It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in INSCAPE Corporation (TSE:INQ).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

View our latest analysis for INSCAPE

INSCAPE Insider Transactions Over The Last Year

While no particular insider transaction stood out, we can still look at the overall trading.

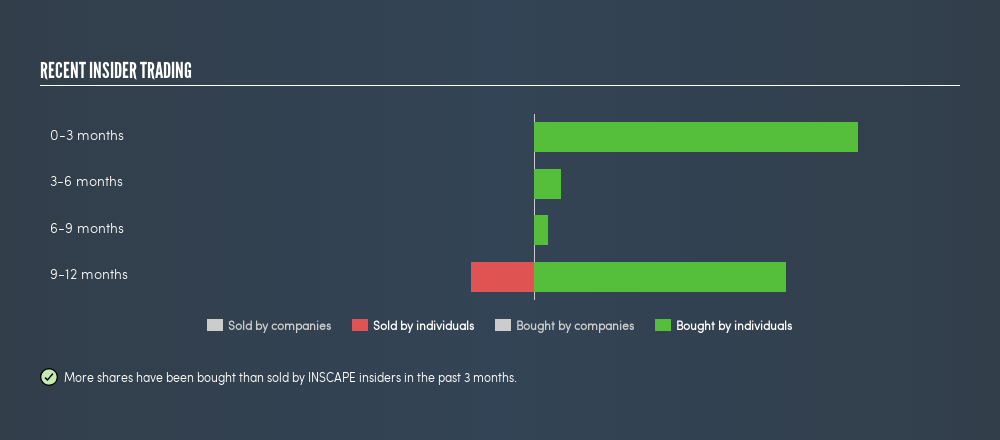

In the last twelve months insiders purchased 113.96k shares for CA$196k. But they sold 11.60k for CA$22k. In the last twelve months there was more buying than selling by INSCAPE insiders. Their average price was about CA$1.72. These transactions suggest that insiders have considered the current price of CA$1.40 attractive. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Insiders at INSCAPE Have Bought Stock Recently

Over the last quarter, INSCAPE insiders have spent a meaningful amount on shares. Overall, 2 insiders shelled out CA$85k for shares in the company -- and none sold. That shows some optimism about the company's future.

Does INSCAPE Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. INSCAPE insiders own about CA$12m worth of shares (which is 60% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At INSCAPE Tell Us?

It's certainly positive to see the recent insider purchases. And an analysis of the transactions over the last year also gives us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about INSCAPE. One for the watchlist, at least! Along with insider transactions, I recommend checking if INSCAPE is growing revenue. This free chart of historic revenue and earnings should make that easy.

But note: INSCAPE may not be the best stock to buy. So take a peek at this freelist of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:INQ

Inscape

Inscape Corporation, together with its subsidiaries, manufactures office furniture and wall products in the United States and Canada.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives