As the Canadian market navigates a cooling labor landscape and potential interest rate cuts, investors are keenly observing opportunities that may arise. Penny stocks, while often perceived as niche investments, can still present intriguing prospects for those interested in smaller or newer companies. When backed by solid financials, these stocks hold the potential for significant returns and stability amidst broader market shifts.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$182.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$290.15M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$222.65M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.33 | CA$321.48M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.07 | CA$205.39M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Helium Evolution (TSXV:HEVI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helium Evolution Incorporated focuses on the exploration and production of helium in southern Saskatchewan, with a market cap of CA$12.48 million.

Operations: Helium Evolution Incorporated has not reported any revenue segments.

Market Cap: CA$12.48M

Helium Evolution Incorporated, with a market cap of CA$12.48 million, is currently pre-revenue and unprofitable. The company maintains a strong financial position with short-term assets of CA$4.9 million exceeding liabilities and no debt on its balance sheet. Despite high volatility in its share price, it has not experienced significant shareholder dilution over the past year. Recently, Helium Evolution announced participation in drilling a joint well with North American Helium Inc., holding a 20% interest in the project at an estimated cost of CA$0.4 million, supported by its working capital of CA$4.7 million as of June 2024.

- Unlock comprehensive insights into our analysis of Helium Evolution stock in this financial health report.

- Examine Helium Evolution's earnings growth report to understand how analysts expect it to perform.

Mene (TSXV:MENE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mene Inc. designs, manufactures, and markets 24 karat gold and platinum jewelry worldwide with a market cap of CA$27.33 million.

Operations: The company generates CA$22.45 million in revenue from its Jewelry & Watches segment.

Market Cap: CA$27.33M

Mene Inc., with a market cap of CA$27.33 million, has no debt and maintains a solid financial position as its short-term assets of CA$16.6 million exceed both short-term and long-term liabilities. Despite being unprofitable, the company has reduced losses over the past five years and boasts a positive free cash flow with sufficient runway for over three years. Recent executive changes saw Sean Ty appointed as CFO, bringing experience from Ernst & Young and various Canadian listed companies. However, Mene's share price remains highly volatile, reflecting broader challenges in stabilizing its financial performance amidst industry competition.

- Dive into the specifics of Mene here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Mene's track record.

Titan Logix (TSXV:TLA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Titan Logix Corp. develops, manufactures, and markets technology fluid management solutions in Canada, the United States, and internationally with a market cap of CA$19.98 million.

Operations: The company generates revenue primarily from its Mobile Liquid Measurement Solutions segment, amounting to CA$6.75 million.

Market Cap: CA$19.98M

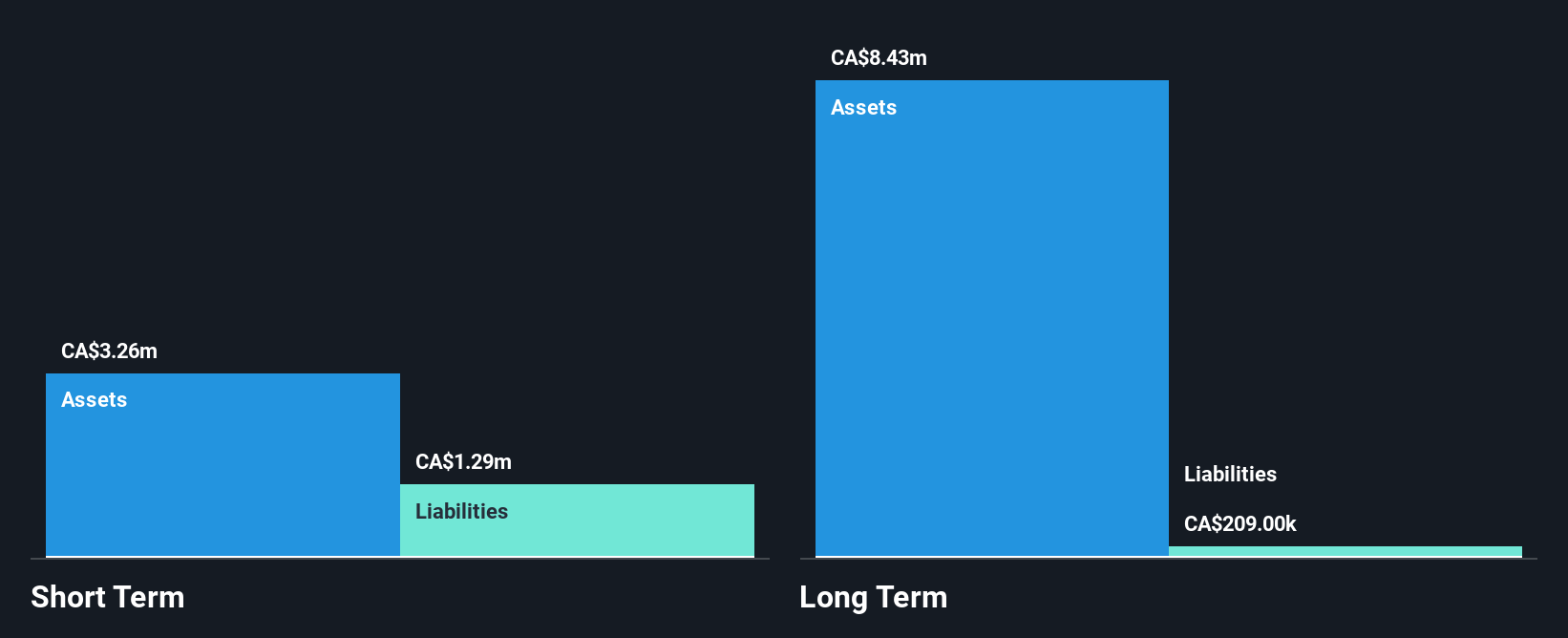

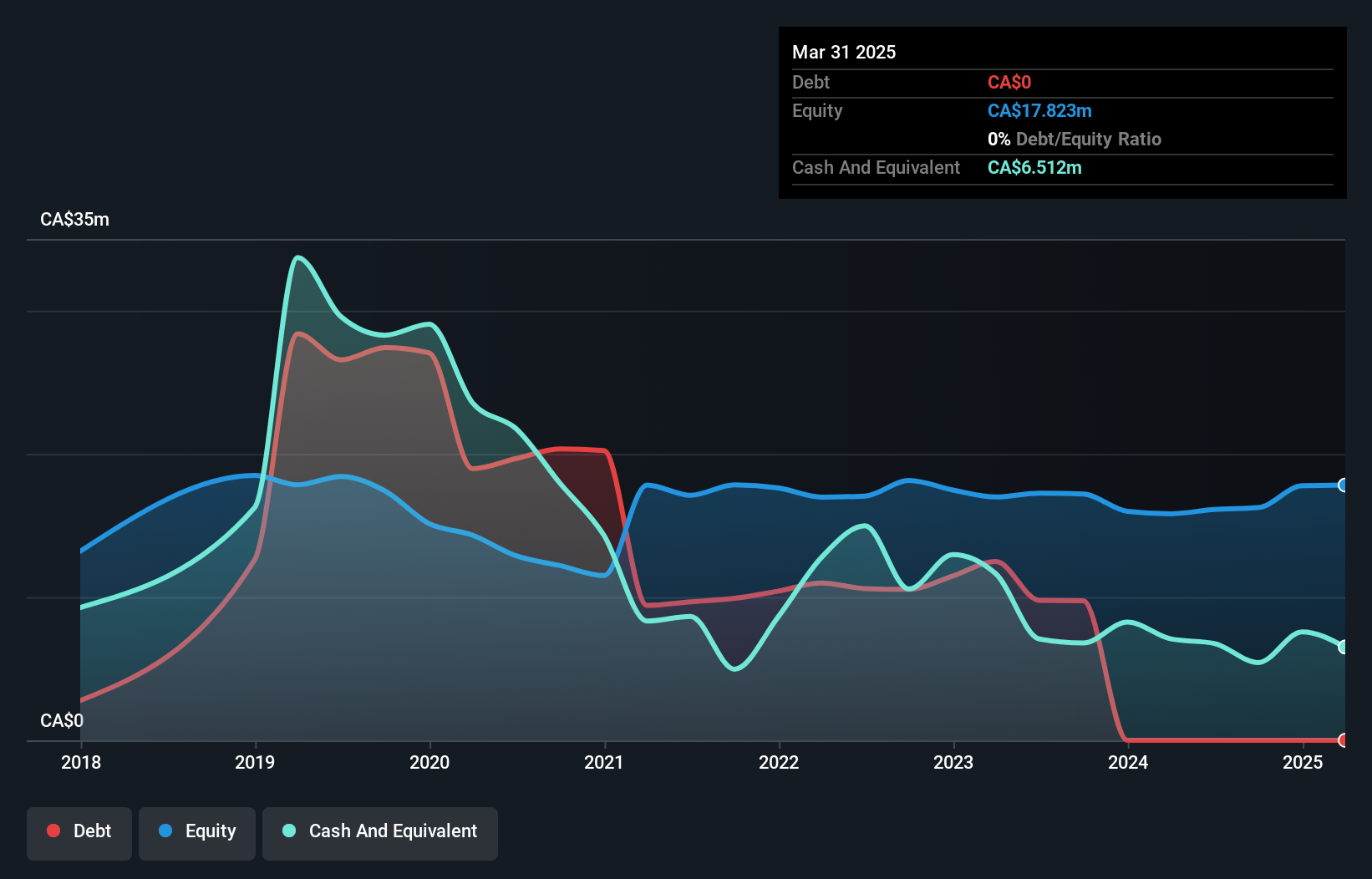

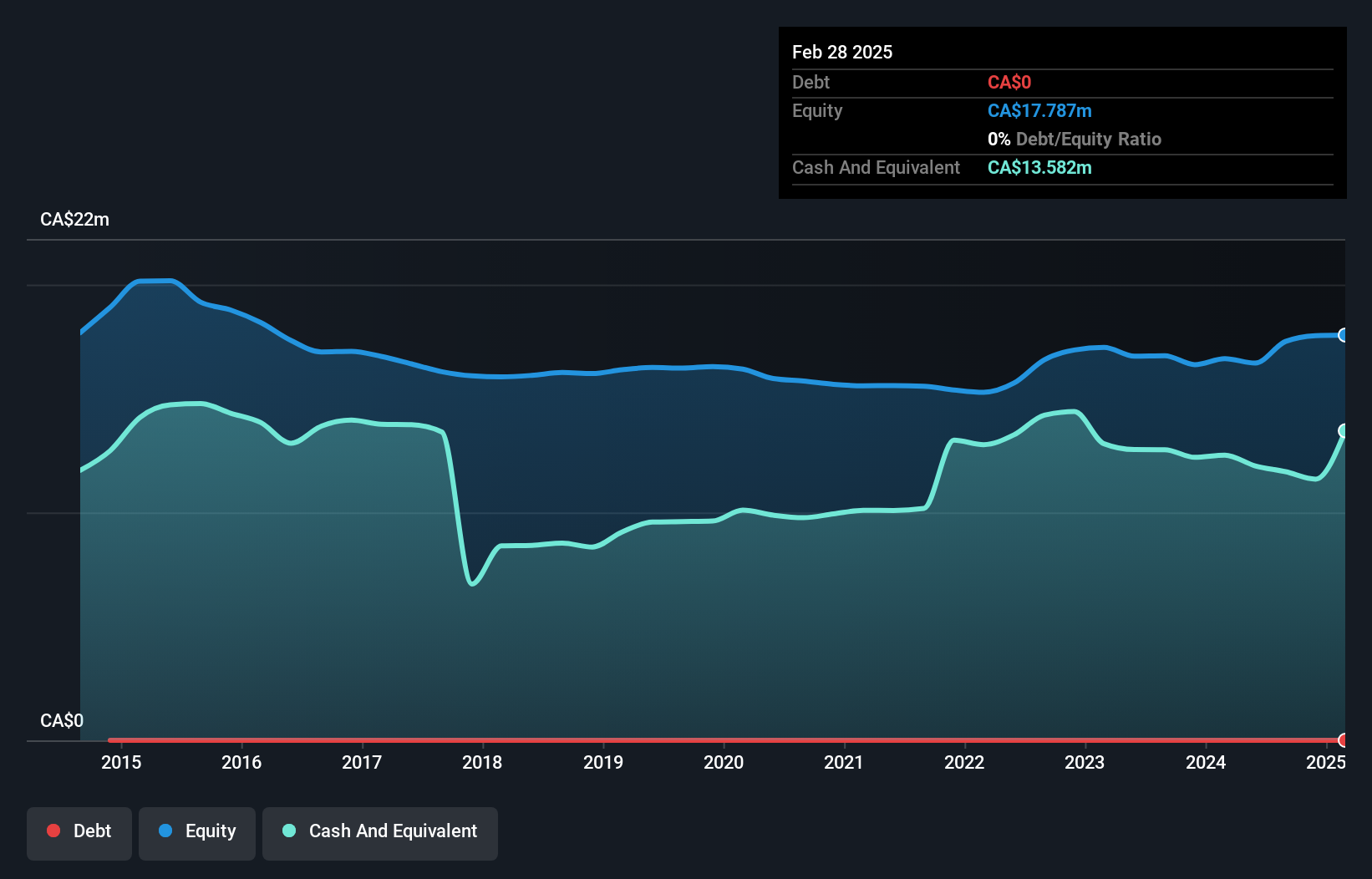

Titan Logix Corp., with a market cap of CA$19.98 million, is unprofitable but has reduced losses by 17.2% annually over the past five years. The company generates revenue from its Mobile Liquid Measurement Solutions segment, totaling CA$6.75 million, indicating it is not pre-revenue. Titan Logix maintains a strong balance sheet with short-term assets of CA$14.9 million surpassing both short-term and long-term liabilities, while being debt-free for the past five years eliminates concerns about interest coverage or cash flow issues related to debt servicing. However, management's average tenure of 1.6 years suggests a relatively new team in place.

- Click here and access our complete financial health analysis report to understand the dynamics of Titan Logix.

- Learn about Titan Logix's historical performance here.

Turning Ideas Into Actions

- Take a closer look at our TSX Penny Stocks list of 963 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titan Logix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TLA

Titan Logix

Develops, manufactures, and markets technology fluid management solutions in Canada, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives