- Canada

- /

- Commercial Services

- /

- TSXV:VTX

Vertex Resource Group Ltd. (CVE:VTX) Screens Well But There Might Be A Catch

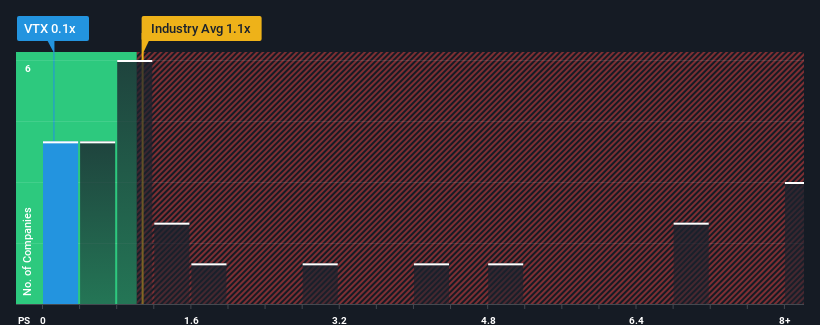

When close to half the companies operating in the Commercial Services industry in Canada have price-to-sales ratios (or "P/S") above 1.1x, you may consider Vertex Resource Group Ltd. (CVE:VTX) as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Vertex Resource Group

How Vertex Resource Group Has Been Performing

While the industry has experienced revenue growth lately, Vertex Resource Group's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vertex Resource Group.Is There Any Revenue Growth Forecasted For Vertex Resource Group?

In order to justify its P/S ratio, Vertex Resource Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 58% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will show minor resilience over the next year growing only by 3.7%. Meanwhile, the broader industry is forecast to contract by 3.4%, which would indicate the company is doing better than the majority of its peers.

With this in consideration, we find it intriguing that Vertex Resource Group's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Vertex Resource Group currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Vertex Resource Group, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:VTX

Vertex Resource Group

Provides environmental and industrial services in Canada and the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion