- Canada

- /

- Metals and Mining

- /

- TSXV:UGD

TSX Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The Canadian market has been experiencing improvements in labor productivity and corporate earnings growth, which are contributing to a positive economic outlook. Amid these conditions, investors might find opportunities in penny stocks—an area that remains relevant despite its somewhat outdated terminology. These smaller or newer companies can offer unique value propositions, especially when they boast strong financials and potential for growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.62 | CA$61.7M | ✅ 3 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$47.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.87 | CA$578.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.15 | CA$342.36M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.79 | CA$212.66M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.21M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.47 | CA$8.39M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 430 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Almaden Minerals (TSXV:AMM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Almaden Minerals Ltd. is an exploration stage company focused on acquiring, exploring, evaluating, and developing mineral properties in Mexico with a market cap of CA$34.34 million.

Operations: Almaden Minerals Ltd. does not report any specific revenue segments, as it is currently in the exploration stage.

Market Cap: CA$34.34M

Almaden Minerals Ltd., with a market cap of CA$34.34 million, is currently pre-revenue and operates in the exploration stage, focusing on mineral properties in Mexico. Recent earnings showed an improvement with a small net income for Q2 2025 compared to a loss last year. The company has shifted its primary exchange listing to the TSX Venture Exchange and has sufficient cash runway for over three years, despite having more cash than debt. Almaden's management and board are experienced, but it remains unprofitable with increased losses over five years and significant debt-to-equity ratio growth.

- Dive into the specifics of Almaden Minerals here with our thorough balance sheet health report.

- Assess Almaden Minerals' previous results with our detailed historical performance reports.

Mene (TSXV:MENE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mene Inc. designs, manufactures, and markets 24 karat gold and platinum jewelry globally, with a market cap of CA$40.35 million.

Operations: The company generates revenue of CA$28.31 million from its Jewelry & Watches segment.

Market Cap: CA$40.35M

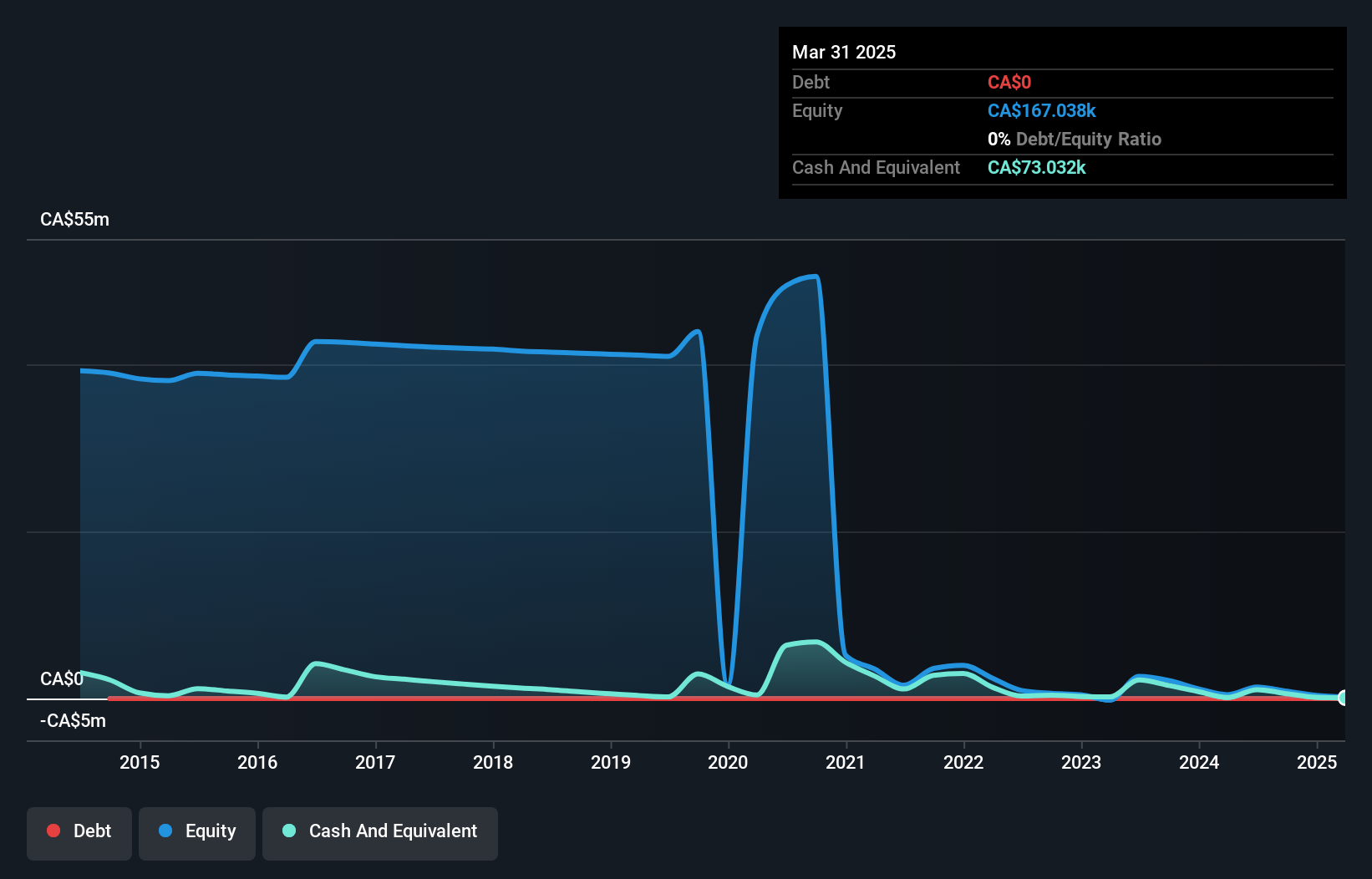

Mene Inc., with a market cap of CA$40.35 million, has shown resilience by reducing losses at 35.3% annually over the past five years despite being unprofitable. The company reported Q1 2025 sales of CA$7.34 million, an increase from the previous year’s CA$4.83 million, while net loss decreased significantly to CA$0.21 million from CA$0.92 million a year ago. Mene operates debt-free and maintains sufficient cash runway for over three years based on current free cash flow trends, though its high volatility remains a concern compared to most Canadian stocks. Management's short tenure suggests recent leadership changes amidst stable board experience.

- Click to explore a detailed breakdown of our findings in Mene's financial health report.

- Evaluate Mene's historical performance by accessing our past performance report.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Unigold Inc. is a junior natural resource company dedicated to exploring and developing gold projects in the Dominican Republic, with a market cap of CA$38.92 million.

Operations: Unigold Inc. currently does not report any revenue segments.

Market Cap: CA$38.92M

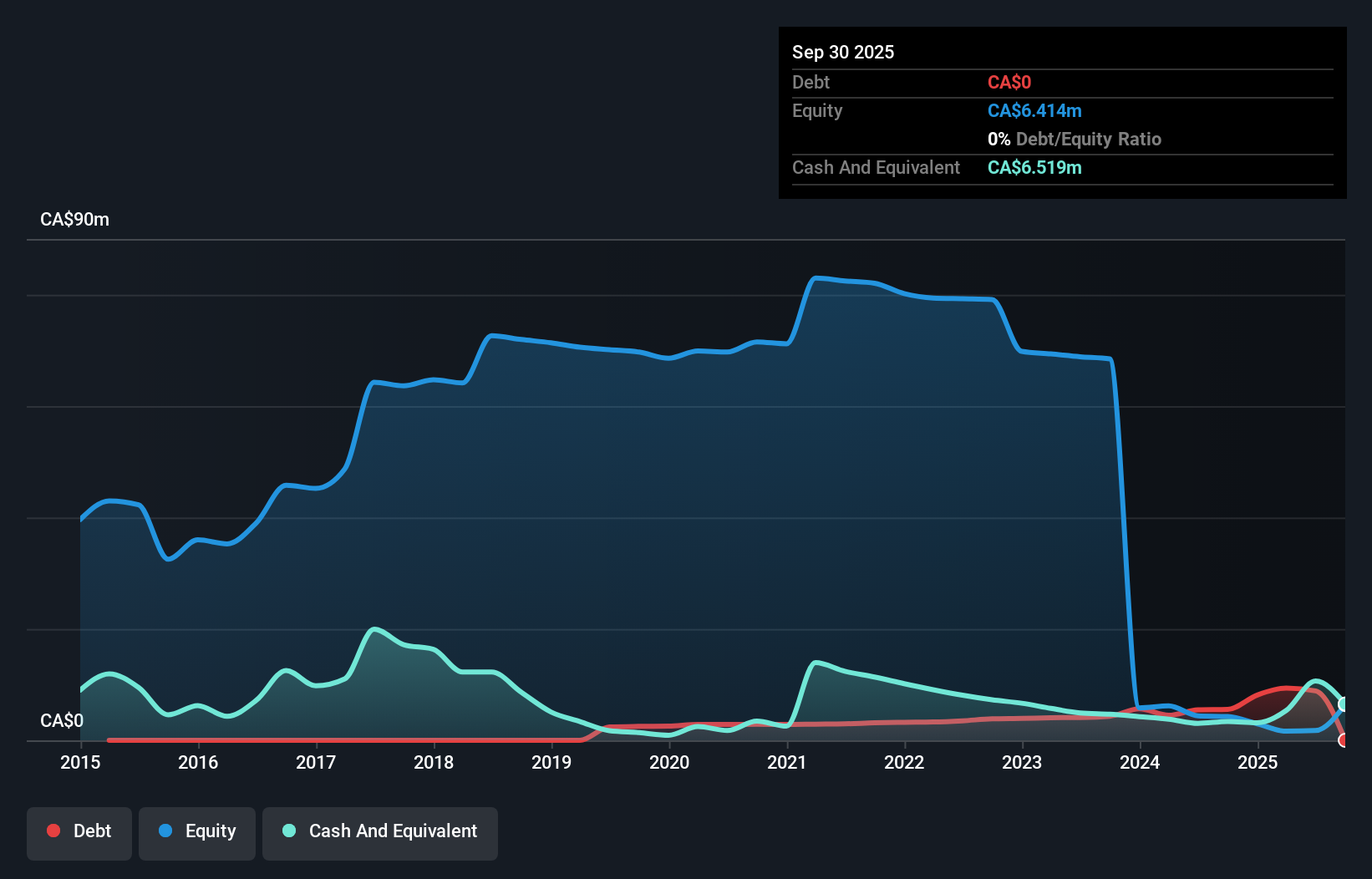

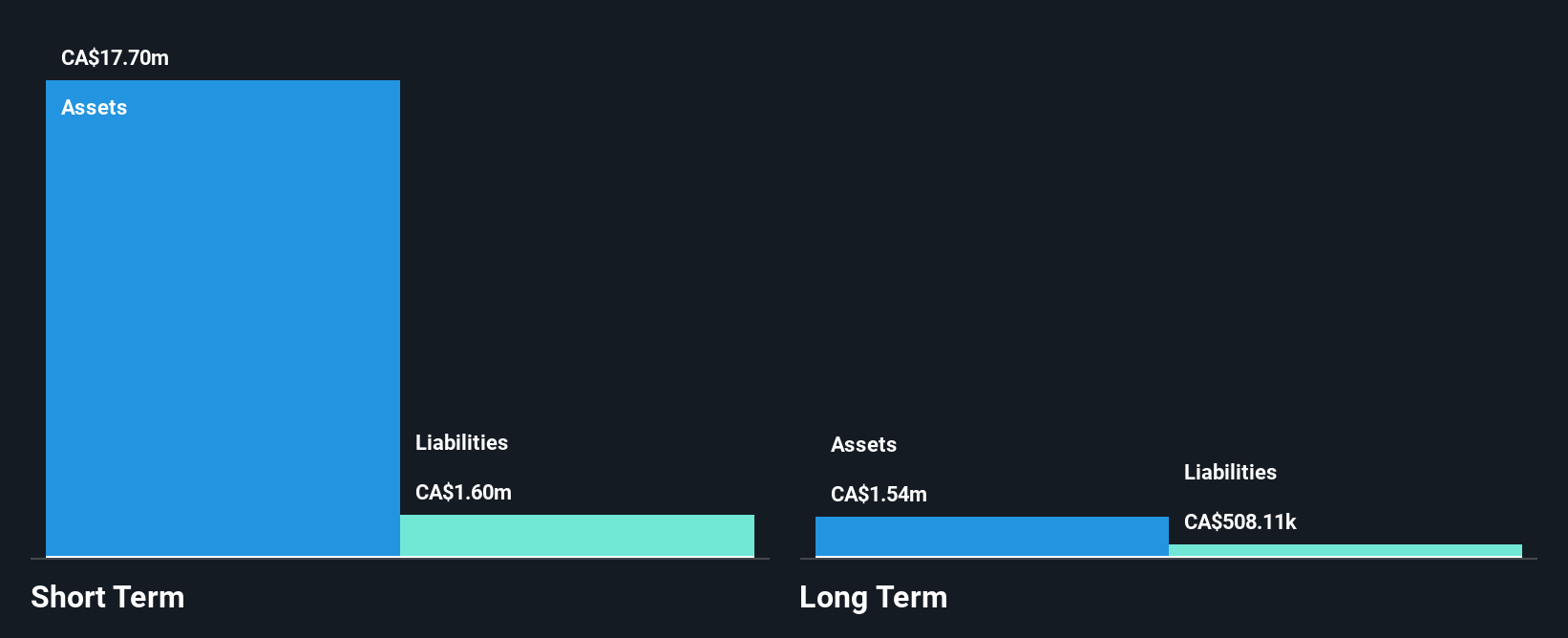

Unigold Inc., with a market cap of CA$38.92 million, remains pre-revenue and is focused on gold exploration in the Dominican Republic. Despite its unprofitable status, Unigold has successfully reduced losses by 13.6% annually over the past five years while maintaining a debt-free balance sheet. The company's recent private placement raised CA$1.57 million to bolster its financial position, though it still faces challenges with short-term liabilities exceeding short-term assets by CA$264.1K as of March 2025. Unigold's seasoned management and board bring stability amid high share price volatility compared to most Canadian stocks.

- Jump into the full analysis health report here for a deeper understanding of Unigold.

- Gain insights into Unigold's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Investigate our full lineup of 430 TSX Penny Stocks right here.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:UGD

Unigold

A junior natural resource company, focuses on exploring and developing gold projects in the Dominican Republic.

Flawless balance sheet with low risk.

Market Insights

Community Narratives