- Canada

- /

- Consumer Durables

- /

- TSX:DBO

If EPS Growth Is Important To You, D-BOX Technologies (TSE:DBO) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in D-BOX Technologies (TSE:DBO). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

D-BOX Technologies' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that D-BOX Technologies grew its EPS from CA$0.0015 to CA$0.018, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of D-BOX Technologies shareholders is that EBIT margins have grown from 2.5% to 9.7% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

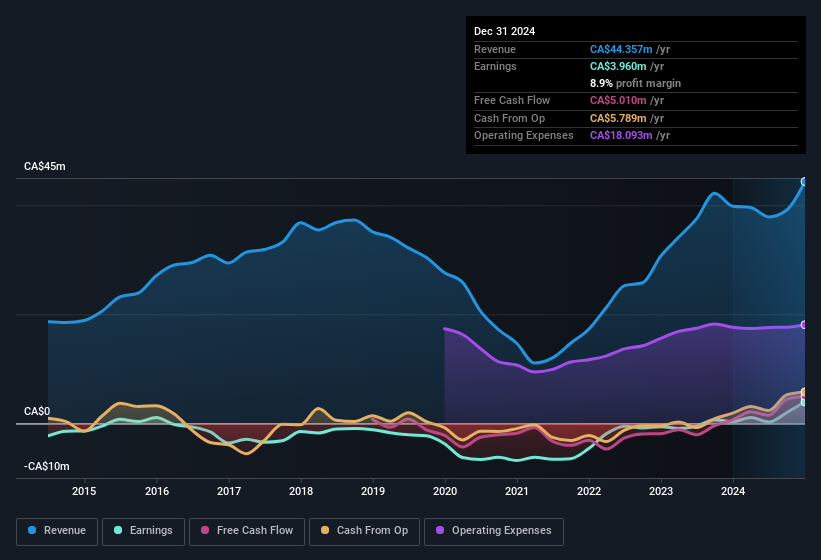

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Check out our latest analysis for D-BOX Technologies

D-BOX Technologies isn't a huge company, given its market capitalisation of CA$31m. That makes it extra important to check on its balance sheet strength .

Are D-BOX Technologies Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some D-BOX Technologies insiders disposing of some shares, we note that there was CA$83k more in buying interest among those who know the company best Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. We also note that it was the Independent Director, Dave McLurg, who made the biggest single acquisition, paying CA$33k for shares at about CA$0.17 each.

Should You Add D-BOX Technologies To Your Watchlist?

D-BOX Technologies' earnings per share growth have been climbing higher at an appreciable rate. Growth investors should find it difficult to look past that strong EPS move. And may very well signal a significant inflection point for the business. If this these factors intrigue you, then an addition of D-BOX Technologies to your watchlist won't go amiss. Even so, be aware that D-BOX Technologies is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of D-BOX Technologies, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DBO

D-BOX Technologies

Designs, manufactures, and commercializes haptic motion systems intended for theatrical entertainment, sim racing and simulation, and training business in the United States, Canada, Europe, Asia, South America, Oceania, and Africa.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026