- Canada

- /

- Professional Services

- /

- TSX:TRI

Thomson Reuters (TSX:TRI): Evaluating Valuation After Analyst Upgrades and $1 Billion Buyback Announcement

Reviewed by Kshitija Bhandaru

Thomson Reuters (TSX:TRI) has seen a wave of analyst upgrades following rapid adoption of its Gen AI-enabled products and stronger revenue growth. Management’s recent $1 billion share repurchase program is also drawing investor attention.

See our latest analysis for Thomson Reuters.

It has been a lively year for Thomson Reuters, with last week's Semicon West presentation and a billion-dollar buyback punctuating news of surging Gen AI adoption. While the share price has faced pressure, down 22.6% over the last 90 days, the company’s three-year total shareholder return remains a robust 65.8%, reflecting underlying strength despite recent volatility.

If Thomson Reuters' repositioning has you rethinking where momentum might be building next, now could be the time to discover fast growing stocks with high insider ownership.

But with shares still trading nearly 25 percent below analyst price targets and the business showing strong organic growth, investors must weigh whether Thomson Reuters is undervalued or if the market has already priced in its future gains.

Most Popular Narrative: 19.7% Undervalued

Thomson Reuters is trading below the narrative fair value, with a gap suggesting potential upside if forecasts are realized. This sets up a critical juncture as investors weigh whether these ambitious projections are justified by the company’s future performance and sector outlook.

The company's proprietary, authoritative content and integrated product suite positions it as a trusted platform, benefiting from the global proliferation of data and increasingly complex regulatory environments. This status as a "category leader," combined with tight workflow integration, supports higher client retention and market share gains, boosting long-term recurring revenues.

What drives such a bold fair value estimate? The narrative relies on a dynamic interplay of workflow innovation, market share expansion, and aggressive profitability forecasts. Want to uncover the specific assumptions propelling this valuation target? You may be surprised by where future growth is projected to come from.

Result: Fair Value of $276.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in legal tech and challenges integrating new acquisitions could threaten Thomson Reuters’ profitability and could slow its anticipated growth trajectory.

Find out about the key risks to this Thomson Reuters narrative.

Another View: Market Multiples Tell a Different Story

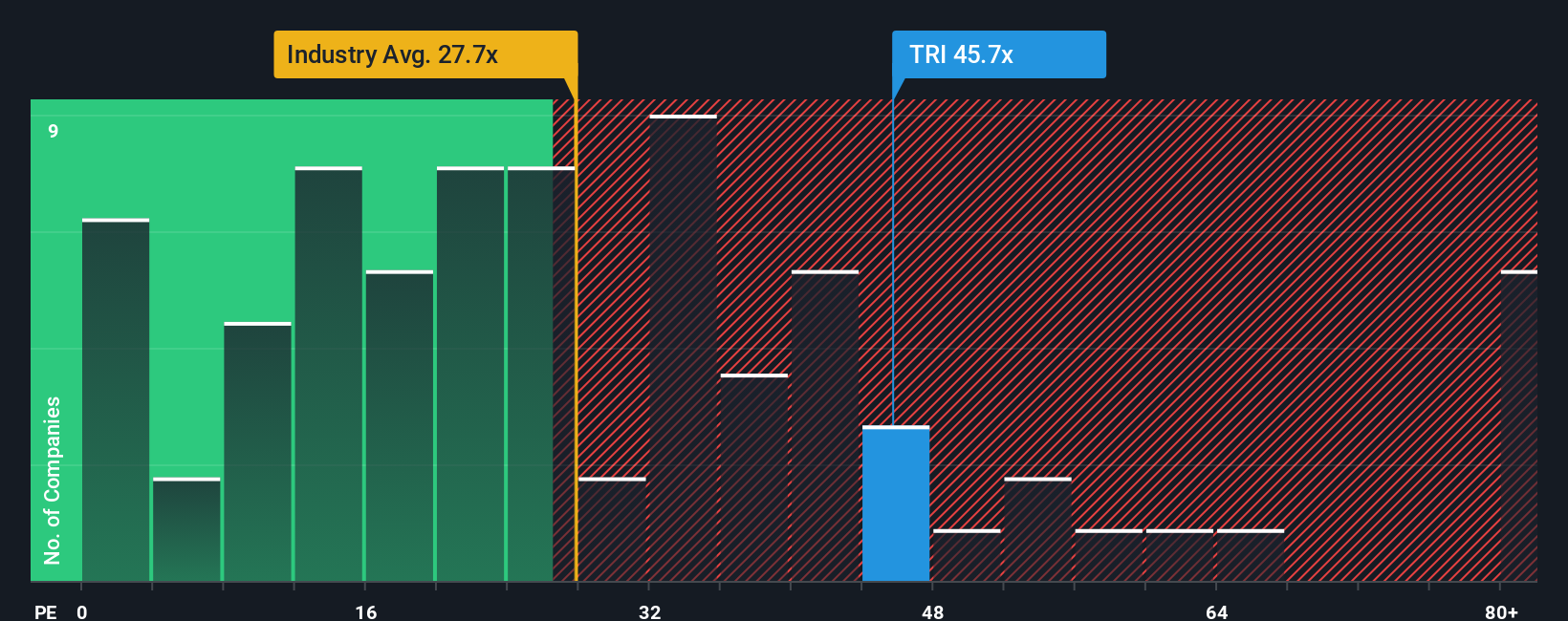

While the fair value shows Thomson Reuters as undervalued, a look at its price-to-earnings ratio reveals a more cautious picture. Trading at 44.6 times earnings, the shares are well above both peer (32.6x) and industry (26.7x) averages, and even higher than their own fair ratio of 30.6x. This significant premium suggests the market is pricing in a lot of future optimism. Could this be setting investors up for disappointment if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thomson Reuters Narrative

If you have a different perspective or want to interpret Thomson Reuters’ story for yourself, you can explore the underlying numbers and develop your narrative in just minutes with Do it your way.

A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let market opportunities pass you by. Now is a good time to act on new possibilities and strengthen your portfolio with standout companies in emerging sectors.

- Expand your income stream and access reliable payouts by checking out these 18 dividend stocks with yields > 3% offering yields above 3%.

- Catch the edge in healthcare innovation when you consider these 33 healthcare AI stocks, featuring advances transforming patient outcomes and medical intelligence.

- Grow your wealth in tomorrow’s tech frontier by selecting these 24 AI penny stocks set to benefit from artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives