- Canada

- /

- Commercial Services

- /

- TSXV:BRM

Golden Shield Resources And 2 Other Promising TSX Penny Stocks

Reviewed by Simply Wall St

As the Canadian market continues its strong momentum into 2025, investors are advised to remain vigilant for potential curveballs that could impact their portfolios. Amidst this backdrop, penny stocks—though a somewhat outdated term—remain a relevant investment area, offering unique opportunities for growth at lower price points. In this article, we explore three promising TSX penny stocks that combine financial strength and potential upside, providing an intriguing option for those looking to diversify beyond the more prominent names in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.24 | CA$154.9M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$281.86M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.36 | CA$120.59M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.89 | CA$187.19M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.45 | CA$335.5M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$215.73M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 960 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Golden Shield Resources (CNSX:GSRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Shield Resources Inc. is involved in the acquisition, exploration, and development of mineral properties in Guyana with a market cap of CA$2.64 million.

Operations: Golden Shield Resources Inc. has not reported any revenue segments.

Market Cap: CA$2.64M

Golden Shield Resources Inc., with a market cap of CA$2.64 million, is pre-revenue and currently unprofitable, lacking significant revenue streams. The company has no debt but faces financial challenges with less than a year of cash runway based on current free cash flow trends. Its stock is highly volatile, reflecting increased weekly volatility over the past year. Recent developments include the cancellation of a proposed reverse merger with Tucano Gold Inc., which would have significantly altered its shareholder structure and potentially provided strategic benefits. The board's average tenure suggests limited experience, adding to investment risks associated with this penny stock.

- Jump into the full analysis health report here for a deeper understanding of Golden Shield Resources.

- Gain insights into Golden Shield Resources' historical outcomes by reviewing our past performance report.

BioRem (TSXV:BRM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BioRem Inc. is a clean technology engineering company that designs, manufactures, distributes, and sells air pollution control systems to eliminate odors, VOCs, and HAPs, with a market cap of CA$47.54 million.

Operations: The company's revenue is derived entirely from the manufacture and sale of pollution control systems, totaling CA$40.31 million.

Market Cap: CA$47.54M

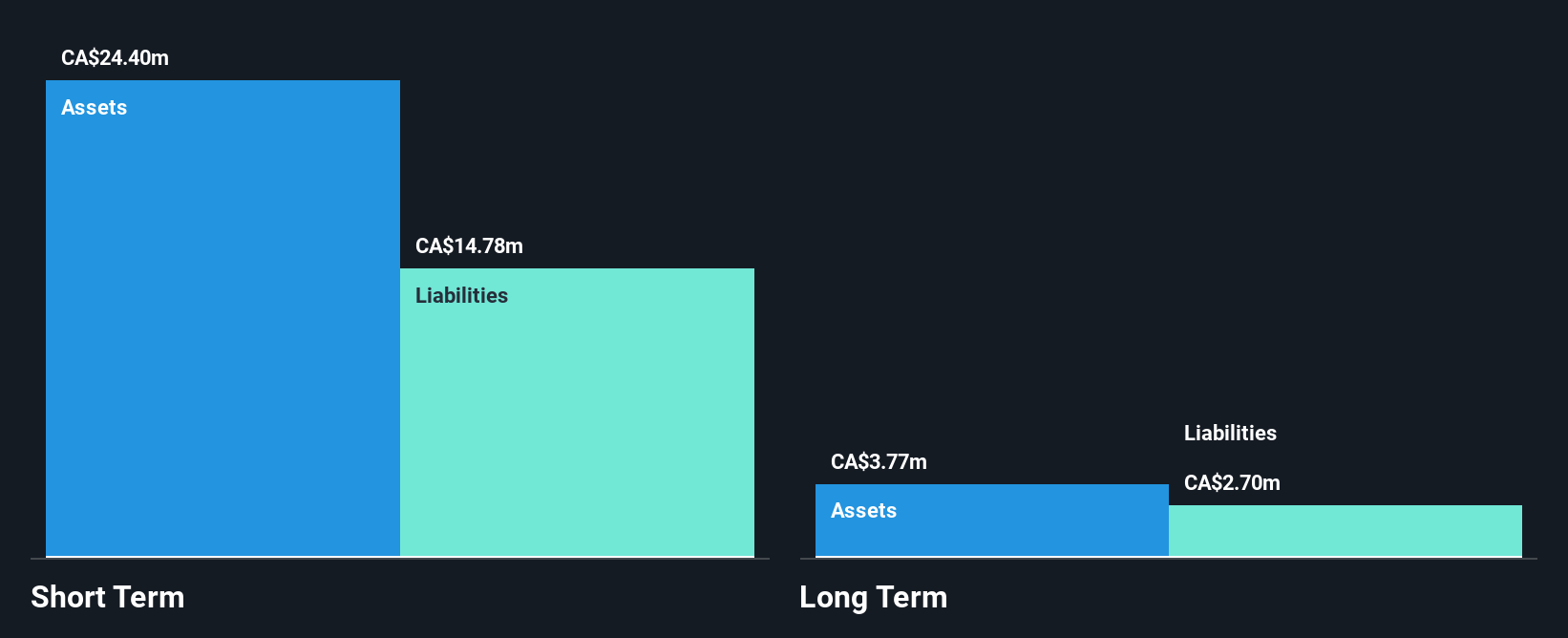

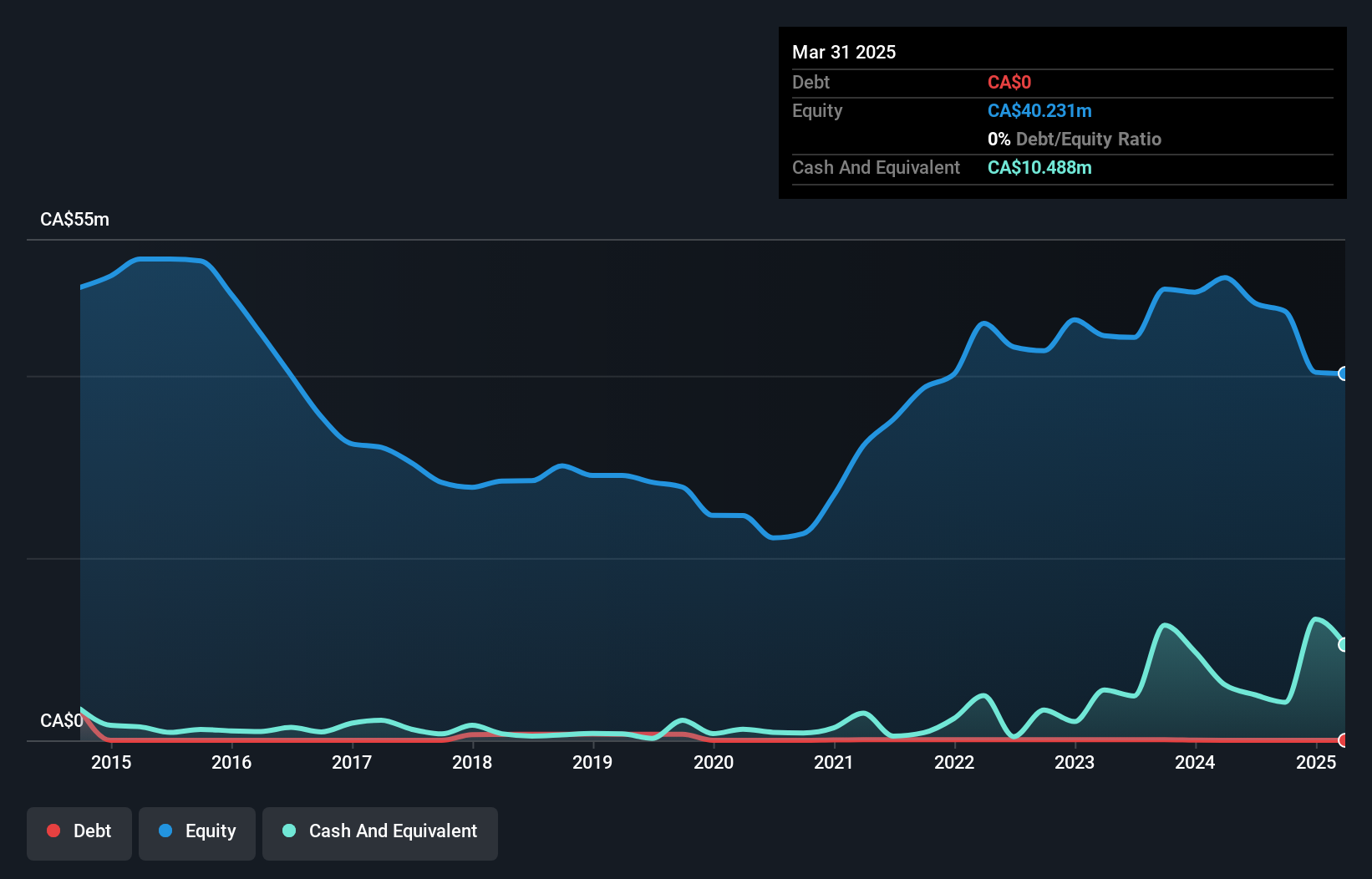

BioRem Inc., with a market cap of CA$47.54 million, has demonstrated significant financial growth, reporting third-quarter sales of CA$14.89 million compared to CA$5.51 million the previous year and net income of CA$2.19 million up from CA$0.50 million. The company’s earnings have surged by 711.5% over the past year, outpacing industry averages, while maintaining high-quality earnings and an outstanding return on equity at 52.2%. BioRem's financial health is robust with more cash than debt and strong interest coverage ratios, although its debt-to-equity ratio has increased over five years to 25.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of BioRem.

- Understand BioRem's track record by examining our performance history report.

Mongolia Growth Group (TSXV:YAK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mongolia Growth Group Ltd. operates as a merchant bank with real estate investments in Mongolia and has a market cap of CA$34.28 million.

Operations: The company's revenue is derived from Subscription Products, which generated CA$2.72 million, and Corporate activities, contributing CA$0.11 million.

Market Cap: CA$34.28M

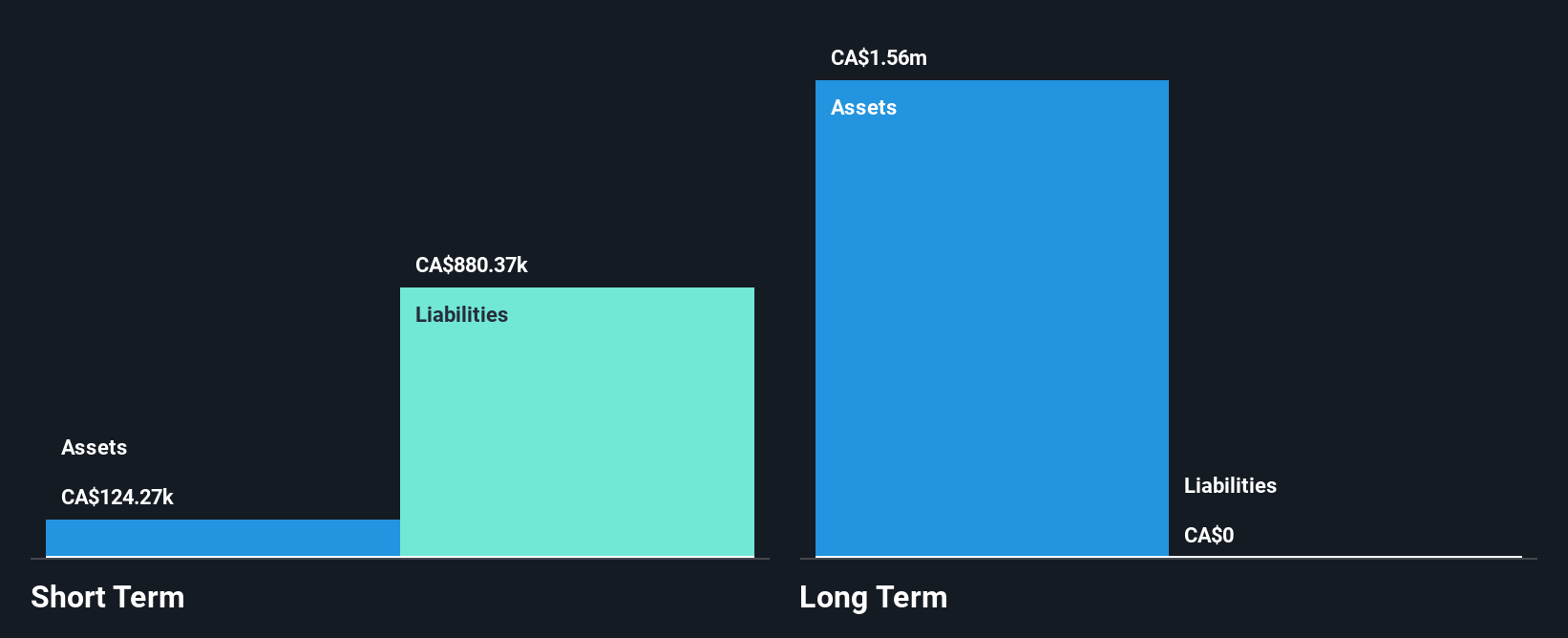

Mongolia Growth Group Ltd., with a market cap of CA$34.28 million, remains unprofitable and pre-revenue, generating CA$3 million in revenue. Despite no debt and stable weekly volatility, the company reported a net loss of CA$0.76 million for Q3 2024, contrasting sharply with the previous year's net income of CA$7.88 million. Shareholders have not faced significant dilution recently, and short-term assets exceed liabilities by a comfortable margin. The board is experienced with an average tenure of nearly 10 years, though management's experience level is unclear due to insufficient data on tenure.

- Click here to discover the nuances of Mongolia Growth Group with our detailed analytical financial health report.

- Gain insights into Mongolia Growth Group's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Take a closer look at our TSX Penny Stocks list of 960 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioRem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BRM

BioRem

A clean technology engineering company, designs, manufactures, distributes, and sells air pollution control systems that are used to eliminate odors, volatile organic compounds, and hazardous air pollutants.

Excellent balance sheet and fair value.

Market Insights

Community Narratives