BRP (TSX:DOO) Valuation in Focus After Unveiling New Electric Off-Road Lineup and Strategic Updates

Reviewed by Simply Wall St

If you have been following BRP (TSX:DOO), the past week’s action likely made you pause and wonder what comes next. The company unveiled its new 2026 lineup, headlined by the Can-Am Outlander Electric and a completely overhauled Traxter. This positions BRP at the forefront of off-road innovation and electric powersports. Management emphasized their focus on electrification and indicated a willingness to pivot the business by selling off non-core brands, all while openly acknowledging tariffs and trade uncertainty that currently affect consumer sentiment and guidance.

The excitement around BRP’s new vehicles appeared to inject fresh energy into a stock that has otherwise struggled over the past year, with shares sliding about 15%. However, momentum has picked up sharply, as the stock rebounded by 18% in the past month and surged nearly 60% over the past three months. The launch of electric ATVs and a strategic focus within their portfolio is resetting the narrative for BRP. Still, near-term demand challenges and deferred guidance continue to give some investors pause.

After this recent run-up and bold product announcements, you might be asking yourself whether there is real value left to unlock in BRP or if markets are now fully pricing in its future growth potential.

Most Popular Narrative: 10.4% Overvalued

According to the community narrative, BRP is currently considered overvalued by 10.4% based on future earnings growth, margin improvements, and other projections, using a discount rate of 7.1%.

The introduction of new products, such as Can-Am electric motorcycles and updated ATV platforms, is expected to generate consumer interest and drive sales, which can contribute to revenue growth. BRP has achieved over $200 million in lean savings, indicating an improvement in operational efficiency. This could enhance net margins by reducing costs and improving profitability.

What is fueling this fresh price target? The narrative points to bold strategies, operational wins, and future profitability, yet leaves the main drivers just out of view. Curious how analysts expect revenue, margins, and that all-important profit multiple to develop over the next three years? The most critical assumptions and their surprising effects on fair value await those ready to dig deeper.

Result: Fair Value of $73.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff disputes and unpredictable consumer demand remain significant risks that could quickly shift BRP’s growth outlook and market valuation.

Find out about the key risks to this BRP narrative.Another View: SWS DCF Model Paints a Different Picture

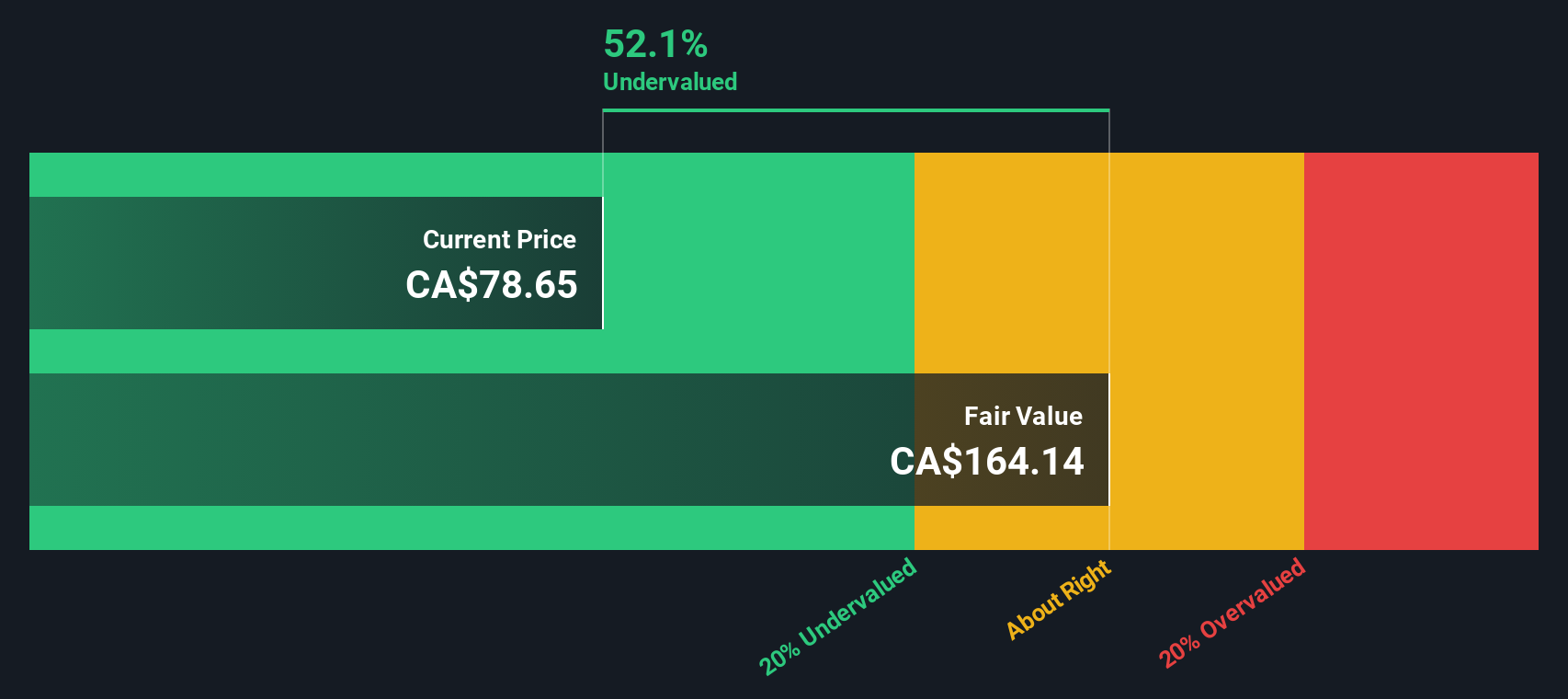

While popular sentiment suggests BRP is overvalued, our DCF model arrives at a much more optimistic assessment. This method considers long-term cash flows and indicates the stock could be dramatically undervalued. The question remains: which result better reflects reality as the company pivots its strategy?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BRP Narrative

If you have your own perspective or want to sharpen your investment view, you can dive into the numbers and craft a personalized narrative in just minutes, or simply do it your way.

A great starting point for your BRP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for What's Next? Boost Your Portfolio With Smart Ideas

The right investment can set you up for lasting results, and you do not need to stop at BRP. Take this opportunity to spot companies with unique strengths in promising sectors. These could be the opportunities others miss. Give your portfolio the edge by acting on strategies that reflect tomorrow’s trends today.

- Catch reliable income streams and target leading companies that offer stable returns above 3% annual yield with our handpicked dividend stocks with yields > 3%.

- Tap into breakthrough opportunities as AI reshapes industries. Find high-potential picks powering tomorrow’s innovations through our AI penny stocks.

- Seize growth before the crowd by scanning undervalued stocks using market-leading cash flow insights in our practical undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives