David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Mene Inc. (CVE:MENE) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Mene

What Is Mene's Debt?

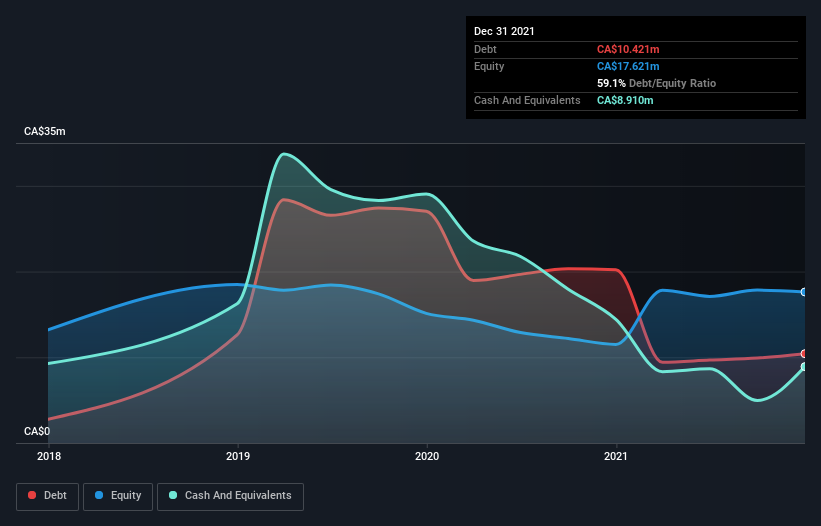

As you can see below, Mene had CA$10.4m of debt at December 2021, down from CA$20.2m a year prior. However, it does have CA$8.91m in cash offsetting this, leading to net debt of about CA$1.51m.

How Strong Is Mene's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Mene had liabilities of CA$12.1m due within 12 months and no liabilities due beyond that. On the other hand, it had cash of CA$8.91m and CA$49.8k worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$3.11m.

This state of affairs indicates that Mene's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CA$191.2m company is short on cash, but still worth keeping an eye on the balance sheet. But either way, Mene has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Mene's debt to EBITDA ratio (3.1) suggests that it uses some debt, its interest cover is very weak, at 0.91, suggesting high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. One redeeming factor for Mene is that it turned last year's EBIT loss into a gain of CA$319k, over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Mene will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, Mene burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Mene's interest cover left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its level of total liabilities is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Mene's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Mene insiders have sold any shares recently. You click here to find out if insiders have sold recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MENE

Mene

Designs, manufactures, and markets 24 karat gold and platinum jewelry worldwide.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026