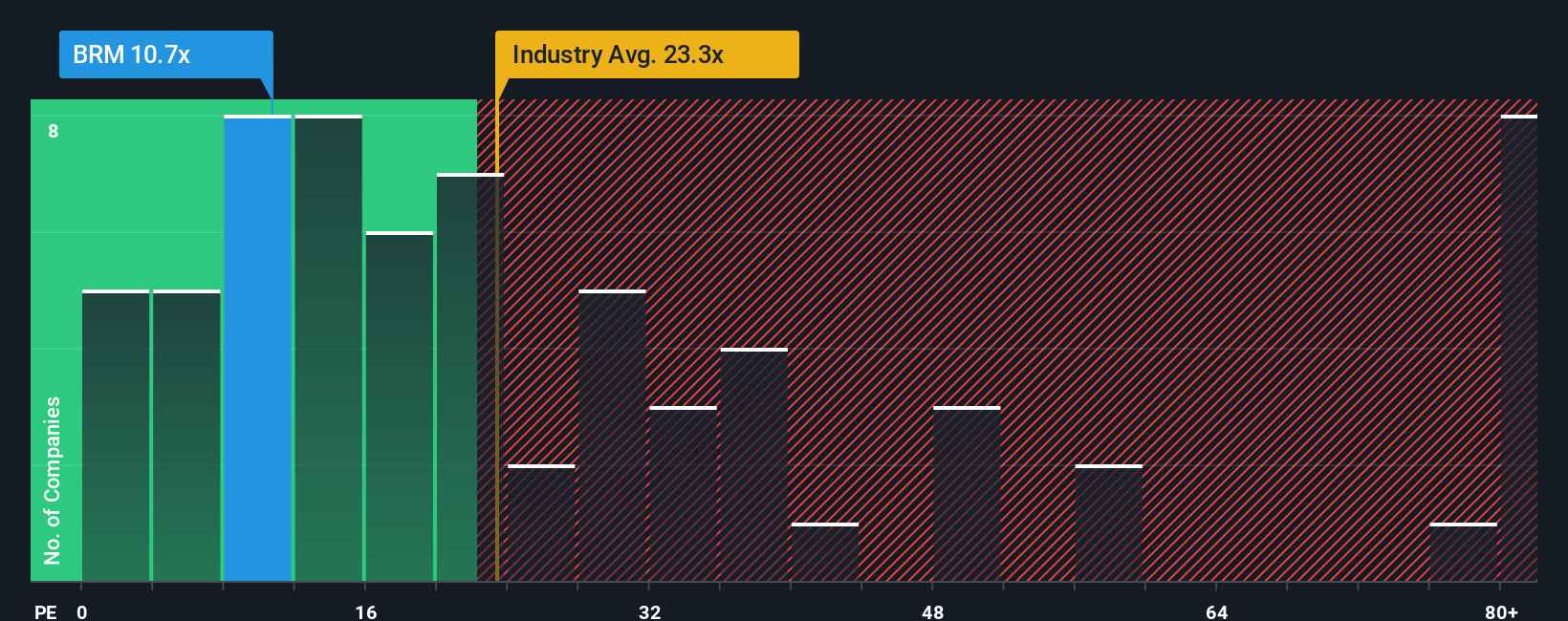

BioRem Inc.'s (CVE:BRM) price-to-earnings (or "P/E") ratio of 10.7x might make it look like a buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 16x and even P/E's above 29x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

BioRem could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for BioRem

How Is BioRem's Growth Trending?

In order to justify its P/E ratio, BioRem would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 225% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 36% over the next year. That's shaping up to be materially higher than the 18% growth forecast for the broader market.

With this information, we find it odd that BioRem is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From BioRem's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that BioRem currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for BioRem that you need to take into consideration.

Of course, you might also be able to find a better stock than BioRem. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BioRem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BRM

BioRem

A clean technology engineering company, designs, manufactures, distributes, and sells air pollution control systems that are used to eliminate odors, volatile organic compounds, and hazardous air pollutants.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.