- Canada

- /

- Capital Markets

- /

- CNSX:QCA

3 Canadian Penny Stocks On TSX With Market Caps Under CA$40M

Reviewed by Simply Wall St

Recent economic data from Canada and the U.S. highlight the resilience of consumer spending, despite challenges like inflation and higher interest rates. This strength in consumption underscores the importance of identifying investment opportunities that can capitalize on such trends. While penny stocks might seem like a term from a bygone era, they continue to offer potential for growth, particularly when these smaller or newer companies are backed by solid financials and fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$165.86M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.66 | CA$278.54M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.16 | CA$119.58M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.16 | CA$395.45M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$237.5M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.45 | CA$955.1M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$4.87M | ★★★★★★ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Quinsam Capital (CNSX:QCA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quinsam Capital Corporation is an investment and merchant banking firm based in Canada with a market capitalization of CA$4.62 million.

Operations: Quinsam Capital Corporation's revenue segments include Unclassified Services, which reported a revenue of -CA$0.078 million.

Market Cap: CA$4.62M

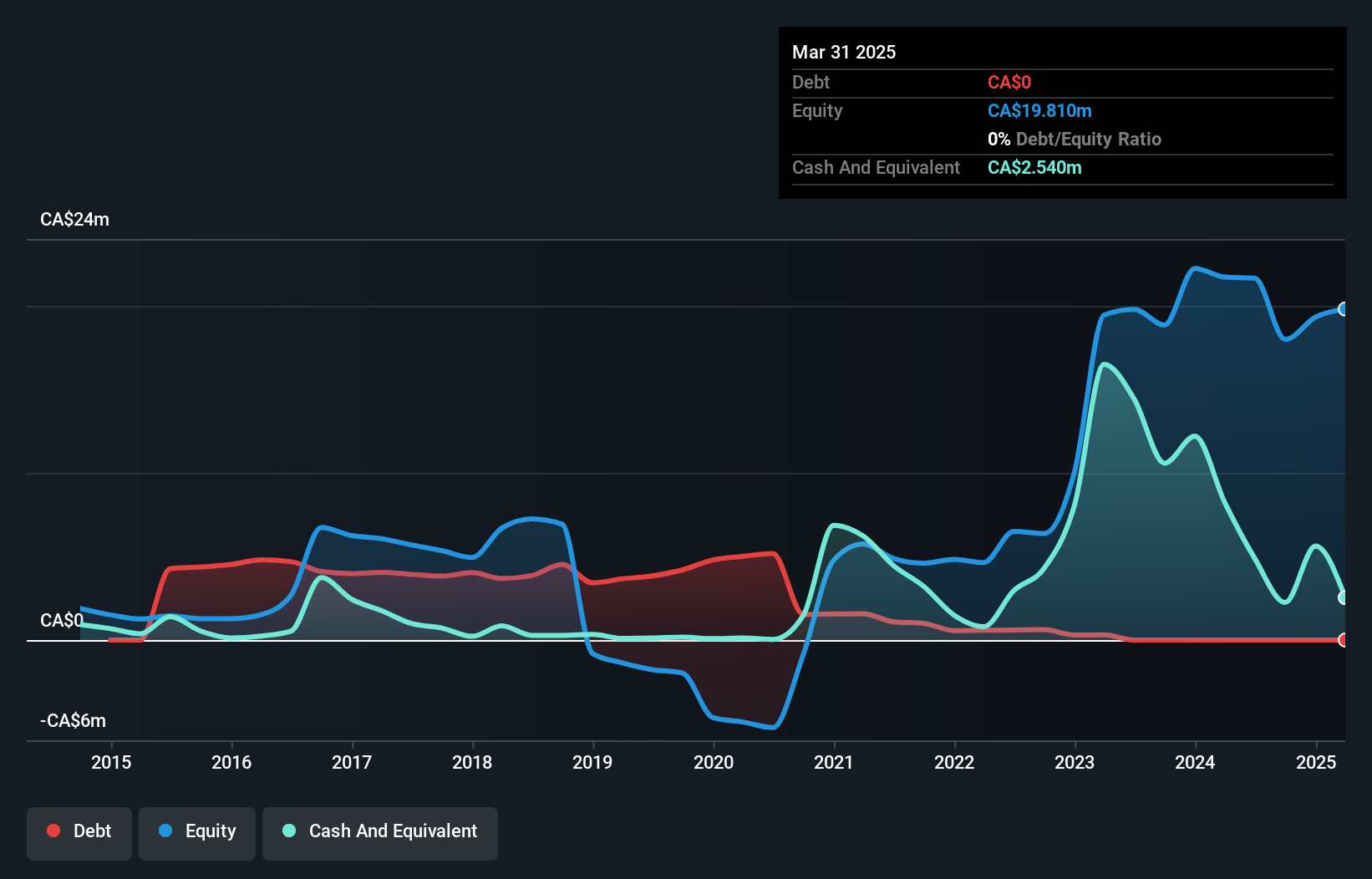

Quinsam Capital Corporation, with a market cap of CA$4.62 million, is pre-revenue and currently unprofitable but has shown significant improvement in recent earnings. For the third quarter of 2024, net income rose to CA$1.21 million from CA$0.070776 million a year ago, indicating potential progress despite its small revenue base. The company benefits from being debt-free and having sufficient cash runway for over three years based on current free cash flow levels. However, it experiences high share price volatility compared to most Canadian stocks and maintains a negative return on equity at -2.52%.

- Navigate through the intricacies of Quinsam Capital with our comprehensive balance sheet health report here.

- Evaluate Quinsam Capital's historical performance by accessing our past performance report.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes motion systems for the entertainment and simulation and training markets worldwide, with a market cap of CA$28.63 million.

Operations: The company's revenue is derived from Entertainment (CA$21.92 million), Simulation and Training (CA$8.05 million), and Rights for Use, Rental, and Maintenance (CA$9.17 million).

Market Cap: CA$28.63M

D-BOX Technologies Inc., with a market cap of CA$28.63 million, has demonstrated robust earnings growth, achieving profitability over the past five years with a notable 196.9% increase in the last year alone. This growth surpasses industry averages and reflects improved profit margins from 1.6% to 5.1%. The company's financial stability is supported by short-term assets exceeding both short and long-term liabilities, alongside well-covered interest payments and debt by cash flow. Despite these strengths, D-BOX faces high share price volatility and recent board changes following Zrinka Dekic's resignation due to her new role at J.P. Morgan.

- Jump into the full analysis health report here for a deeper understanding of D-BOX Technologies.

- Gain insights into D-BOX Technologies' past trends and performance with our report on the company's historical track record.

Brunswick Exploration (TSXV:BRW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brunswick Exploration Inc. is a junior exploration and evaluation company focused on acquiring, exploring, and evaluating mining property assets in Canada, with a market cap of CA$31.69 million.

Operations: Brunswick Exploration Inc. does not have any reported revenue segments as it is focused on the exploration and evaluation of mining property assets in Canada.

Market Cap: CA$31.69M

Brunswick Exploration Inc., with a market cap of CA$31.69 million, is a pre-revenue company focused on mining property exploration in Canada and Greenland. The company recently expanded its exploration licenses in Greenland following the discovery of lithium-bearing pegmatites, highlighting significant potential for future resource development. Despite high share price volatility and negative return on equity (-51.32%), Brunswick remains debt-free with experienced management and board teams. Recent capital raised through private placements aims to support ongoing exploration activities, although the cash runway remains limited to two months based on current free cash flow estimates before additional funding was secured.

- Get an in-depth perspective on Brunswick Exploration's performance by reading our balance sheet health report here.

- Gain insights into Brunswick Exploration's historical outcomes by reviewing our past performance report.

Key Takeaways

- Embark on your investment journey to our 915 TSX Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quinsam Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:QCA

Quinsam Capital

Operates as an investment and merchant banking firm in Canada.

Flawless balance sheet low.

Market Insights

Community Narratives