- Canada

- /

- Commercial Services

- /

- TSXV:SECU

TSX Opportunities Aurion Resources And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

Despite a few bumps in the road, Canadian markets have shown resilience, closing October near record highs even amid cautious signals from central banks and evolving trade dynamics. In this context, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or newer companies that offer a mix of affordability and growth potential. By focusing on those with strong financials, these stocks can provide intriguing possibilities for those looking to explore promising investments in the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.53 | CA$65.48M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.42 | CA$238.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.395 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.385 | CA$56.33M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.05 | CA$705.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.05 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.00 | CA$149.22M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.115 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Aurion Resources (TSXV:AU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aurion Resources Ltd. is involved in the acquisition, exploration, and evaluation of mineral properties in Finland with a market cap of CA$168.39 million.

Operations: Aurion Resources Ltd. does not report any revenue segments, as it is focused on the acquisition, exploration, and evaluation of mineral properties in Finland.

Market Cap: CA$168.39M

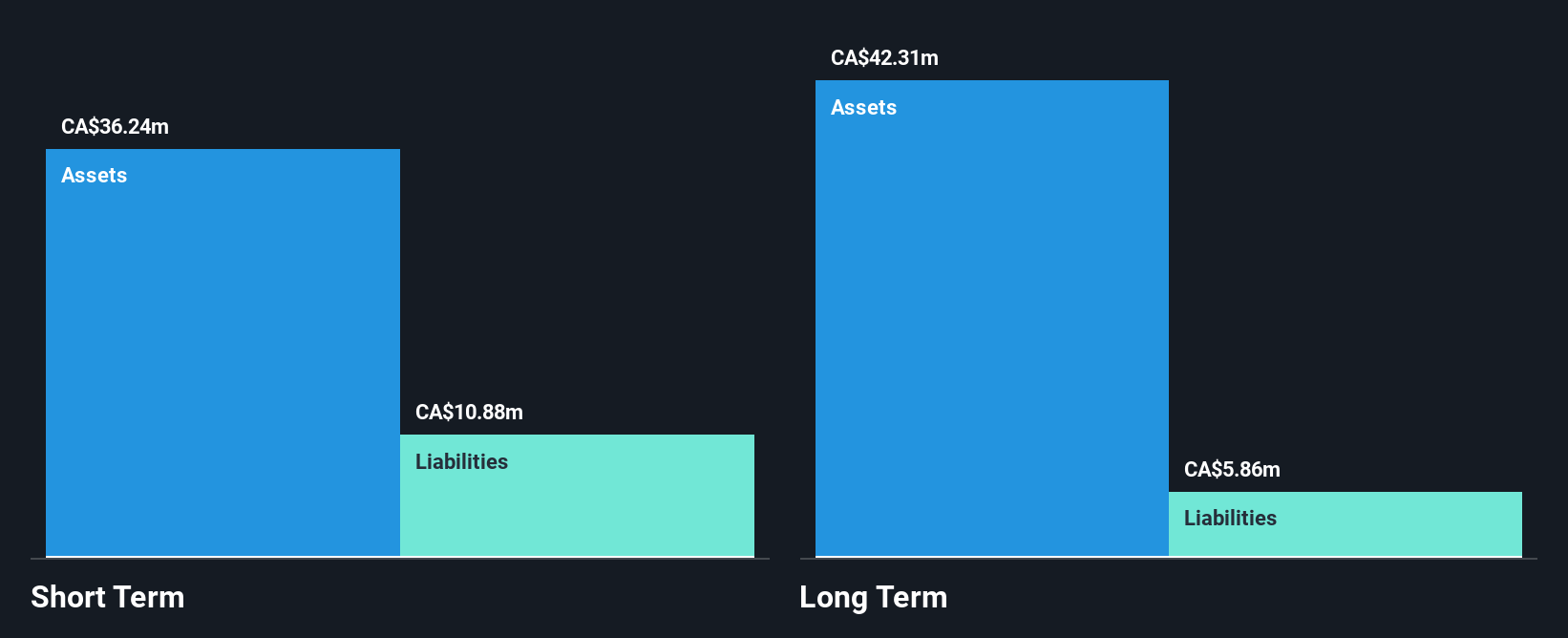

Aurion Resources Ltd., a pre-revenue company with a market cap of CA$168.39 million, focuses on mineral exploration in Finland. Its Risti property is central to its operations, where recent drilling extended the gold mineralized system at the Vanha prospect by 300 meters westward and highlighted promising gold grades. The company's strategic partnerships, such as with KoBold Metals, involve significant exploration commitments that could enhance resource potential. Aurion remains debt-free but relies on capital raises for funding; recent private placements included substantial participation from Kinross Gold Corporation, maintaining their stake in Aurion's growth trajectory.

- Navigate through the intricacies of Aurion Resources with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Aurion Resources' future.

Metavista3D (TSXV:DDD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metavista3D Inc. focuses on the research and development of pseudo-holographic display technologies, with a market cap of CA$116.08 million.

Operations: Metavista3D Inc. has not reported any revenue segments.

Market Cap: CA$116.08M

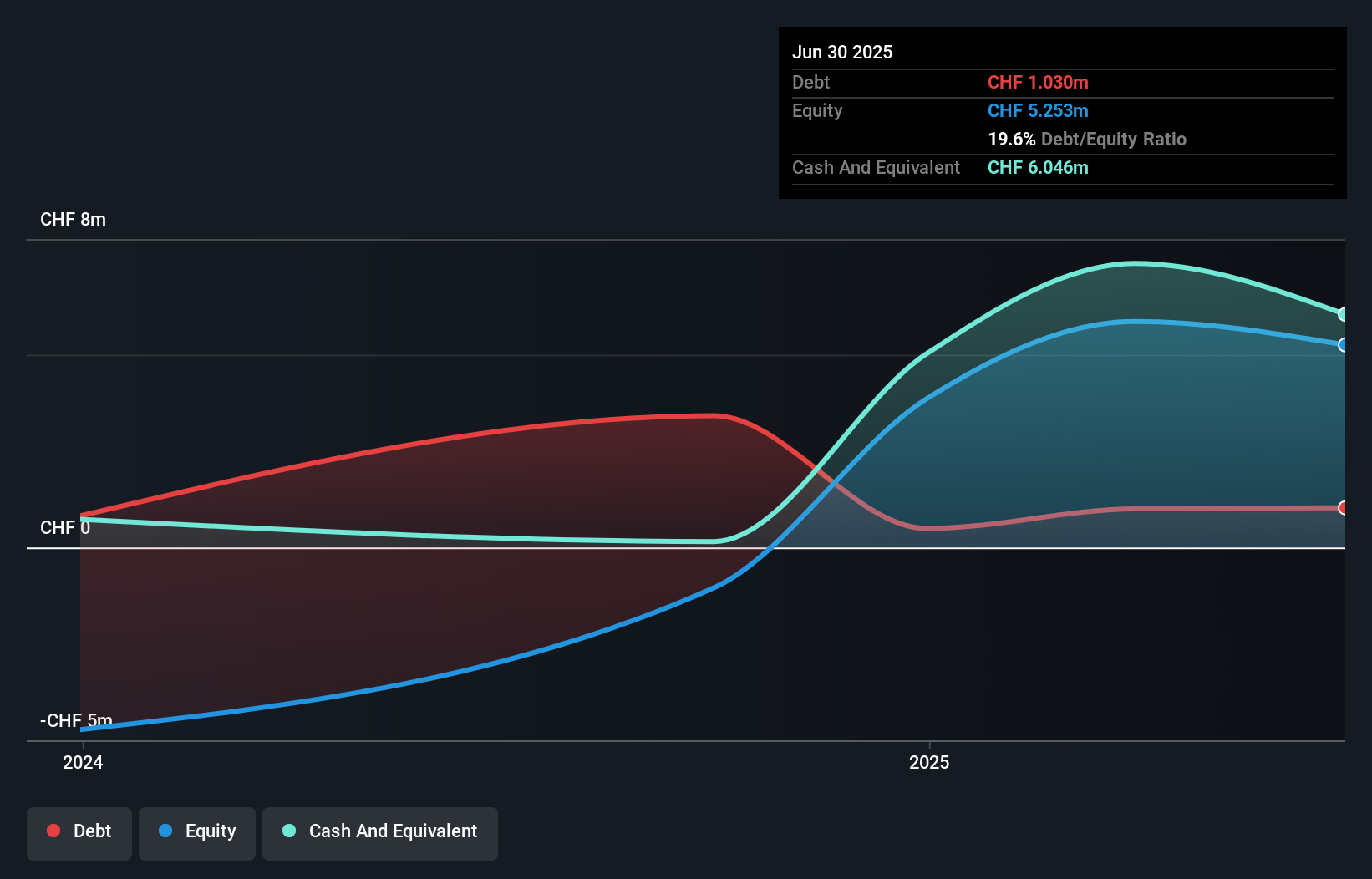

Metavista3D Inc., with a market cap of CA$116.08 million, is pre-revenue and focuses on pseudo-holographic display technologies. Recent advancements include their AI-driven 3D E-Mirror technology, showcased at the AutoTech Science Fair, which enhances real-time visualization for automotive applications. The company secured a loan agreement for up to CA$12.5 million from a UAE investor to support its R&D initiatives. Metavista3D has binding agreements for demonstration units and test projects worth approximately CA$4.5 million in gross revenue, though significant costs are anticipated. The firm maintains more cash than debt and has not experienced shareholder dilution recently.

- Unlock comprehensive insights into our analysis of Metavista3D stock in this financial health report.

- Understand Metavista3D's track record by examining our performance history report.

SSC Security Services (TSXV:SECU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SSC Security Services Corp. offers cyber, physical, and electronic security services to commercial, industrial, and public sector clients in Canada with a market cap of CA$49.32 million.

Operations: The company's revenue is primarily derived from its Security segment, which accounts for CA$116.80 million, complemented by CA$4.43 million from its Corporate segment.

Market Cap: CA$49.32M

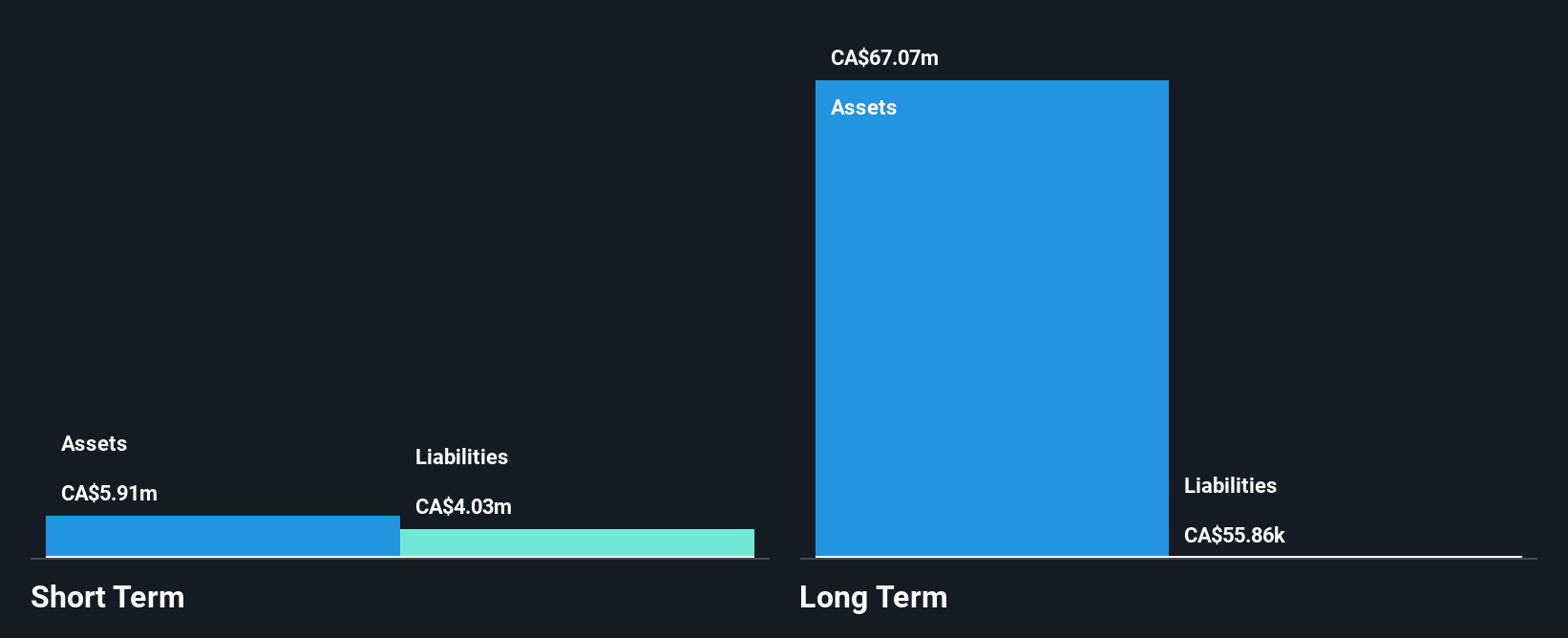

SSC Security Services Corp., with a market cap of CA$49.32 million, remains unprofitable but demonstrates financial stability with no debt and sufficient cash runway for over three years. The company reported Q3 sales of CA$30.18 million, slightly up from the previous year, though it faced a net loss over nine months compared to a profit last year. Despite losses, SSC continues to pay dividends at an annualized rate of CA$0.12 per share and completed a share buyback program repurchasing 0.76% of shares for CA$0.34 million, indicating confidence in its future prospects amidst ongoing challenges in profitability growth.

- Jump into the full analysis health report here for a deeper understanding of SSC Security Services.

- Gain insights into SSC Security Services' past trends and performance with our report on the company's historical track record.

Make It Happen

- Dive into all 410 of the TSX Penny Stocks we have identified here.

- Ready For A Different Approach? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SECU

SSC Security Services

Provides cyber, physical, and electronic security services to commercial, industrial, and public sector clients in Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives