- Canada

- /

- Professional Services

- /

- TSX:TRI

Is Clockwork.ai Partnership and Share Buyback Shifting Thomson Reuters' Strategy (TSX:TRI)?

Reviewed by Simply Wall St

- In August 2025, Clockwork.ai announced a partnership with Thomson Reuters to integrate its AI-driven financial planning tools into Thomson Reuters' ecosystem, enhancing services for accounting firms across its network.

- This agreement, alongside Thomson Reuters' recently authorized US$1 billion share repurchase program, marks a coordinated push to strengthen both its service offerings and capital allocation strategy for clients and shareholders.

- We'll explore how the combination of the share buyback and expanded AI capabilities may influence Thomson Reuters' broader investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Thomson Reuters Investment Narrative Recap

Investing in Thomson Reuters is a bet on its ability to lead as a platform for AI-powered legal and financial solutions, underpinned by deep, trusted content and advanced workflow automation. The recent Clockwork.ai partnership and US$1 billion share buyback do align with key competitive themes, but do not appear to materially alter the company’s main near-term catalyst, broadening client adoption of its proprietary AI tools, or address the largest immediate risk, which remains aggressive competition in legal technology.

Of the latest announcements, the August launch of CoCounsel Legal stands out. This new AI-driven solution aims to streamline legal research and workflow automation, feeding directly into the core catalyst of accelerating adoption across legal and accounting clients, which management continues to spotlight as critical for driving higher subscription revenue and pricing power.

However, it’s important to recognize that despite these advances, intense competition from new AI entrants remains a factor investors should be mindful of if...

Read the full narrative on Thomson Reuters (it's free!)

Thomson Reuters is projected to reach $9.2 billion in revenue and $2.1 billion in earnings by 2028. This outlook is based on a 7.8% annual revenue growth rate and a $0.5 billion increase in earnings from the current $1.6 billion level.

Uncover how Thomson Reuters' forecasts yield a CA$274.11 fair value, a 11% upside to its current price.

Exploring Other Perspectives

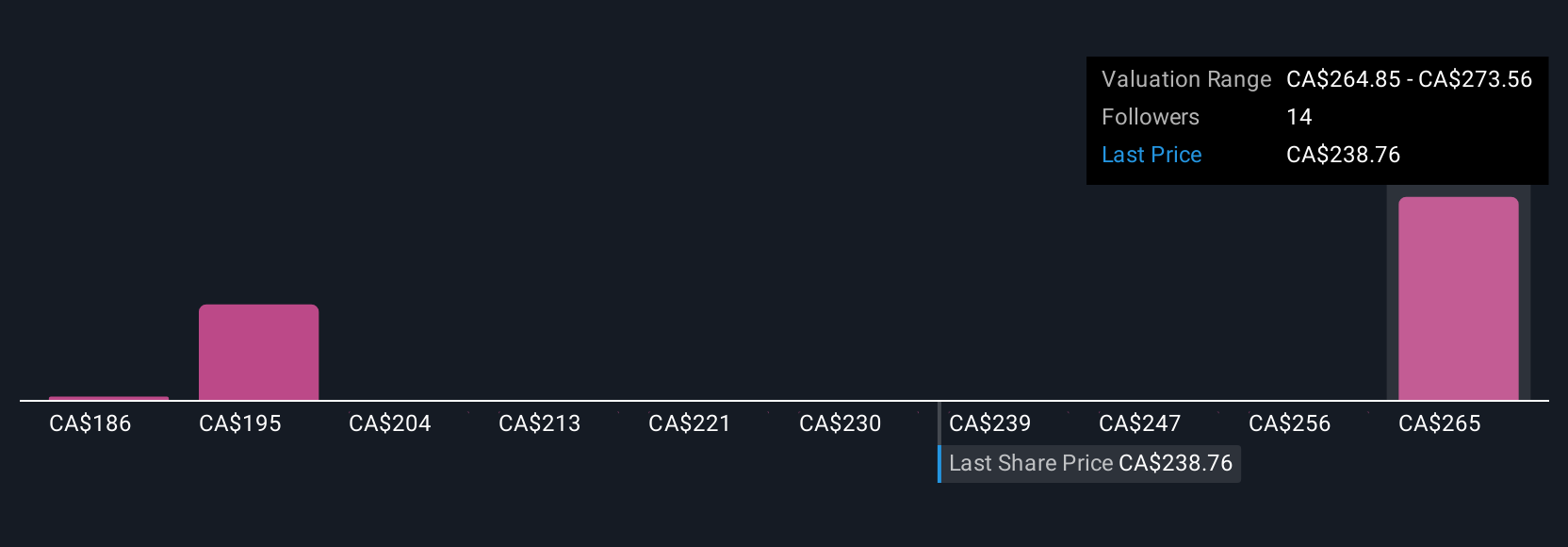

Four separate fair value estimates from the Simply Wall St Community range from CA$186.45 to CA$274.11. Many point to the accelerating adoption of agentic AI solutions as central to the company’s future performance, and readers can compare these diverse views for additional insight.

Explore 4 other fair value estimates on Thomson Reuters - why the stock might be worth as much as 11% more than the current price!

Build Your Own Thomson Reuters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thomson Reuters research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Thomson Reuters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thomson Reuters' overall financial health at a glance.

No Opportunity In Thomson Reuters?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives