Canada Goose Holdings' (TSE:GOOS) earnings have declined over five years, contributing to shareholders 57% loss

While not a mind-blowing move, it is good to see that the Canada Goose Holdings Inc. (TSE:GOOS) share price has gained 19% in the last three months. But that doesn't change the fact that the returns over the last half decade have been disappointing. In fact, the share price has declined rather badly, down some 57% in that time. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

The recent uptick of 4.7% could be a positive sign of things to come, so let's take a look at historical fundamentals.

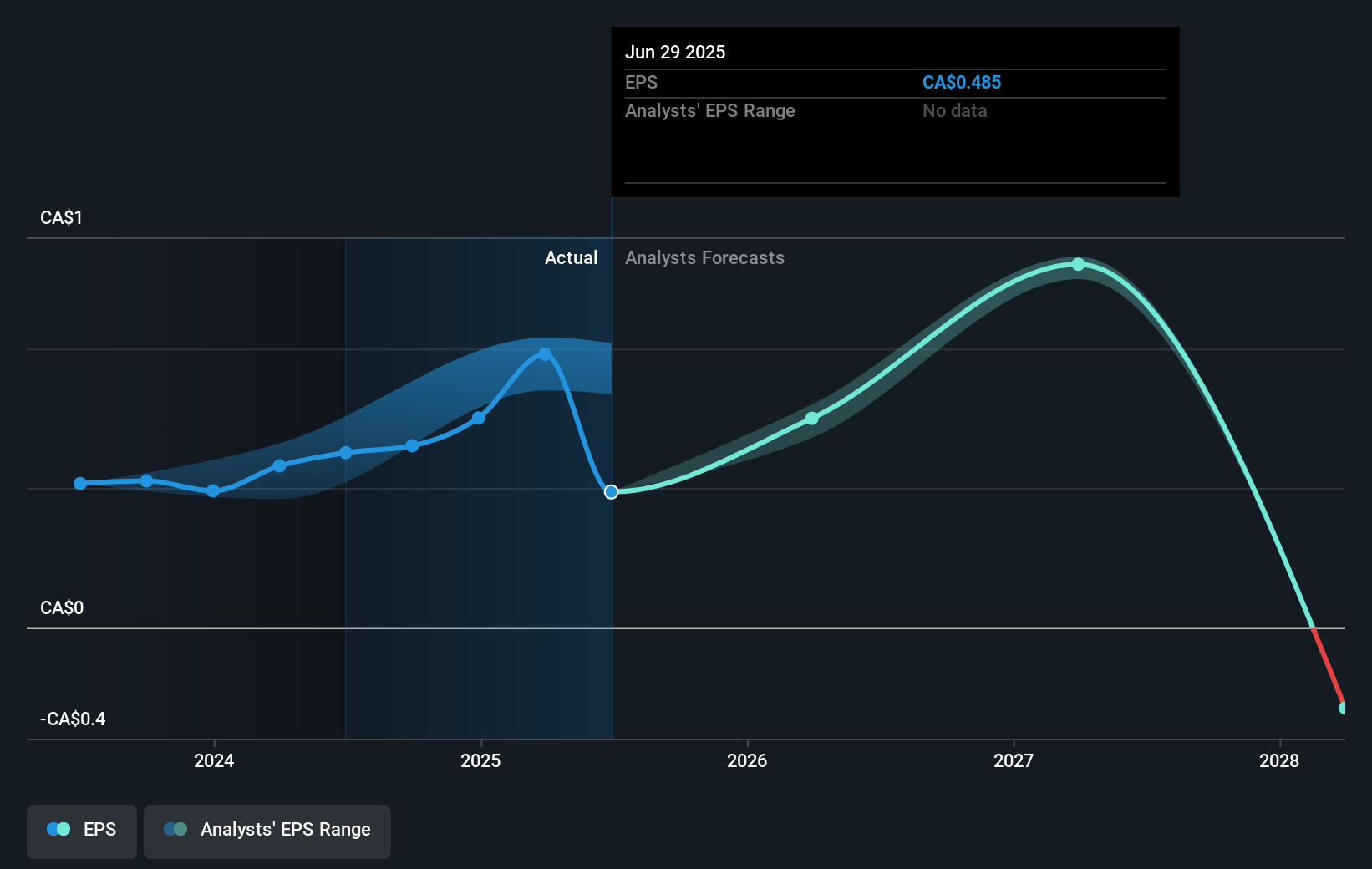

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, Canada Goose Holdings' earnings per share (EPS) dropped by 16% each year. Notably, the share price has fallen at 15% per year, fairly close to the change in the EPS. This suggests that market participants have not changed their view of the company all that much. Rather, the share price change has reflected changes in earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Canada Goose Holdings' earnings, revenue and cash flow.

A Different Perspective

Canada Goose Holdings shareholders gained a total return of 19% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Canada Goose Holdings you should be aware of.

But note: Canada Goose Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Mediocre balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives