- Canada

- /

- Professional Services

- /

- TSX:TRI

Thomson Reuters (TSX:TRI) Boosts AI Offerings with CoCounsel 2.0 Amid Strong Financial Performance

Reviewed by Simply Wall St

The Thomson Reuters (TSX:TRI) is navigating a dynamic period with both promising advancements and notable challenges. Recent developments include a 12.7% earnings growth and strong interest in generative AI products, contrasted by a forecasted earnings decline and concerns over overvaluation. In the discussion that follows, we will explore Thomson Reuters' financial health, operational challenges, strategic growth plans, and potential risks to provide a comprehensive overview of the company's current business situation.

Get an in-depth perspective on Thomson Reuters's performance by reading our analysis here.

Strengths: Core Advantages Driving Sustained Success For Thomson Reuters

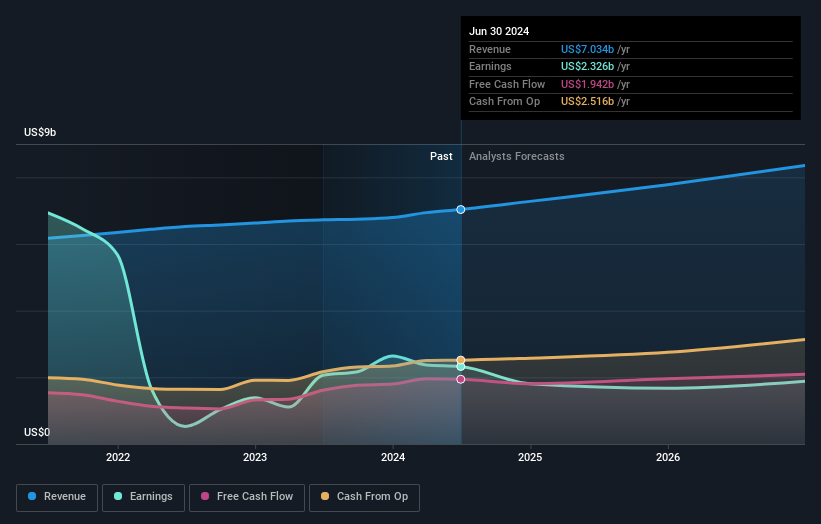

Thomson Reuters has demonstrated strong financial health, with earnings growing by 12.7% over the past year, outpacing the Professional Services industry average of 4.9%. The company’s strategic initiatives, particularly in generative AI, have shown promise, with strong interest in offerings like Westlaw Precision and CoCounsel. CEO Steve Hasker highlighted that total company organic revenues rose 6%, with the Big 3 segments growing by 8%. Additionally, the company's capital capacity and liquidity are pivotal assets, enabling strategic investments to create shareholder value. Despite trading above the estimated fair value of CA$170.61 at CA$231.42, TRI's Price-to-Earnings Ratio (33.3x) is favorable compared to the peer average of 43.7x, indicating value relative to its peers.

To gain deeper insights into Thomson Reuters's historical performance, explore our detailed analysis of past performance.

Weaknesses: Critical Issues Affecting Thomson Reuters's Performance and Areas For Growth

Thomson Reuters faces several financial challenges, including a forecasted annual earnings decline of 1.7% over the next three years. The company's current share price of CA$231.42 trading above its fair value estimate of CA$170.61 suggests potential overvaluation. Furthermore, adjusted EBITDA fell by 2% to $646 million, with a 300 basis point margin decline to 37.1%, as noted by Steve Hasker. The company’s Price-to-Earnings Ratio (33.3x) is also higher than the North American Professional Services industry average of 28.2x, indicating it is expensive relative to the industry. Additionally, the decline in print revenue by 7% and challenges in the FindLaw segment highlight areas needing improvement.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Thomson Reuters is well-positioned to leverage growth through strategic expansions and product innovations. The company has increased its pace of organic and inorganic investments, aiming for faster revenue growth in 2025 and beyond. Recent product-related announcements, such as the launch of CoCounsel 2.0, underscore its commitment to innovation and enhancing market position. The second annual Future of Professionals Report indicates optimism among knowledge workers about productivity boosts from AI, which could redefine workflows. Additionally, regulatory changes and strategic partnerships, particularly in audit methodology content, present further opportunities for growth and market expansion.

See what the latest analyst reports say about Thomson Reuters's future prospects and potential market movements.

Threats: Key Risks and Challenges That Could Impact Thomson Reuters's Success

Thomson Reuters faces significant competitive pressures, with increased activity from both traditional competitors and new start-ups. Economic factors, such as the expectation of higher investment levels in the second half of the year, pose additional risks. CFO Michael Eastwood highlighted ongoing discussions and operational risks that could impact the company's strategic goals. Market risks, including the unpredictability of how certain initiatives will play out, add to the uncertainty. Moreover, significant insider selling over the past three months and the forecasted earnings decline of 1.7% per year for the next three years underscore potential vulnerabilities.

Conclusion

Thomson Reuters' strong financial health, evidenced by a 12.7% earnings growth and strategic investments in generative AI, underscores its potential for sustained success. However, the company's forecasted annual earnings decline of 1.7% and a current share price of CA$231.42, which is significantly higher than the estimated fair value of CA$170.61, suggest caution is warranted. While opportunities in AI and strategic partnerships present avenues for growth, competitive pressures and economic uncertainties pose significant risks. Investors should weigh these factors carefully, as the company's future performance will hinge on its ability to navigate these challenges while capitalizing on its strengths.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives