- Canada

- /

- Commercial Services

- /

- TSXV:BQE

Why Investors Shouldn't Be Surprised By BQE Water Inc.'s (CVE:BQE) 47% Share Price Surge

BQE Water Inc. (CVE:BQE) shares have continued their recent momentum with a 47% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 72%.

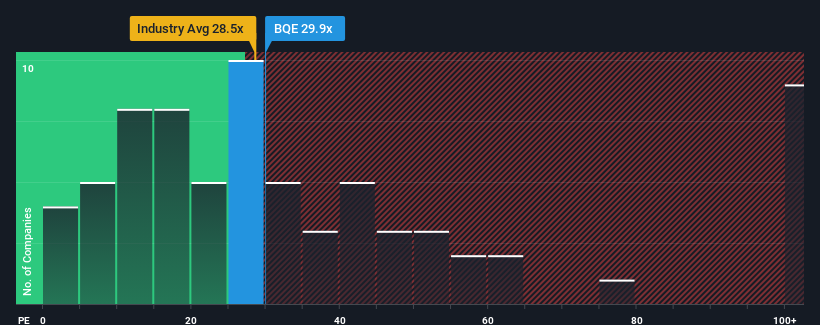

Since its price has surged higher, BQE Water may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 29.9x, since almost half of all companies in Canada have P/E ratios under 14x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

BQE Water has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. It seems that many are expecting the comparatively superior earnings performance to persist, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if earnings continue to dissolve.

Check out our latest analysis for BQE Water

What Are Growth Metrics Telling Us About The High P/E?

BQE Water's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.6%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 181% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 100% during the coming year according to the one analyst following the company. With the market only predicted to deliver 19%, the company is positioned for a stronger earnings result.

With this information, we can see why BQE Water is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in BQE Water have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that BQE Water maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for BQE Water (of which 1 is significant!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade BQE Water, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BQE Water might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BQE

BQE Water

A water treatment company, provides wastewater management and treatment solutions to the mining and metallurgical industry in Canada, the United States, Latin America, China, and internationally.

Outstanding track record and undervalued.

Market Insights

Community Narratives