Assessing Canada Goose (TSX:GOOS) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 1% Overvalued

According to the most widely followed narrative, Canada Goose Holdings is presently priced slightly above its perceived fair value. Projections are based on expanding international demand, improved brand strength, and future profitability growth.

Exceptional revenue growth in North America and Mainland China, especially driven by rising affluence and demand for premium and luxury goods in Asia, highlights Canada Goose’s ability to tap expanding high-end consumer markets. This suggests a longer-term expansion of the addressable customer base and continued international revenue growth.

What is fueling this higher price? One core narrative connects ambitious growth plans, clever year-round product bets, and significant estimates for higher margins. Interested in the financial factors that give Canada Goose its potential? Review the underlying projections to see which performance upgrades could influence this fair value assessment.

Result: Fair Value of $20.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key international regions and rising operating costs could limit the upside if Canada Goose's growth plans do not deliver as expected.

Find out about the key risks to this Canada Goose Holdings narrative.Another View

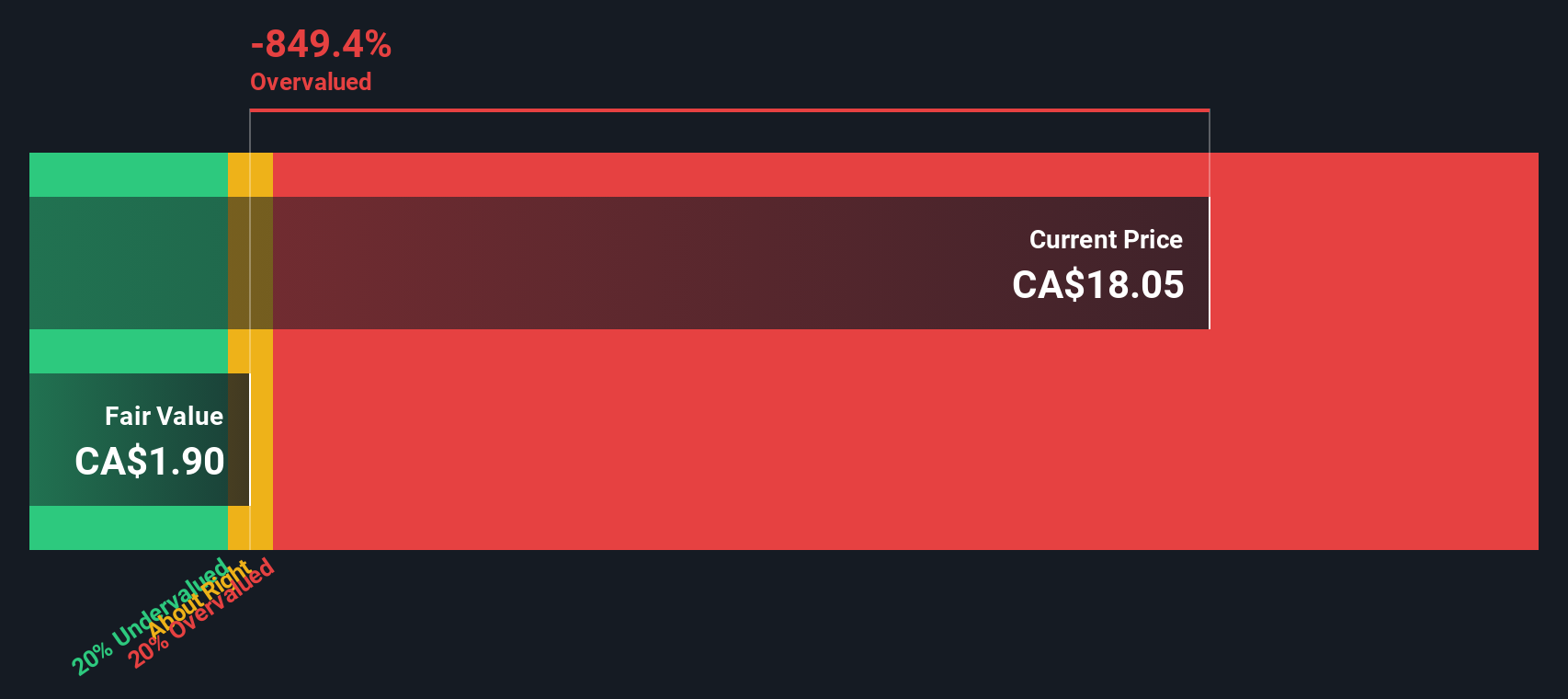

A different way to look at Canada Goose is through our DCF model. This approach asks if the stock’s future cash flows can justify its price. This method signals it may actually be overvalued right now. Which perspective feels most convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canada Goose Holdings Narrative

If you see the story differently or want to investigate the numbers firsthand, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Canada Goose Holdings research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Maximize your next move by using the Simply Wall Street Screener. Smart investors always keep an eye open for new angles and untapped opportunities. Don’t let the next big winners pass you by.

- Catch quality and value in one shot by hunting for undervalued stocks based on future cash flow strength with our undervalued stocks based on cash flows.

- Ride the wave of innovation and pinpoint groundbreaking companies powering the next digital era with our hand-picked selection of AI penny stocks.

- Boost your income by finding reliable earners offering robust yields through our targeted choices of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives