- Canada

- /

- Consumer Durables

- /

- TSX:DII.B

Dorel Industries Inc.'s (TSE:DII.B) Subdued P/S Might Signal An Opportunity

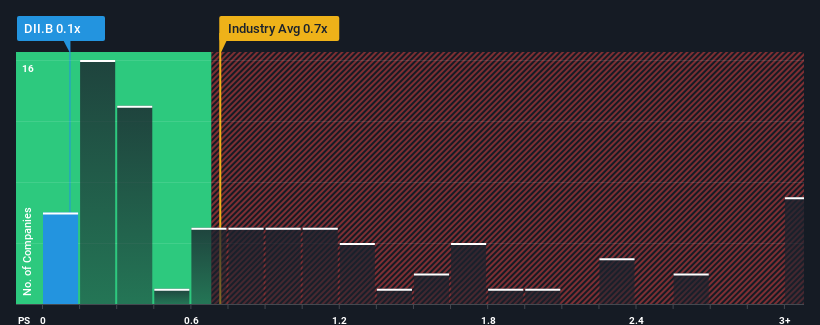

It's not a stretch to say that Dorel Industries Inc.'s (TSE:DII.B) price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" for companies in the Consumer Durables industry in Canada, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Dorel Industries

What Does Dorel Industries' P/S Mean For Shareholders?

There hasn't been much to differentiate Dorel Industries' and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to continue matching the industry, which has kept the P/S in line with expectations. You'd much rather the company improve its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Dorel Industries will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Dorel Industries' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 9.7% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 5.0%, which is noticeably less attractive.

With this information, we find it interesting that Dorel Industries is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Dorel Industries' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Dorel Industries' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Dorel Industries with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DII.B

Dorel Industries

Engages in the designing, manufacturing, sourcing, marketing, and distributing home and juvenile products in the United States, Europe, Latin America, Canada, and Asia .

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.