It is doubtless a positive to see that the Ceres Global Ag Corp. (TSE:CRP) share price has gained some 30% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 40% in the last three years, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Ceres Global Ag

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Ceres Global Ag moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

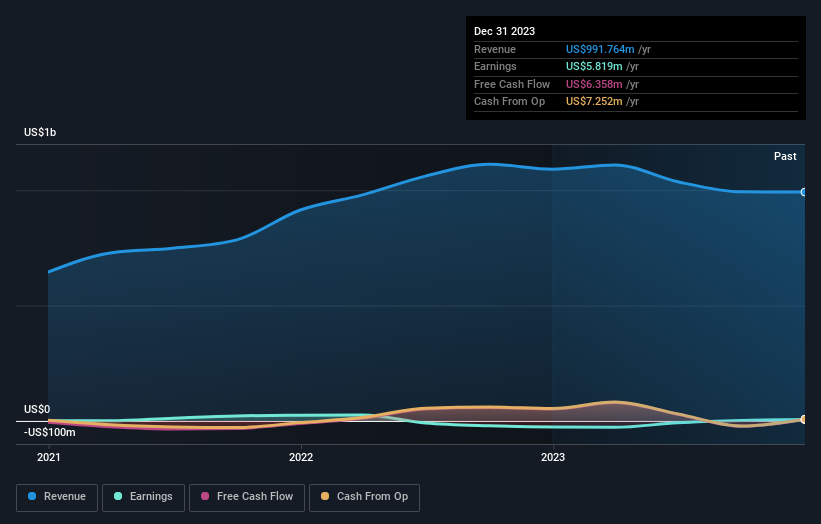

We note that, in three years, revenue has actually grown at a 14% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Ceres Global Ag further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Ceres Global Ag's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Ceres Global Ag has rewarded shareholders with a total shareholder return of 22% in the last twelve months. That certainly beats the loss of about 6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Ceres Global Ag has 3 warning signs (and 1 which is concerning) we think you should know about.

We will like Ceres Global Ag better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CRP

Ceres Global Ag

Provides agricultural commodities and value-added products, industrial products, fertilizers, energy products, and supply chain logistics services.

Adequate balance sheet with acceptable track record.